Samsung Chairman Lee meets with Xiaomi CEO Lei Jun for partnership

The Lee-Jun meeting could signal a deeper collaboration between Samsung and Xiaomi in the future mobility segment

By Mar 24, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

BEIJING – Samsung Electronics Co. Chairman Lee Jae-yong has met with Xiaomi Inc. Chief Executive Lei Jun in the Chinese capital, raising speculation about a potential partnership in the electric vehicle (EV) sector.

The meeting took place at Xiaomi's EV manufacturing plant, underscoring the South Korean tech giant's growing interest in automotive electronics.

With Xiaomi aggressively expanding its presence in the EV market and Samsung focusing on vehicle components, the meeting of the two leaders could signal a deeper collaboration, analysts said.

Lee, widely known in international business circles by his English name Jay Y. Lee, met with the Xiaomi CEO, often referred to as China's Elon Musk, on Saturday ahead of the annual China Development Forum (CDF), which kicked off on Sunday for a two-day run.

This is the two leaders' first official meeting in seven years, company officials said.

‘FRENEMIES’

Samsung and Xiaomi have long maintained a relationship, often described as “frenemies” – both friends and enemies.

While they fiercely compete in consumer electronics, especially smartphones and home appliances, they also collaborate extensively in the semiconductor and display sectors.

Xiaomi is a key customer for Samsung's memory chips, NAND flash storage and foldable OLED displays.

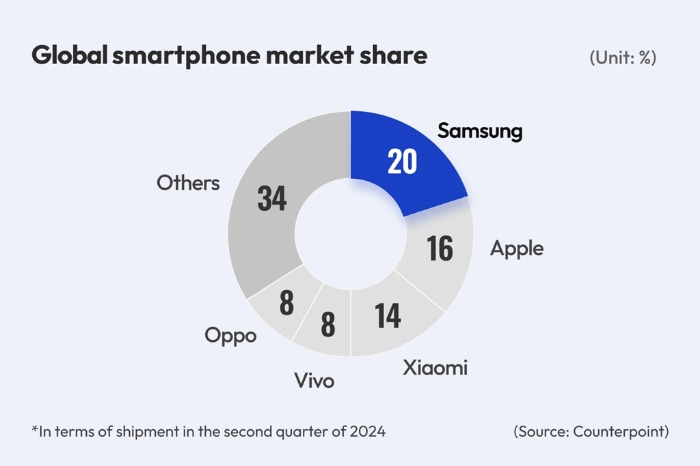

In the global smartphone market, Samsung is the top player with 19% market share at the end of 2024. Xiaomi is following fast with 14% market share, ranking third.

XIAOMI ENTERS EV MARKET, POTENTIAL VIP FOR SAMSUNG

With the launch of its first EV model, the Xiaomi SU7, last year, the Chinese company has emerged as a potential strategic partner for Samsung.

The SU7 series saw remarkable success, with 136,854 units sold in its debut year. The company’s innovation business revenue, including EVs, reached 32.8 billion yuan ($4.5 billion) in 2024.

Xiaomi has since revised its 2025 EV delivery target to 350,000 units from 300,000 units earlier. It also plans to expand into overseas automotive markets by 2027.

For Samsung, the meeting with Xiaomi CEO Jun could pave the way for greater access to the burgeoning automotive electronics market.

Samsung Electronics, a global leader in memory chips, smartphones and home appliances, is actively seeking business opportunities in the automotive sector, together with its affiliates such as Samsung Display Co., Samsung Electro-Mechanics Co., Samsung SDI Co. and Harman International Industries Inc., a US-based audio and automotive electronics subsidiary.

However, gaining traction in China’s highly competitive automotive supply chain is a challenge for the Korean tech giant.

Local suppliers such as display maker BOE Technology Group Co. and battery maker Contemporary Amperex Technology Co. Ltd. (CATL) dominate the Chinese market.

Industry watchers said Lee’s direct engagement with Xiaomi’s Jun signals Samsung's determination to strengthen its presence in the automotive sector.

Meanwhile, “Xiaomi also needs Samsung to enhance its presence in the EV market,” said a local industry official.

GLOBAL EXECTUIVES CONVERGE AT CDF

Lee’s visit to China marks his first return to the CDF in two years.

This year's forum, themed “Unleashing Development Momentum for Stable Growth of Global Economy,” brought together over 80 global business leaders, including SK Hynix Inc. CEO Kwak Noh-jung, Apple CEO Tim Cook, Qualcomm CEO Cristiano Amon and Saudi Aramco CEO Amin H. Nasser.

Chinese Premier Li Qiang opened the forum with a keynote address emphasizing China’s commitment to further opening its economy.

Against this backdrop, Samsung’s efforts to deepen its relationships with Chinese partners are seen as both strategic and timely, analysts said.

The conference takes place amid global trade uncertainties sparked by the US Trump administration's tougher new tariff scheme.

Write to Jung-Soo Hwang, Jung-Eun Shin and Eun-Jung Kim at hjs@hankyung.com

In-Soo Nam edited this article.

-

Business & PoliticsS.Korea wary of inclusion on US ‘Dirty 15’ nations list for reciprocal tariffs

Business & PoliticsS.Korea wary of inclusion on US ‘Dirty 15’ nations list for reciprocal tariffsMar 19, 2025 (Gmt+09:00)

3 Min read -

Leadership & ManagementSamsung in 'do or die' situation'; Lee sounds crisis alarm

Leadership & ManagementSamsung in 'do or die' situation'; Lee sounds crisis alarmMar 17, 2025 (Gmt+09:00)

2 Min read -

EnergyTrump-driven energy boom spurs Korean firms to hike US gas investments

EnergyTrump-driven energy boom spurs Korean firms to hike US gas investmentsMar 10, 2025 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung’s system chip, foundry business under close scrutiny for overhaul

Korean chipmakersSamsung’s system chip, foundry business under close scrutiny for overhaulMar 06, 2025 (Gmt+09:00)

5 Min read -

Business & PoliticsTrump says Korea interested in Alaska gas project; Korean firms skeptical

Business & PoliticsTrump says Korea interested in Alaska gas project; Korean firms skepticalMar 05, 2025 (Gmt+09:00)

3 Min read -

ElectronicsSamsung's Harman goes from ugly duckling to golden swan

ElectronicsSamsung's Harman goes from ugly duckling to golden swanFeb 18, 2025 (Gmt+09:00)

3 Min read -

ElectronicsSamsung’s Circle to Search available on Galaxy A series to rival Xiaomi

ElectronicsSamsung’s Circle to Search available on Galaxy A series to rival XiaomiAug 16, 2024 (Gmt+09:00)

4 Min read -

ElectronicsVertu, Motorola, Xiaomi eye Korean smartphone market as LG exits

ElectronicsVertu, Motorola, Xiaomi eye Korean smartphone market as LG exitsNov 18, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung to supply mobile chips to Xiaomi, Oppo; to rank 3rd in AP market

Korean chipmakersSamsung to supply mobile chips to Xiaomi, Oppo; to rank 3rd in AP marketNov 02, 2020 (Gmt+09:00)

3 Min read