Mergers & Acquisitions

Arkema buys S.Korea's PI Advanced for about $800 mn

The French company is optimistic about PI Advanced despite poor results in 2022 and Q1, 2023

By Jun 28, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Arkema, a French specialty materials producer, on Wednesday signed an agreement to purchase a 54.07% stake in South Korea’s PI Advanced Materials Co., the world’s largest polyimide film manufacturer, for 1 trillion won ($765 million), PI Advanced said.

It is set to buy the stake from Hong Kong-based Glenwood Private Equity. The price tag is about 70% higher than its market value and the PE firm’s acquisition price.

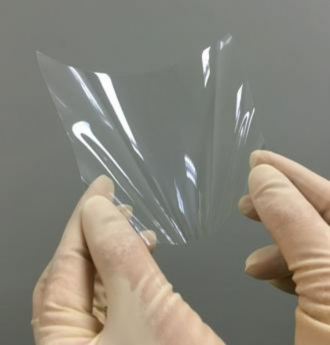

PI Advanced commands more than 30% of the global PI film market. The film is a key material for flexible printed circuit boards and heat-resistant sheets.

The former unit of Total SA said in a statement the acquisition will be a “new significant milestone in Arkema’s transformation into a pure specialty materials player.”

It is also a rare opportunity to broaden its polymer range with ultra-high performance and cutting-edge technology, according to the company.

"This acquisition is fully aligned with our strategy to be at the forefront of high-performance materials for high-growth end markets supported by megatrends such as electric vehicles and advanced electronics," said Thierry Le Henaff, Arkema's chairman and chief executive.

Kospi-listed PI Advanced was established as a 50:50 joint venture between SKC Ltd. and Kolon Industries Co. in 2008. Glenwood acquired the majority stake from the two companies for 607 billion won in 2020.

Arkema, listed on the Euronext Paris stock market, is one of the world’s three-largest chemicals companies, along with BASF SE and Dow Chemical Co.

Taking control of PI Advanced means the Paris-based company will be able to advance into the PI film market and strengthen its presence in Asia, as well as in Europe and the US.

Under the management of Glenwood, the company doubled PI film output and boosted its market share in the smartphone-use film market.

It also diversified into battery insulating films and varnish used to coat EV motors, reducing its reliance on the smartphone materials market to 51% of sales from 85%. China is the company’s biggest market, generating 58% of its revenue.

RENEWED ATTEMPT

When the PI Advanced stake was up for grabs last year, Arkema was one of the shortlisted bidders for PI Advanced, but lost to Hong Kong-based Baring Private Equity Asia.

Baring PEA withdrew from the deal worth 1.3 trillion won late last year, saying the closing conditions were unmet.

After the deal with Baring PEA collapsed, Arkema approached Glenwood again and showed keen interest in PI Advanced, according to people with knowledge of the situation.

VALUATIONS

The South Korean company posted a 30% drop in operating profit to 52.1 billion won in 2022 from the previous year. Sales decreased 8% to 276.4 billion won. In the first quarter of this year, it swung to an operating loss of 11.7 billion won.

Its share price has slid about 20% over the past year, underperforming a 15% gain in the broader Kospi market during the period.

But Arkema gave an upbeat outlook for PI Advanced. The premium of 70% it is paying is slightly higher than the 60% proposed by Baring PEA.

It noted that PI films are increasingly used in attractive markets such as electric vehicles, consumer electronics, semiconductor manufacturing and other advanced industrial applications.

It estimated the South Korean company’s earnings before interest, tax, depreciation and amortization (EBITDA) margin at 30%, based on its 2022 revenue.

The valuation represents 20 times its EBITDA in 2021 and 2022 on average, with the merger expected to create synergy worth $30 million.

This transaction is expected to close next March, pending approval from the countries where Arkema runs its business.

Write to Jun-Ho Cha and Ji-Eun Ha at chacha@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Mergers & AcquisitionsSKC to sell unit to Glenwood PE at $390 mn for future biz

Mergers & AcquisitionsSKC to sell unit to Glenwood PE at $390 mn for future bizJun 13, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsGlenwood files $40 mn arbitration claim against Baring PEA

Mergers & AcquisitionsGlenwood files $40 mn arbitration claim against Baring PEAApr 21, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsBaring PEA breaks $1 bn PI Advanced Materials buyout deal

Mergers & AcquisitionsBaring PEA breaks $1 bn PI Advanced Materials buyout dealDec 08, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsPI Advanced up for sale in deal estimated at $1 bn

Mergers & AcquisitionsPI Advanced up for sale in deal estimated at $1 bnFeb 15, 2022 (Gmt+09:00)

1 Min read -

Industrial materialsPI Advanced Materials emerges as high-tech golden goose

Industrial materialsPI Advanced Materials emerges as high-tech golden gooseFeb 15, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN