Mergers & Acquisitions

Samsung Electronics' key M&A man returns; big deals in the offing

A couple of deals are already in the works and an announcement looks imminent, analysts say

By Apr 12, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

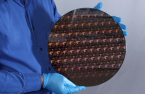

Samsung Electronics Co., the world’s top memory chipmaker and leading smartphone and electronics maker, has been absent from the mergers and acquisitions market for years.

However, signs are looming that the South Korean tech giant is set to return to the M&A market with mega-deals apparently in the works.

According to industry sources on Friday, Ahn Joonghyun, president and head of the Future Industry Research Division at Samsung Global Research, has returned to Samsung Electronics’ Management Support Division, which is responsible for the conglomerate’s management strategy and M&A push.

Two years ago, he moved to the group think tank after leading Samsung’s high-profile M&A deals for nearly a decade.

His return as Samsung’s key M&A man signals the company’s determination to seek new growth drivers through acquisitions of promising rivals, sources said.

THE MAN BEHIND SAMSUNG’S HARMAN ACQUISITION

The former M&A chief, also known as James Ahn, previously led nearly all of Samsung’s major acquisitions and divestitures, including the 9.2 trillion won ($6.7 billion) acquisition in 2017 of Harman International Industries Inc., a US electronics systems maker for automobiles.

He also drove Samsung Group to streamline its business portfolio by selling its chemical and defense businesses to Hanwha and Lotte groups between 2015 and 2016, in deals worth a combined 5 trillion won.

Back in 2004, he took charge of setting up S-LCD, the LCD joint venture between Samsung Electronics and Sony Corp.

Ahn joined Samsung Electronics in 1986 as a software engineer and worked in research and development for 10 years. He majored in electrical engineering at Korea University and earned an MBA from the Korea Advanced Institute of Science and Technology (KAIST).

AI, BIO, AUTO PARTS: NEW GROWTH ENGINES

Industry officials said the artificial intelligence, biotechnology, auto parts and wireless communications businesses are key sectors in which Samsung is most interested for M&A targets.

The semiconductor segment is Samsung’s mainstay business but an acquisition of a chip company is less likely as the sector is strongly guarded as a national security business by many countries.

Back in 2022, its attempt to acquire ARM Inc., a British chip design firm, fell through. The same year, it was said to have checked out NXP Semiconductors, a Dutch chip designer and Infineon Technologies’ automotive electronics business for acquisitions.

While sitting on cash reserves of 79.7 billion won ($60 billion) at the end of 2023, Samsung has been absent from the M&A market since it acquired Harman.

LOST DECADE

Industry officials said Samsung couldn't make any significant strategic decisions without leader Jay Y. Lee at the helm of the conglomerate while he was embroiled in legal disputes.

Last February, however, a Seoul court acquitted Lee of a raft of criminal charges linked to the controversial 2015 merger of Cheil Industries Inc. and Samsung C&T Corp.

Cleared of wrongdoing charges that shackled his leadership for years, Lee will actively seek M&As for renewed growth, leaving the “lost decade” of inactivity behind him, analysts said.

Last month, Reuters reported that Samsung has joined the race to buy Johnson Controls International plc’s heating, ventilation and air conditioning (HVAC) assets worth over $6 billion.

Samsung is also rumored to be looking into buying the automotive electronics business of Continental AG, a German automotive parts maker, to strengthen its advanced driver assistance system (ADAS) and vehicle display businesses.

Han Jong-hee, vice chairman and head of Samsung's Device eXperience (DX) division, said at Samsung’s annual general meeting that it has made significant progress on a new M&A deal and would soon share the details with shareholders.

Write to Eui-Myung Park at uimyung@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EarningsSamsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demand

EarningsSamsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demandApr 05, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsSamsung Elec vies for Johnson Controls' HVAC units

Mergers & AcquisitionsSamsung Elec vies for Johnson Controls' HVAC unitsMar 25, 2024 (Gmt+09:00)

2 Min read -

Korean innovators at CES 2024Samsung, Harman move in lockstep to advance in-vehicle technology

Korean innovators at CES 2024Samsung, Harman move in lockstep to advance in-vehicle technologyJan 10, 2024 (Gmt+09:00)

2 Min read -

Corporate strategySamsung Elec's ex-M&A head to extend clout in Samsung Group

Corporate strategySamsung Elec's ex-M&A head to extend clout in Samsung GroupApr 19, 2022 (Gmt+09:00)

3 Min read -

Fraud scandalsSamsung shares struggle as big strategic decisions still await Lee

Fraud scandalsSamsung shares struggle as big strategic decisions still await LeeAug 11, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN