Hahn & Co. buys SK Enpulse’s chip wafer polishing pad business

The private equity firm has been snapping up SK Group's units, including shipping and rental car units, since 2018

By Dec 26, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Seoul-based private equity firm Hahn & Co. has agreed to buy the chemical mechanical polishing (CMP) pads manufacturing division of SK Enpulse Co., wholly owned by SKC Ltd., for 341.0 billion won ($233 million), the latest in a series of its acquisitions of SK Group’s businesses.

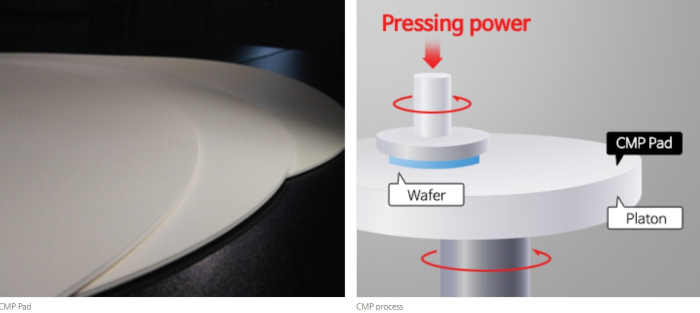

A CMP pad is used to physically and chemically polish the surface of semiconductor wafers to enhance the integration of semiconductors. Demand for the consumable is rising thanks to the increase in three-dimensional NAND flash production.

The disposal of the business is aimed at improving its financial conditions, SK Enpulse said in a regulatory filing on Tuesday. The deal will close on April 1, 2025.

The acquisition follows Hahn & Co.’s 330.3-billion-won purchase in October of SK Enpulse’s fine ceramics business, which produces consumable materials such as alumina, silicon and quartz used in semiconductor and display manufacturing processes.

On Tuesday, the buyout firm also agreed to purchase an 85% stake in the world’s top specialty gas producer SK Specialty Co. for 2.7 trillion won from SK Inc.

Apart from the latest deal with the private equity house, SK Enpulse will spin off the business that produces testers, equipment front end modules (EFEM) and chemicals used for the final steps of semiconductor manufacturing.

Write to Ji-Eun Ha at hazzys@hankyung.com

Yeonhee Kim edited this article.

-

Mergers & AcquisitionsHahn & Co. to buy controlling stake in SK’s specialty gas unit for $1.9 bn

Mergers & AcquisitionsHahn & Co. to buy controlling stake in SK’s specialty gas unit for $1.9 bnDec 24, 2024 (Gmt+09:00)

1 Min read -

Private equityHahn & Co. overhauls Namyang board, ending family control

Private equityHahn & Co. overhauls Namyang board, ending family controlMar 29, 2024 (Gmt+09:00)

2 Min read -

Chemical IndustryS.Korea's SKC to sell fine ceramic business for $270 mn

Chemical IndustryS.Korea's SKC to sell fine ceramic business for $270 mnOct 31, 2023 (Gmt+09:00)

1 Min read -

Corporate strategyS.Korea's SKC Solmics changes name to SK Enpulse

Corporate strategyS.Korea's SKC Solmics changes name to SK EnpulseJan 16, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsHahn & Co. puts SK Shipping’s tanker business up for sale

Mergers & AcquisitionsHahn & Co. puts SK Shipping’s tanker business up for saleMar 13, 2023 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsKorean PE firm Hahn & Co to sell used-car platform K Car

Mergers & AcquisitionsKorean PE firm Hahn & Co to sell used-car platform K CarDec 16, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsHahn & Co. completes SKC's industrial film unit takeover for $1.2 bn

Mergers & AcquisitionsHahn & Co. completes SKC's industrial film unit takeover for $1.2 bnDec 05, 2022 (Gmt+09:00)

1 Min read -

Private equityHahn & Co. to sell off Korea's major biofuel maker SK Eco Prime

Private equityHahn & Co. to sell off Korea's major biofuel maker SK Eco PrimeOct 07, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsSKC to sell plastic film business to Hahn & Co. for $1.3 billion

Mergers & AcquisitionsSKC to sell plastic film business to Hahn & Co. for $1.3 billionJun 02, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsHahn & Co. buys Korean food startup in bolt-on deal

Mergers & AcquisitionsHahn & Co. buys Korean food startup in bolt-on dealApr 12, 2022 (Gmt+09:00)

2 Min read -

Private equityK Car's evolution into top Korean used car sales platform

Private equityK Car's evolution into top Korean used car sales platformMar 08, 2022 (Gmt+09:00)

4 Min read