Macquarie PE

Scope

Date

~

-

Airlines

AirlinesPE firm VIG Partners takes over Korean low-cost carrier Eastar

South Korean private equity firm VIG Partners has acquired a 100% stake in low-cost carrier (LCC) Eastar Jet Co., the asset manager said on Jan. 6. ...

Jan 06, 2023 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsHyundai Home Shopping to divest rental unit for $107 mn

Hyundai Home Shopping Network Corp., a TV shopping channel operator owned by South Korea's Hyundai Department Store Group, said on Dec. 26 it will s...

Dec 26, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsKKR to buy 100% stake in SK E&S' Busan City Gas for $561 mn

Private equity giant KKR & Co. is slated to buy a 100% stake in Busan City Gas Co., wholly owned by South Korean energy company SK E&S Co., ...

Dec 20, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsGlenwood to sue Baring PEA over buyout deal cancellation

South Korea’s Glenwood Private Equity is set to take legal action against Hong Kong-based Baring Private Equity Partner over the cancellation ...

Dec 16, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsKorean PE firm Hahn & Co to sell used-car platform K Car

South Korean private equity firm Hahn & Co. is set to sell a majority stake in local used-car trading platform K Car Co. as its initial public o...

Dec 16, 2022 (Gmt+09:00)

-

Shipping & Shipbuilding

Shipping & ShipbuildingCurious completes second Samsung Heavy drillship sale

South Korean private equity firm Curious Partners has recently completed selling an undelivered drillship constructed by Samsung Heavy Industries Co...

Dec 13, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsMacquarie bids for transportation card operator Loca Mobility

Macquarie Asset Management participated in a bid on Dec. 6 to acquire Loca Mobility Corp., Lotte Card Co.’s subsidiary and the second-largest ...

Dec 07, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsHahn & Co. completes SKC's industrial film unit takeover for $1.2 bn

South Korean private equity firm Hahn & Co. has completed a 1.6 trillion won ($1.2 billion) deal to wholly acquire the industrial film business ...

Dec 05, 2022 (Gmt+09:00)

-

Private debt

Private debtMBK joins acquisition of $1.3 bn debts in Marelli from KKR

MBK Partners Ltd., alongside Deutsche Bank AG and other four investment firms, has acquired $1.3 billion worth of distressed debts in auto-parts sup...

Dec 04, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsKorea's KDB to sell off its life insurer for fifth time

South Korea’s state-run Korea Development Bank (KDB) is poised to accelerate the selling off of its affiliate KDB Life Insurance Co. next week...

Nov 22, 2022 (Gmt+09:00)

-

Private equity

Private equityKorean PE firms struggle with fundraising on illiquidity

South Korean private equity (PE) firms are having trouble fundraising as institutional investors' capital for new investment is drying up amid inter...

Nov 10, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsEQT Partners to invest $1.4 bn in Korea's No. 2 physical security firm

Sweden’s EQT Partners AB is set to acquire a 36.87% stake in South Korean security services provider SK Shieldus Co. from a consortium led by ...

Nov 02, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsForeign PE firms on hunt for Korea Inc. with strong dollar

Foreign private equity firms have taken advantage of the strong dollar to dominate corporate acquisition deals in South Korea, adding to expectation...

Nov 01, 2022 (Gmt+09:00)

-

ASK 2022

ASK 2022KIC sees secondary and deep value investments as attractive

Korea Investment Corporation (KIC) is eyeing secondary and deep value strategies, the sovereign wealth fund’s Senior Director of Private Equit...

Oct 27, 2022 (Gmt+09:00)

-

Shareholder activism

Shareholder activismSingapore PE firm proposes KT&G spin off ginseng biz

A Singaporean private equity firm has proposed a number of measures to KT&G Corp., the world’s fifth-largest tobacco maker, including a sp...

Oct 26, 2022 (Gmt+09:00)

-

Investment banking

Investment bankingGoldman taps TPG Korea's Lee as Seoul office PE head

Goldman Sachs Group Inc. is set to hire Lee Seung-june, managing director at US investment firm TPG's Seoul office, as Goldman Sachs' private equity...

Oct 21, 2022 (Gmt+09:00)

-

Private equity

Private equityHahn & Co. to sell off Korea's major biofuel maker SK Eco Prime

South Korean private equity firm Hahn & Company is set to put a 100% stake in biofuel manufacturer SK Eco Prime on sale, with Goldman Sachs as a...

Oct 07, 2022 (Gmt+09:00)

-

Banking & Finance

Banking & FinanceKorea Investment & Securities and Stifel Financial form joint venture

Korea Investment & Securities Co., a subsidiary of Korea Investment Holdings, announced on Wednesday that it has formed a joint venture with Mis...

Sep 28, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsDiageo revokes agreement for sale of Windsor to South Korean consortium

London-based global alcoholic beverage company Diageo plc announced Tuesday it plans to revoke the domestic management rights of the Windsor whisky ...

Sep 27, 2022 (Gmt+09:00)

-

Cloud computing

Cloud computingKKR, Macquarie race for $728 mn stake in Korea’s KT Cloud

Global private equity giants Kohlberg Kravis Roberts & Co. (KKR) and Macquarie Asset Management are among the preliminary bidders for shares wor...

Sep 05, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

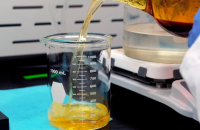

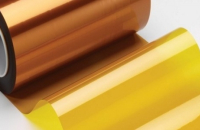

Mergers & AcquisitionsKorea PE firms to buy FCCL maker NexFlex at $463 mn

South Korean private equity firms are set to take over NexFlex Co., the country’s largest manufacturer of flexible copper-clad laminates (FCCL...

Sep 02, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsKKR, Anchor Equity tipped to exit from TMON in 7 yrs

KKR & Co. and Anchor Equity Partners have tentatively agreed to sell their majority stake in South Korea’s e-commerce player TMON Inc. to ...

Aug 26, 2022 (Gmt+09:00)

-

Corporate strategy

Corporate strategySK Group reworks 'financial story' action plans

Chief executives of South Korea’s No. 2 conglomerate SK Group are overhauling their action plans to implement the “financial story&rdquo...

Aug 26, 2022 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsSoftBank Son's youngest brother poised to buy Korean VC arm

Taizo Son, the youngest brother of SoftBank Chairman Masayoshi Son, is poised to buy the group's South Korean venture capital arm for around 200 bil...

Aug 24, 2022 (Gmt+09:00)

-

Private equity

Private equitySK taps Korean PE for $1.5 bn after Carlyle's Lee quit

SK On Co. has turned to domestic private equity firms to raise up to 2 trillion won ($1.5 billion) after talks with four big global funds have dried...

Aug 19, 2022 (Gmt+09:00)

-

Pension funds

Pension fundsCarlyle tops NPS' favorite PE managers as of end-2021

The Carlyle Group was the most preferred fund manager hired by South Korea’s National Pension Service (NPS) as of end-2021, according to NPS&r...

Aug 16, 2022 (Gmt+09:00)

-

Private equity

Private equityKorea's small PE firms putting fundraising plans off to 2023

South Korea’s small and mid-sized private equity firms are increasingly postponing fundraising schedules for their project-based funds to the ...

Aug 11, 2022 (Gmt+09:00)

-

Korean startups

Korean startupsMegazone Cloud receives $343 mn from MBK, IMM PE in Series C funding

Megazone Cloud Corp., South Korea’s largest managed cloud service provider (MSP), has completed its Series C funding round with a combined 450...

Aug 10, 2022 (Gmt+09:00)

-

Private equity

Private equityCarlyle CEO Lee’s sudden exit puts the PE’s Korea strategy in spotlight

The sudden resignation of The Carlyle Group Inc. Chief Executive Kewsong Lee has not just surprised the global investment community but raised quest...

Aug 08, 2022 (Gmt+09:00)

-

Upcoming IPOs

Upcoming IPOsKB Asset aims for first IPO of Korea's homegrown infrastructure fund

South Korea’s KB Asset Management Co. is set to list its Balhae Infrastructure Fund (Balhae) on the country’s main bourse Kospi in the s...

Jul 18, 2022 (Gmt+09:00)

Latest News

- 1 Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

- 2 CJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

- 3 Trump Jr. meets Korean business chiefs in back-to-back sessions

- 4 Samsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

- 5 Kookmin Bank raises $700 mn in forex bonds amid strong demand