SK Group reworks 'financial story' action plans

SK Ecoplant is looking for new co-investors in Singapore's TES as the group's PE funding plans hit roadblocks

By Aug 26, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

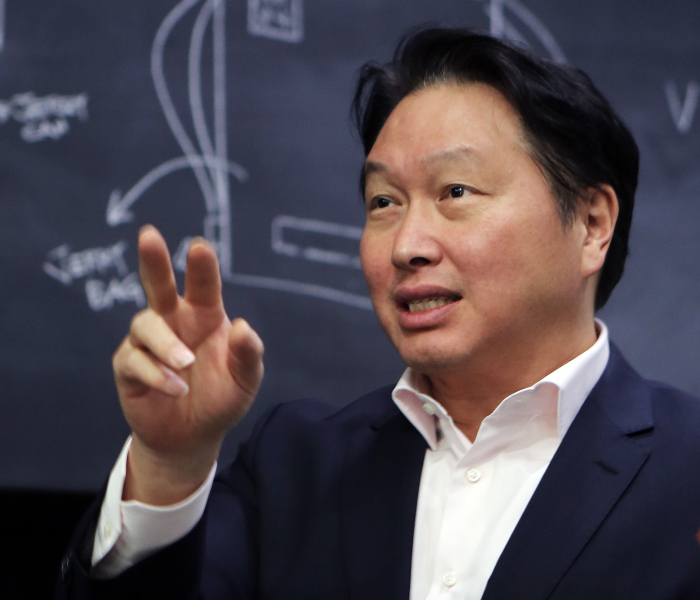

Chief executives of South Korea’s No. 2 conglomerate SK Group are overhauling their action plans to implement the “financial story” vision, as outlined by the group Chairman Chey Tae-won two years ago, the group said on Thursday.

Chey put forward the business mantra at the group’s annual CEO seminar in October 2020, calling for maximum use of the group's assets to raise capital to put into new growth areas and those aligning with the ESG principles.

SK's "financial story" means that the group's subsidiaries measure the financial benefits of each business and focus on profit-making segments. Choi noted that enterprise values are no longer measured only by numeric results.

In that regard, SK became the first business group in South Korea this year to disclose its monetized social value.

However, the chairman expressed his dissatisfaction with action plans presented by some SK Group subsidiaries at a June executive meeting, where they reviewed the progress made to achieve carbon neutrality goals and digital transformation.

Chey criticized their lack of details and called for an overhaul of the plans. In response, the group CEOs will unveil revised specific plans at the group’s annual CEO seminar in October.

An SK Group executive elaborated that Chey’s remarks could be seen as pulling on the reins of the group companies since their business cultures seemed loose following the group's rise to the No. 2 position among Korean conglomerates, after Samsung Group.

PRIVATE EQUITY FUNDING

SK Group is among the business groups most affected by subdued investor sentiment on the back of rising interest rates and a gloomy economic outlook.

Its subsidiaries have hit roadblocks with a series of fundraising plans either through IPOs or stake sales to private equity firms, aimed at financing their business expansion.

SK Ecoplant Co., a construction and waste treatment unit, acquired Singapore-based electronic waste disposal and recycling company TES Envirocorp Pte. Ltd for $1 billion early this year.

It funded the acquisition with $675 million in short-term loans from banks, which it planned to replace with private equity funding from IMM Investment.

But now IMM has difficulty raising its targeted money, SK Ecoplant is looking for other PE investors to fill in for the Seoul-based PE house, according to sources with knowledge of the matter on Thursday.

Electric vehicle battery maker SK On Co. recently turned to domestic PE firms to raise up to 2 trillion won after talks with global investment giants such as The Carlyle Group, KKR & Co. and Singapore’s GIC dried up.

ESG GOALS

Regarding the group’s efforts to go carbon-free, Chairman Chey said at an executive gathering this week that the group has been on track toward the goals, but still has a long way to go to achieve them.

He urged the executives to further advance relevant technologies and adopt new businesses to meet ESG standards.

Last month, SK announced a plan to build its first memory chip packaging facility in the US as part of a fresh $22 billion investment in the US manufacturing sector.

Write to Kyung-Min Kang at kkm1019@hankyung.com

Yeonhee Kim edited this article.

-

Behind the ScenesSK Group’s 'financial story' running out of steam?

Behind the ScenesSK Group’s 'financial story' running out of steam?Jun 14, 2022 (Gmt+09:00)

5 Min read -

Corporate governanceSK becomes first group to disclose monetized social value

Corporate governanceSK becomes first group to disclose monetized social valueMay 24, 2022 (Gmt+09:00)

1 Min read -

SK Group's financial story: Measure, divest and focus

SK Group's financial story: Measure, divest and focusMar 09, 2021 (Gmt+09:00)

5 Min read -

Private equitySK Group's PE-funded transformation in the spotlight

Private equitySK Group's PE-funded transformation in the spotlightMar 07, 2022 (Gmt+09:00)

5 Min read -

Corporate restructuringSK's 5-year journey toward batteries, bio and chips

Corporate restructuringSK's 5-year journey toward batteries, bio and chipsJan 23, 2022 (Gmt+09:00)

3 Min read -

ESGSK Chairman vows to achieve carbon neutrality ahead of 2050 UN target

ESGSK Chairman vows to achieve carbon neutrality ahead of 2050 UN targetJun 23, 2021 (Gmt+09:00)

3 Min read