League table

UBS tops Korea’s M&A advisor list on Asiana, Affinity deals

UBS advises four acquisition deals worth $2 billion in total; Samsung Securities, Kim & Chang benefit from Blackstone-MBK deal

By Jul 01, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

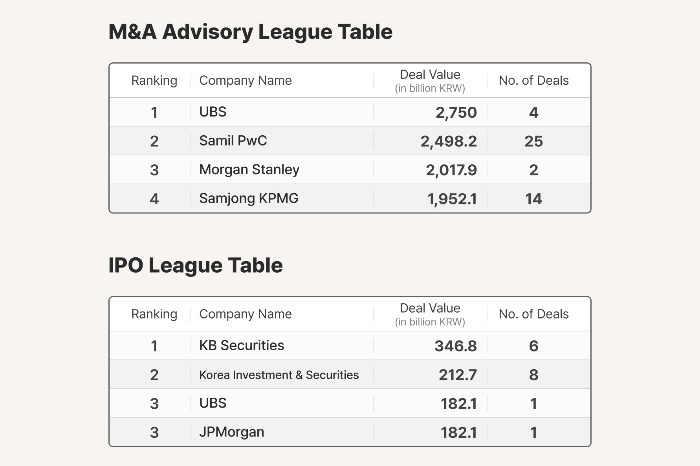

UBS Group AG topped the South Korean mergers and acquisitions (M&A) league table in the second quarter as the global investment bank worked on major deals such as Korean Air Lines Co.'s sale of the cargo unit of Asiana Airlines Inc., data showed on Monday.

KB Securities Co., the brokerage unit of the leading South Korean financial institution KB Financial Group, took the throne in the capital market as it worked on the most stock and bond sales in the April-June period, according to data compiled by The Korea Economic Daily and local financial data provider FnGuide Inc.

UBS participated in four acquisition deals worth a total of 2.8 trillion won ($2 billion). The Zürich-based bank was involved in Korean Air’s sale of Asiana’s cargo unit to secure approval of their merger from the antitrust body European Commission (EC).

The investment bank was an advisor for SK Networks Co., which sold a 100% stake in South Korea’s second-largest car leasing company SK Rent-a-Car Co. for 820 billion won to Affinity Equity Partners.

Samil PricewaterhouseCoopers ranked second on the list as the South Korean member firm of global accounting industry leader PwC worked on 25 deals worth 2.5 trillion won in total. Morgan Stanley was third with 2 trillion won in two deals, while Samjong KPMG dropped to fourth place, slipping from the top position in the first quarter

KB SECURITIES DOMINATES ECM, DCM

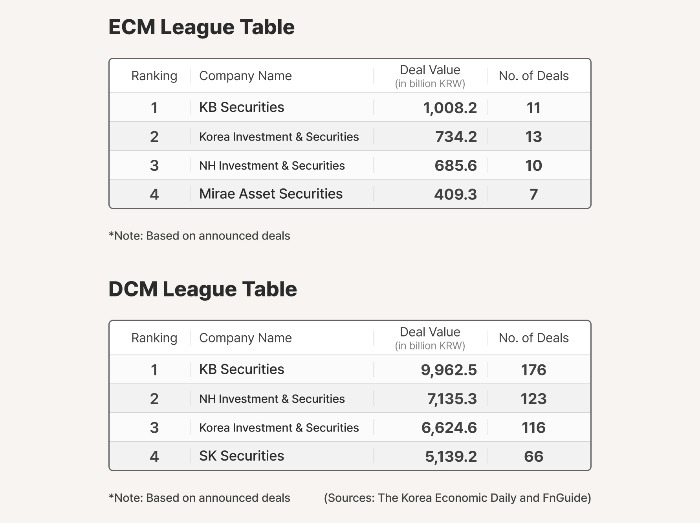

KB Securities took the top spot on the equity capital market (ECM) and debt capital market (DCM) league tables.

The brokerage house managed 11 ECM deals worth 1 trillion won in aggregate, including the rights offering of Sillajen Inc., followed by Korea Investment & Securities Co. with 13 deals totaling 734.2 billion won. NH Investment & Securities Co. and Mirae Asset Securities Co. ranked No. 3 and No. 4 as they handled deals worth 685.6 billion won and 409.3 billion won, respectively.

KB Securities also topped the initial public offering league table as it managed six deals on the local stock exchange such as the listing of HD Hyundai Marine Solution Co., the country’s largest IPO in more than two years.

The securities firm maintained the No. 1 position on the DCM as it handled 176 deals worth nearly 10 trillion won in total to sell straight corporate bonds. NH Investment & Securities followed the company with 123 deals worth 7.1 trillion won.

SAMSUNG, KIM & CHANG BENEFIT FROM BLACKSTONE, MBK DEAL

In the acquisition financing and refinancing sector, Samsung Securities Co. was the top player as it managed two acquisition financing and two refinancing deals, the four deals totaling 1.3 trillion won.

The brokerage house handled the acquisition financing for Asian buyout firm MBK Partners’ takeover of the holding firm of Geo-Young Corp., the country's largest medicine wholesaler, from global private equity giant Blackstone Inc.

Among legal advisors, Kim & Chang, South Korea’s largest law firm, secured the top spot as it participated in 23 deals worth 9.5 trillion won in aggregate. The firm advised both Blackstone and MBK Partners for the Geo-Yong deal.

Shin & Kim LLC followed Kim & Chang providing legal advisory to 18 deals totaling 6.1 trillion won. Shin & Kim helped KCC Corp. buy a 40% stake in the US' Momentive Performance Materials Group, a global high-performance silicone and specialty solutions company, for 807.9 billion won.

Write to Jong-Kwan Park, Ji-Eun Ha, Jeong-Cheol Bae and Hyun-Ju Jang at pjk@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Private equityAffinity to buy Korea's No. 2 car leasing firm for $591 mn

Private equityAffinity to buy Korea's No. 2 car leasing firm for $591 mnJun 20, 2024 (Gmt+09:00)

2 Min read -

AirlinesAsiana's cargo unit to be sold for $362 mn to Air Incheon

AirlinesAsiana's cargo unit to be sold for $362 mn to Air IncheonJun 14, 2024 (Gmt+09:00)

3 Min read -

IPOsHD Hyundai Marine Solution stock price doubles on Kospi debut

IPOsHD Hyundai Marine Solution stock price doubles on Kospi debutMay 08, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsBlackstone signs over $1 bn deal with MBK for 1st exit in Korea

Mergers & AcquisitionsBlackstone signs over $1 bn deal with MBK for 1st exit in KoreaApr 22, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN