Korean stock market

PCB makers in record-setting rally on strong outlook

S.Korean PCB makers are poised for record profits in 2022, driven by high-performance chip package substrates

By Feb 25, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Shares in South Korea's small and medium-sized printed circuit board (PCB) makers extended their upward run to hit fresh highs this week, bucking the trend in the broader market.

They have significantly outperformed the sluggish stock market over the past few months, with their stronger-than-expected results further underpinning the bullish outlook for the sector.

Simmtech Co. rallied to its all-time high of 54,200 won ($45) on Friday morning, a day after the company said tha its 2022 operating profit would leap 78% on-year to 303 billion won ($252 million), compared with a 90% surge last year.

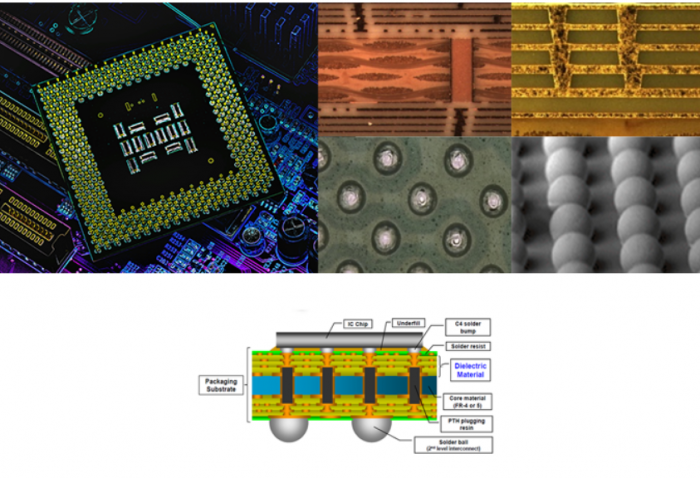

Simmtech produces high-performance substrates for flip chip-chip scale packaging (FCCSP), used for mobile application processors and for a computing platform of a system in package.

Its share price gained 19% year-to-date, reversing a 10% decline in the broader market over the same period. The 25th-largest stock on Kospi has advanced 81% since early November, when its share price began its upward march.

Daeduck Electronics Co. was trading near its peak of 25,450 won scraped early last month. The stock has advanced 34% over the past four months.

Daeduck supplies circuit boards for flip chip-ball grid array (FCBGA), a type of highly integrated package boards used in the central processing units (CPUs) of PCs, graphic processing units (GPUs) for game consoles and automotive chips.

Booming demand for high-performance semiconductor substrates was behind their above-consensus earnings, driving them to aggressively expand production capacity last year.

Analysts said the country's PCB suppliers will report record-breaking profits again in 2022, upgrading their target prices for the stocks.

"Major FCBGA substrate suppliers have already set up detailed investment plans until 2024 and beyond," said Samsung Securities analyst Lee Jong-wook.

"It is highly likely that the FCBGS market will remain buoyant at least through 2023."

The share price of Interflex Co. jumped to a peak of 18,800 won on Wednesday. On Friday, it rose 7.8% to close at 19,400 won on Kosdaq.

Korea Circuit Co. has nearly doubled in share price since early November. On Friday, it was trading 5% higher at 32,300 won.

Isupetasys Co. gained 3% to 7,300 won, after climbing to its historic high of 7,690 won on Monday.

Operating profit at Isupetasys nearly quadrupled to 47 billion won in 2021 over the year, with its net loss shrinking to one-third of the previous year’s at 4 billion won, according to a regulatory filing early this month.

TARGET PRICE UPGRADES

In 2021, operating profits at South Korea's six medium-sized PCB makers skyrocketed by 26,291% on-year to a combined 158.2 billion won, according to Daishin Securities.

Daishin Securities Co., DB Financial Investment Co. and HI Investment & Securities Co. all lifted their target prices on Daeduck Electronics by 10-17% on Thursday. This year, Shinhan Investment Co. and Kiwoom Securities Co. initiated their coverage of Daeduck.

Since the start of this year, Daishin Securities also upgraded its target price for Simmtech twice from 44,000 won to 56,000 won and to 60,000 won.

Daishin Securities analyst Park Kang-ho said that FCBGA-type substrates will likely expand to 24% of Daeduck's sales next year. It forecast a 72.5% on-year surge in Daeduck's 2022 operating profit to 124 billion won.

"The electrification trends in the automobile industry will also drive Daeduck Electronics' earnings higher on a stable basis. Its valuation will be adjusted accordingly," Park said in a research note released on Thursday.

As chipmakers are shifting toward high-density circuit substrates containing more microcircuits to improve system performance, multi-layer substrates like the FCBGA type are replacing general substrates for electronic components of artificial intelligence, autonomous driving cars and computer servers.

The protracted supply shortage of high-performance circuit boards has pushed their prices sharply higher, amid a cryptocurrency mining boom.

Simmtech on Thursday forecast its 2022 operating profit margin at 18.3%, versus last year's 11.8%.

According to analysts, operating profit at Korea Circuit is projected to rise 62% on-year to 124.4 billion won in 2022, led by FCBGA substrates.

Write to Sung-Mi Shim at smshim@hankyung.com

Yeonhee Kim edited this article

More to Read

-

SemiconductorsSmall-size PCB makers in expansion mode to meet demand

SemiconductorsSmall-size PCB makers in expansion mode to meet demandSep 29, 2021 (Gmt+09:00)

3 Min read -

Electronic componentsS.Korea’s top flexible PCB maker wins big in 5G and EVs

Electronic componentsS.Korea’s top flexible PCB maker wins big in 5G and EVsMar 10, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN