Chipmakers Samsung, SK Hynix among foreigners’ top picks in Korea

Foreigners’ strong ‘Buy Korea’ trend eases concerns over their exit upon the government's short-selling ban

By Dec 04, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s two largest chipmakers, Samsung Electronics Co. and SK Hynix Inc., were among foreign investors’ top picks on the country’s main stock bourse in November, fanning hopes that the anticipated semiconductor industry rebound is just around the corner.

According to the Korea Exchange on Monday, foreigners’ net buying of Korean stocks on the main Kospi market totaled 2.95 trillion won ($2.26 billion) last month. On the tech-heavy Kosdaq market, they bought a net 1.14 trillion won in shares.

Their buying was focused on chipmakers, strengthening the market view that the chip industry will emerge out of its doldrums as early as the first half of next year.

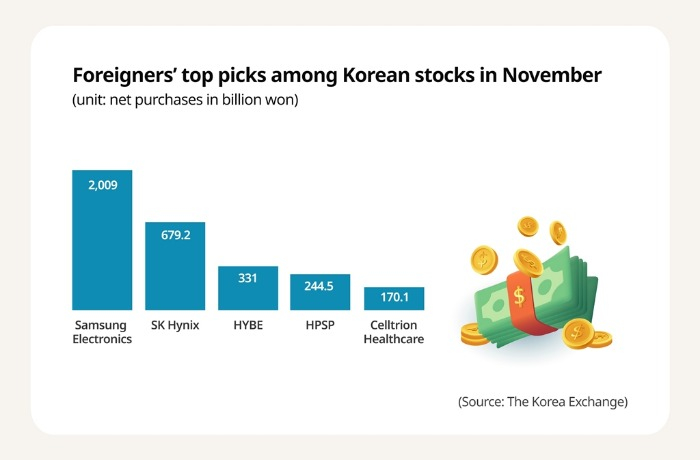

Samsung Electronics, the world’s top memory chipmaker, was their top pick, with purchases of slightly over 2 trillion won in shares, followed by SK Hynix, the No. 2 memory chipmaker, with 679.2 billion won in net buying.

The two chipmakers, combined, accounted for more than 90% of foreign stock purchases on the main bourse in November.

On the Kosdaq market, chip equipment maker HPSP Co. was the most coveted stock among foreigners, who bought 244.5 billion won worth of their shares. HPSP topped the overall most-favored stock list on the junior market last month.

NET SELLERS

Some battery-related stocks were the main target for selling amid concerns over the slowing pace of electric vehicle uptakes.

Foreigners sold 370 billion won in shares of POSCO Holdings Inc., the parent of Korea’s top steelmaker POSCO, which owns several battery materials affiliates, in November.

POSCO Future M Co. a leading Korean battery materials maker, saw as much as 324.5 billion won of its shares sold by foreign investors amid steady price declines of lithium and cathodes – key battery components.

Foreigners also unloaded 358.6 billion won in Samsung SDI Co. shares and 95.4 billion won worth of EcoPro BM Co. shares last month.

As the global EV uptake slows, Korea’s top battery maker LG Energy Solution Ltd. and US carmaker Ford Motor Co. in mid-November scrapped a planned battery manufacturing joint venture in Turkey.

Stock market analysts said foreigners’ current strong “Buy Korea” trend eases concerns over a foreign exit following the government’s ban on short selling.

In early November, the Financial Services Commission (FSC), Korea’s top financial regulator, said it is entirely banning stock short selling until June next year to prevent rampant illegal, naked short sales in Korea.

Foreigners have been the main force on Korean bourses to use the technique – long criticized by the government and retail investors as a “mean” tool that distorts share prices and creates excessive market volatility.

LOOMING SIGNS OF CHIP TURNAROUND

Heavy foreign buying of chip stocks in Korea coincides with the looming signs of a global semiconductor market turnaround.

Data from DRAMeXchange show the November average contract price of DDR4 8Gb for PCs, one of the most common DRAM products, stood at $1.55, up 3.3% from the previous month. In October, the price of such chips gained 15.4% on-month, marking their first price hike since July 2021.

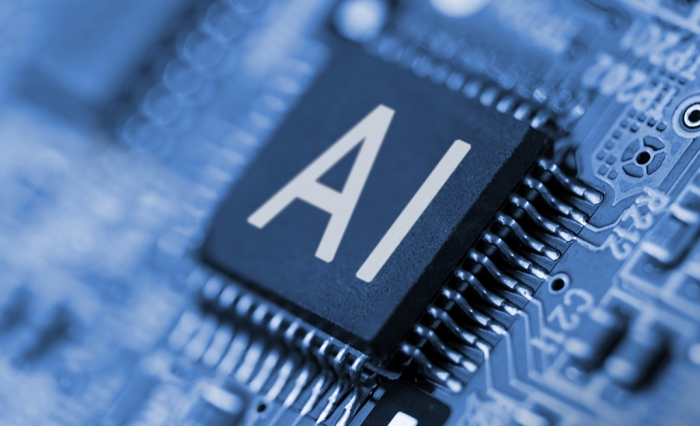

The rise in DRAM prices has been led by so-called artificial intelligence chips such as high bandwidth memory (HBM), the type that powers generative AI devices on high-performance computing systems.

Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest foundry company, saw its sales rise in October, its first turnaround in eight months.

US graphics chip designer Nvidia Corp. recently reported that its third-quarter sales tripled to $18.1 billion from a year ago.

Nvidia largely sources HBM chips used in its graphics processing units (GPUs) from Samsung and SK Hynix.

The two Korean chipmakers, which have seen their semiconductor business losses snowball for most of this year, are certain to swing to profit in 2024.

“The chip industry will likely stage a meaningful upturn from the end of this year,” said Lee Seung-woo, a Eugene Investment & Securities analyst.

With his Samsung Electronics target price of 93,000 won, he forecast the company would post 34 trillion won in operating profit on sales of 303 trillion won next year, up 369% and 16%, respectively.

On Monday, Samsung finished up 0.8% at 72,600 won in Seoul, outperforming the Kospi index’s 0.4% gain. SK Hynix fell 1.1% to close at 131,100 won.

Write to Man-Su Choe at bebop@hankyung.com

In-Soo Nam edited this article.

-

EconomyS.Korea’s chip exports rebound, ending 15-month losing streak

EconomyS.Korea’s chip exports rebound, ending 15-month losing streakDec 01, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returns

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returnsNov 30, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung launches next-generation chip process development unit

Korean chipmakersSamsung launches next-generation chip process development unitNov 29, 2023 (Gmt+09:00)

4 Min read -

BatteriesLG Energy, Ford’s battery JV in Turkey scrapped as EV uptake slows

BatteriesLG Energy, Ford’s battery JV in Turkey scrapped as EV uptake slowsNov 12, 2023 (Gmt+09:00)

3 Min read -

Short sellingKorea bans short selling; battery stocks lead market rally

Short sellingKorea bans short selling; battery stocks lead market rallyNov 06, 2023 (Gmt+09:00)

5 Min read -

BatteriesPOSCO Future M sees cathode material prices falling 12% in Q4

BatteriesPOSCO Future M sees cathode material prices falling 12% in Q4Oct 25, 2023 (Gmt+09:00)

1 Min read -

Korean stock marketKorea warns foreigners of stricter rules on illegal short selling

Korean stock marketKorea warns foreigners of stricter rules on illegal short sellingSep 07, 2023 (Gmt+09:00)

3 Min read