Korean Air-Asiana deal girds for tough US challenge

The US Justice Department recently altered its stance on the nature of the merger, rendering the deal more complicated

By Apr 22, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The merger between South Korea's two largest air carriers – Korean Air Lines Co. Asiana Airlines Inc. – may face a tough challenge in the US as Washington is preparing a more thorough review of their proposed combination than expected.

The US Justice Department recently altered its stance on the nature of their merger, indicating the deal has become more complicated than previously thought, according to South Korean government and airline industry sources on Friday.

To address concerns surrounding their merger, the US authorities will likely demand more detailed documents from Korean Air.

United Airlines, the No. 2 air carrier in the US., is said to have filed a complaint against the tie-up on concerns that Asiana's exit from Star Alliance following the merger would weaken its Asia footprint.

Korean Air belongs to its rival Sky Team Alliance, which includes its long-term partner Delta Airlines.

S.KOREA'S CONDITIONAL APPROVAL

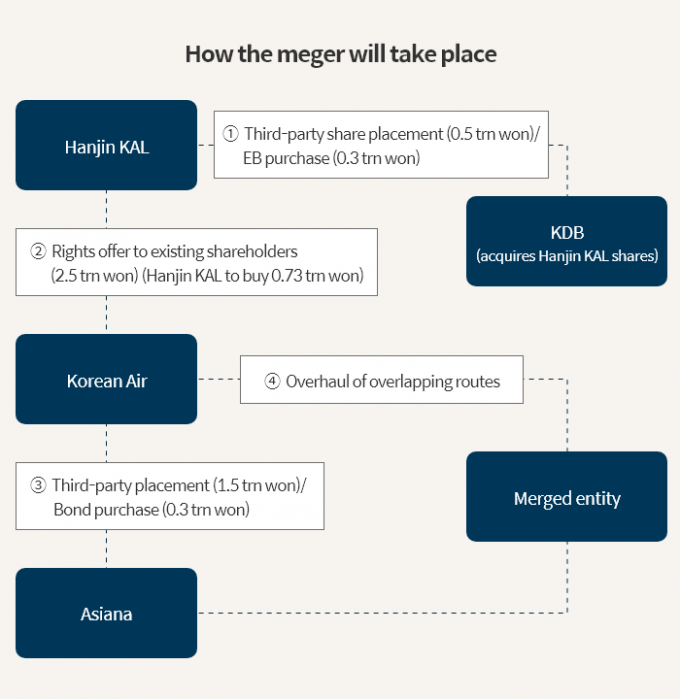

In February of this year, Korea’s Fair Trade Commission (FTC) approved the two full-fledged carriers' merger on the condition of drastically adjusting their profitable routes.

The Korean antitrust regulator said at the time that the merger could hurt competition on 26 international and 14 domestic routes among the two companies’ 87 overlapping routes.

Accordingly, it asked the two carriers to relinquish a portion of their airport slots and traffic rights, mostly on their heaviest routes such as ones from Seoul to New York, Paris, London, Phuket and Guam. The slots will be reallocated to other Korean airlines, namely low-cost carriers.

But Korean Air is hesitant about accepting the requests, saying that giving up on some of its airport slots would result in job cuts and airplane sales.

On top of the protracted review process, eyes are on whether Korean Air will yield to any drastic requirements by other countries' antitrust regulators to push ahead with the transaction.

"Taking into consideration stricter scrutiny by antitrust regulators, Korean Air may have to make big concessions to complete the merger," said an industry source.

"Now the company needs to discuss follow-up measures based on various scenarios."

Write to Zi-Hoon Lee and Jeong-Min Nam at lizi@hankyung.com

Yeonhee Kim edited this article.

-

Mergers & AcquisitionsKorea approves Korean Air-Asiana merger; hurdles remain

Mergers & AcquisitionsKorea approves Korean Air-Asiana merger; hurdles remainFeb 22, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorean Air wary of Asiana deal after EU blocks HHI-DSME merger

Mergers & AcquisitionsKorean Air wary of Asiana deal after EU blocks HHI-DSME mergerJan 14, 2022 (Gmt+09:00)

2 Min read -

AirlinesKorean Air won't sell Asiana's budget carriers post-merger

AirlinesKorean Air won't sell Asiana's budget carriers post-mergerJul 19, 2021 (Gmt+09:00)

2 Min read