UBS retains top position on Korea’s M&A advisor list after Ecorbit deal

UBS led a $1.6 billion Ecorbit sale in August; KB Securities commanded the country’s capital market

By Oct 04, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

UBS Group AG remained on the top of the South Korean merger and acquisition (M&A) advisory market as of the end of the third quarter after adding the sale of Ecorbit Co. valued at 2.1 trillion won ($1.6 billion) to its list of deal arrangements.

KB Securities Co. again dominated the country’s capital market deals, including both equity and debt sales worth 1.06 trillion won and 13.47 trillion won, respectively, in the first nine months of this year.

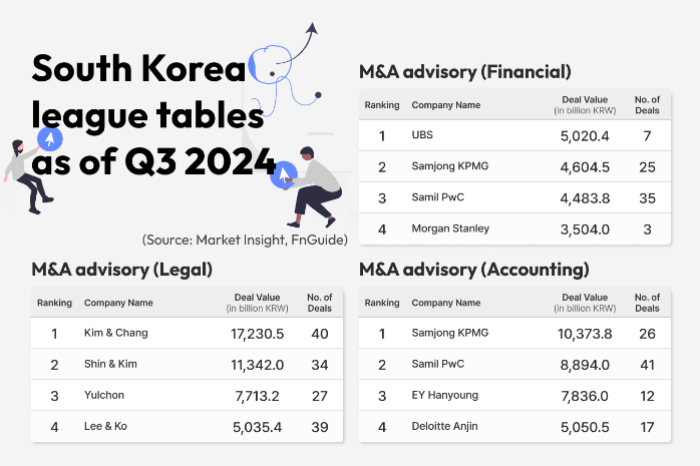

According to the league tables by The Korea Economic Daily’s capital market news outlet Market Insight and Seoul-based financial data provider FnGuide Inc. announced on Thursday, the Switzerland-headquartered multinational investment bank topped Korea’s M&A financial advisor list for the January-September period of this year after leading a total of seven major deals worth 5.02 trillion won.

In August alone, it managed the sale of Korea’s No. 1 landfill company Ecorbit worth 2.07 trillion won to a consortium of IMM Private Equity and IMM Investment. It was the country’s biggest M&A deal in the third quarter.

Samjong KPMG rose by two notches from the end of the second quarter to second place with a combined 25 deals worth 4.60 trillion won after advising the sale of Korea’s largest waste recycling platform company KJ Environment and its affiliated companies to global private equity firm EQT for 1 trillion won in August.

Samil PricewaterhouseCoopers (Samil PwC) ranked third after managing a total of 35 deals valued at 4.48 trillion won in total after outperforming its rivals in cross-border deals, including the sale of Korean medical device maker Jeisys Medical Inc. to French healthcare-focused private equity firm Archimed in a 990-billion-won deal and a $340-million sale of Korea’s No. 3 coffeeshop operator Compose Coffee Co. to the Philippines’ largest fast-food chain Jollibee Foods Corp.

It was the runner-up in the market as of the end of this year's first half.

Morgan Stanley was elbowed out from third to fourth over the same period after advising three deals valued at 3.50 trillion won in total.

KIM & CHANG, UNRIVALED NO. 1 IN M&A LEGAL ADVISORY

Korea’s biggest law firm Kim & Chang retained the top position on the country’s M&A legal advisory list in the first nine months of this year.

It advised 40 deals worth 17.23 trillion won, including the Ecorbit sale and the Geo-Young Corp. deal worth 1.95 trillion won, the country’s biggest M&A in the first half.

Shin & Kim finished in second after dealing 34 cases valued at a combined 11.34 trillion won after advising the buyer side of Hanon Systems Corp., the world’s No. 2 heat pump systems maker based in Korea, in a 1.73 trillion won deal.

Yulchon ranked third, one notch higher from the end of the second quarter, with 27 deals worth 7.71 trillion won, followed by Lee & Ko with 23 deals worth 4.68 trillion won.

Samjong KPMG snatched back the crown from Samil PwC in the league table for Korea’s M&A accounting, ranking top after managing 26 deals worth 10.37 trillion won. It advised the sellers of Ecorbit, as well as Tongyang Life Insurance Co. and ABL Life Insurance Co.

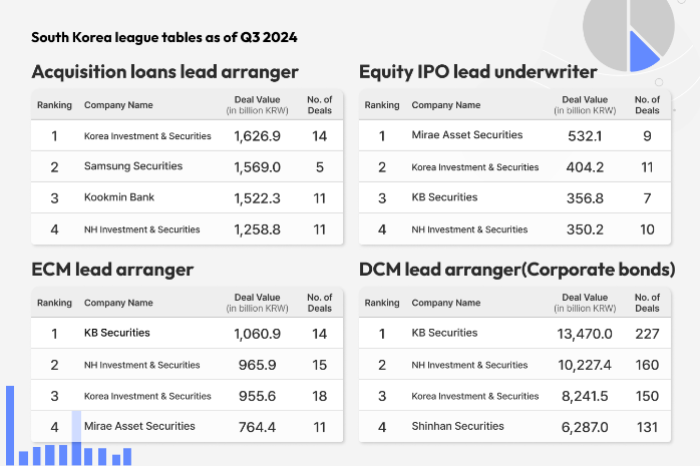

In the acquisition loan arrangement, Korea Investment & Securities Co. led the market with 14 deals worth 1.63 trillion won.

KB SECURITIES REMAINS TOP

KB Securities Co., the brokerage unit of the leading Korean financial institution KB Financial Group, continued ruling the country’s equity capital market (ECM) and debt capital market (DCM) as of the end of the third quarter.

It arranged 14 deals in the ECM market worth 1.06 trillion won, including rights offerings by SillaJen Inc., Insung Information Co. and Hanjoo Light Metal Co. in the third quarter alone.

NH Investment & Securities Co. finished in second position after leading 15 ECM deals worth 965.9 billion won, including the initial public offering of Tencent-backed Shift Up Corp., the Korean game developer behind the global hit game “Goddess of Victory: Nikke,” and Eco & Dream Co.'s new share sale valuing 107.1 billion won.

Korea Investment & Securities and Mirae Asset Securities Co. ranked No. 3 and 4, respectively, in the ECM market.

In the DCM market, KB Securities took the throne again as of the end of the third quarter after arranging 227 corporate bond sales valued at 13.47 trillion won, followed by NH Investment & Securities with 160 debt sales worth 10.23 trillion won.

Write to Ji-Eun Ha, Jong-Kwan Park, Choi,Seok-Cheol and Hyun-Ju Jang at hazzys@hankyung.com

Sookyung Seo edited this article.

-

Mergers & AcquisitionsWoori signs $1.16 bn deal to acquire Tongyang, ABL Life from China’s Dajia

Mergers & AcquisitionsWoori signs $1.16 bn deal to acquire Tongyang, ABL Life from China’s DajiaAug 28, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsIMM consortium picked as preferred bidder for Ecorbit

Mergers & AcquisitionsIMM consortium picked as preferred bidder for EcorbitAug 26, 2024 (Gmt+09:00)

2 Min read -

Food & BeverageJollibee to acquire Korea’s Compose Coffee in $340 mn deal

Food & BeverageJollibee to acquire Korea’s Compose Coffee in $340 mn dealJul 03, 2024 (Gmt+09:00)

2 Min read -

League tableUBS tops Korea’s M&A advisor list on Asiana, Affinity deals

League tableUBS tops Korea’s M&A advisor list on Asiana, Affinity dealsJul 01, 2024 (Gmt+09:00)

3 Min read -

Private equityFrance's Archimed seeks to delist aesthetic laser maker Jeisys

Private equityFrance's Archimed seeks to delist aesthetic laser maker JeisysJun 10, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsHankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

Mergers & AcquisitionsHankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.May 03, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsBlackstone signs over $1 bn deal with MBK for 1st exit in Korea

Mergers & AcquisitionsBlackstone signs over $1 bn deal with MBK for 1st exit in KoreaApr 22, 2024 (Gmt+09:00)

2 Min read