Baring PEA set to buy $1 bn stake in PI Advanced Materials

Glenwood PE will sell the majority stake in the South Korean company for double its purchase price in two and a half years

By Jun 07, 2022 (Gmt+09:00)

S.Korea's LS Materials set to boost earnings ahead of IPO process

NPS to commit $1.1 billion to external managers in 2024

Samsung Heavy Industries succeeds autonomous vessel navigation

Samsung shifts to emergency mode with 6-day work week for executives

Korean battery maker SK On expects business turnaround in H2

Hong Kong-based Baring Private Equity Asia is set to buy a majority stake in the worldŌĆÖs largest polyimide film manufacturer PI Advanced Materials Co. for 1.3 trillion won ($1 billion), according to sources with knowledge of the matter on Tuesday.

Seoul-based Glenwood Private Equity has named Baring PEA as the preferred buyer of its entire 54.06% stake in South KoreaŌĆÖs PI Advanced. The sale price represents about a 60% premium from its market price and slightly more than double GlenwoodŌĆÖs purchase price.

The chunk up for sale had drawn final bids from Belgian chemicals giant Solvay S.A., French specialty materials company Arkema and two South Korean firms -- Lotte Chemical Corp. and KCC Glass Corp. But Baring beat the other bidders in both price and non-price factors, the sources said.

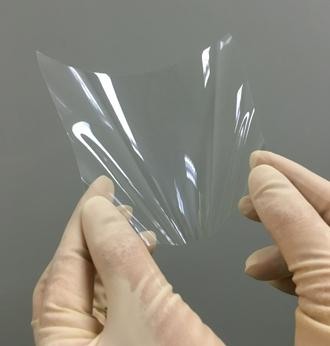

PI AdvancedŌĆÖs polyimide film is a key material for flexible printed circuit boards and heat-resistant sheets for use in smartphones and rechargeable batteries.

Glenwood acquired the majority stake from SKC Ltd. and Kolon Industries Co. for 607 billion won at the end of 2019. Kospi-listed PI Advanced was established as a 50:50 joint venture between SKC Ltd. and Kolon Industries Co. in 2008.

The sale price reflects an expected increase in PI AdvancedŌĆÖs production from the second half of this year when the materials company plans to begin production at its new facility Gumi, North Gyeongsang Province.

The deal's value will be equivalent to 24 times its earnings before interest, tax, depreciation and tax in 2021, which climbed 22.1% on-year to 99.6 billion won.

The company's net profit in 2021 surged 53.4% to a record 64 billion won from a year earlier, with sales up 15.3% to 302 billion won.

Baring plans to further increase PI AdvancedŌĆÖs market share in the polyimide film market to boost its corporate value.

The upcoming deal will mark the second transaction between the two PE firms. Back in 2016, both PE houses jointly acquired a 99.7% stake in Halla Cement Co. for 630 billion won, into which Glenwood injected 400 billion won and Baring poured 180 billion won.

The following year, Baring bought the stake held by Glenwood and then sold Halla to another Korean company Asia Cement Co. for more than twice its acquisition price later in the year.

Baring PEA, established as a subsidiary of Barings Bank, split off from the UK lender. Early this year, Sweden-based EQT Partners bought the Hong Kong-based PE house for Ōé¼6.8 billion ($7.2 billion).

Write to Chae-Yeon Kim at Why29@hankyung.com

Yeonhee Kim edited this article.

-

Mergers & AcquisitionsPI Advanced, NexFlex draw bids from foreign rivals, PE firms

Mergers & AcquisitionsPI Advanced, NexFlex draw bids from foreign rivals, PE firmsMay 27, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsCarlyle, Solvay show interest in Korea's PI Advanced

Mergers & AcquisitionsCarlyle, Solvay show interest in Korea's PI AdvancedApr 07, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsPI Advanced up for sale in deal estimated at $1 bn

Mergers & AcquisitionsPI Advanced up for sale in deal estimated at $1 bnFeb 15, 2022 (Gmt+09:00)

1 Min read