Samsung’s Lee to spur M&As, new growth with ‘lost decade’ behind him

He is expected to meet challenges in Samsung’s key segments such as biotech, chip foundry and smartphones

By Feb 05, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Cleared of wrongdoing charges that shackled his leadership for years, Samsung Group leader Jay Y. Lee now will actively seek mergers and acquisitions for renewed growth, leaving the “lost decade” of inactivity behind him, analysts said.

A Seoul court on Monday acquitted Lee, chairman of Samsung Electronics Co., of a raft of criminal charges linked to a controversial 2015 merger of Cheil Industries Inc. and Samsung C&T Corp.

"Today's verdict has made it clear the merger was legitimate. We sincerely thank the court for its judicious judgment," Lee's attorneys said in a brief statement.

Prosecutors began looking into the case in November 2016. Lee was detained for a total of 565 days in 2017-2018 and in 2021 while undergoing prosecutor investigations and serving a prison term on a separate bribery and embezzlement case.

Samsung, the country’s top conglomerate, largely kept a low profile without his leadership during this time.

Samsung employees called the period the lost decade, during which a sense of crisis ran deep across group affiliates.

Monday’s court ruling, analysts say, will give the Samsung chief, whose Korean name is Lee Jae-yong, a freer rein in steering Korea’s biggest conglomerate, with some raising the possibility of Samsung becoming more active in the M&A market.

THE LAST DEAL IN 2017

While sitting on cash reserves of 79.7 billion won ($60 billion) at the end of 2023, Samsung has been absent from the M&A market since its $8 billion deal in 2017 to acquire Harman, a US electronics systems maker for automobiles.

Industry watchers say Samsung couldn't make any significant strategic decisions without Lee at the helm of the conglomerate.

Lee is now expected to tighten his grip on the management of Samsung’s growth businesses, including artificial intelligence, robots, biotechnology and next-generation telecommunications equipment.

Over the past few years, Samsung has been struggling to catch up to its bigger rivals. In some segments, which the company identifies as its growth drivers, Samsung was overtaken by its competitors.

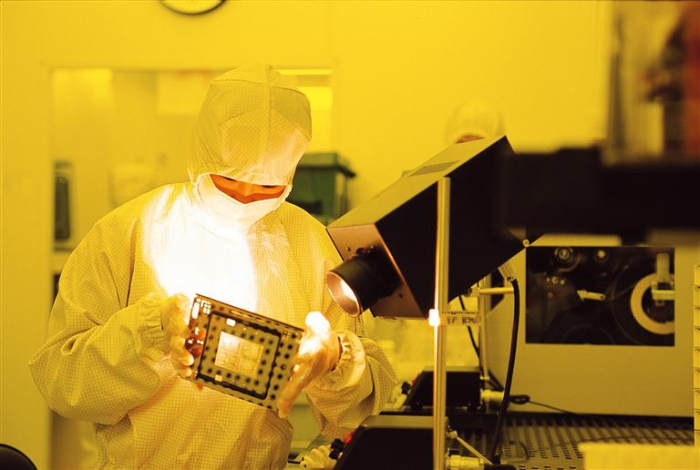

Samsung has been the top player in the global memory chip market since 1993. However, the gap with its followers has narrowed considerably.

According to market tracker TrendForce, Samsung’s DRAM market share was 38.9% at the end of 2023, followed by SK Hynix Inc., the runner-up, which controlled 34.3% of the market.

The 4.6 percentage point gap between the two firms is the narrowest since the second quarter of 2013 when Samsung led SK Hynix by a gap of 2.7 percentage points.

In the contract chipmaking, or foundry, market, Taiwan Semiconductor Manufacturing Co. (TSMC) has for years been the dominant leader, with Samsung a distant second.

As of the third quarter of 2023, TSMC commanded a 57.9% share of the foundry market, followed by Samsung’s 12.4%.

Samsung had also been the top smartphone vendor for years in terms of volume until last year when it lost the crown of the world’s biggest smartphone maker to Apple Inc. and its iPhone series.

While unveiling its latest flagship model, the Galaxy S24, in San Jose, California, last month, Samsung executives vowed to reclaim its market leadership as early as this year.

Samsung also lost its leadership in the foldable organic light-emitting diode (OLED) panel market to China’s BOE Technology Group Co. in the fourth quarter.

“Chairman Lee will take a more decisive role in Samsun’s push to regain its leadership in flagship businesses, seeking more M&As and setting long-term investment plans,” said an industry official.

Some analysts, however, said that Samsung will find it hard to aggressively pursue M&As given growing economic and geopolitical uncertainties around the globe.

Write to Jeong-Soo Hwang and Ye-Rin Choi at hjs@hankyung.com

In-Soo Nam edited this article.

-

Leadership & ManagementSamsung’s Lee cleared of charges over Samsung C&T merger

Leadership & ManagementSamsung’s Lee cleared of charges over Samsung C&T mergerFeb 05, 2024 (Gmt+09:00)

2 Min read -

ElectronicsSamsung Galaxy S24: A success story even before hitting the shelves

ElectronicsSamsung Galaxy S24: A success story even before hitting the shelvesJan 26, 2024 (Gmt+09:00)

2 Min read -

Artificial intelligenceSamsung AI features on 100 mn Galaxy phones by year-end: mobile chief

Artificial intelligenceSamsung AI features on 100 mn Galaxy phones by year-end: mobile chiefJan 18, 2024 (Gmt+09:00)

3 Min read -

ElectronicsSamsung Galaxy S24 heralds dawning of AI smartphone era

ElectronicsSamsung Galaxy S24 heralds dawning of AI smartphone eraJan 18, 2024 (Gmt+09:00)

3 Min read -

Leadership & ManagementSamsung’s Jay Y. Lee heads to Europe for partner meetup, Busan Expo

Leadership & ManagementSamsung’s Jay Y. Lee heads to Europe for partner meetup, Busan ExpoNov 20, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsSamsung’s Jay Y. Lee, Tesla’s Elon Musk discuss tech alliance

Business & PoliticsSamsung’s Jay Y. Lee, Tesla’s Elon Musk discuss tech allianceMay 14, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investments

Korean chipmakersSamsung’s Jay Y. Lee walks on tightrope in US, China investmentsMar 14, 2023 (Gmt+09:00)

4 Min read