S.Korea’s top flexible PCB maker wins big in 5G and EVs

By Mar 10, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

BH Co. is South Korea’s leading manufacturer of flexible printed circuit board (FPCB), an essential component of smartphones, from camera to OLED display modules.

Its list of major customers has expanded to include fast-growing Chinese smartphone makers such as Oppo, Vivo and Xiaomi.

FPCB, evident from its name, is a very flexible and thin circuit board that allows circuits to fit the electronic device, as opposed to modifying the device to conform to the board.

The global FPCB market has seen sustained growth in recent years, with smartphones becoming much thinner and lighter. Its industry size is forecast to reach 20 trillion won ($17.5 billion) by 2024, up 25% from the current level.

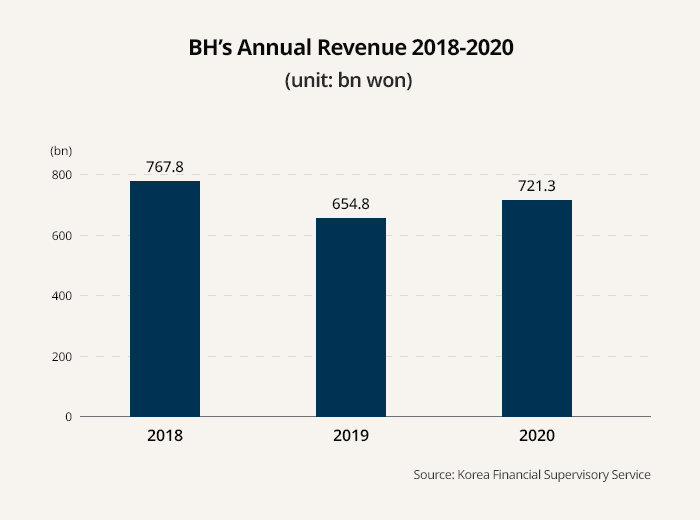

BH is South Korea’s FPCB market leader with annual revenue of 721.3 billion won ($630 million) and operating profit of 34 billion won ($29.7 billion) last year.

Lee Kyung-hwan, the company’s founder and CEO, stated that the company’s revenue is expected to reach 1 trillion won ($ 874 million) by 2022, driven by its successful diversification to the electric vehicle and 5G industries.

“EV and 5G components will be our next growth drivers after smartphones. We are confident to generate a revenue of 1 trillion won by next year,” Lee said.

QUICK WINS IN AUTO SECTOR

In the auto industry, BH is already building a great track record for a company for which the primary focus over the past decade had been on smartphones.

Big-name global players such as Hyundai Motor Co., Audi and Volvo have chosen BH for their EV parts and electronic display components within the vehicle.

Hyundai uses the OLED display components that BH developed in-house over a one-year period for its recently unveiled IONIQ 5, the first model under its standalone EV sub-brand.

IONIQ 5 does not have side mirrors, and instead has thin cameras installed for checking traffic conditions. The driver looks at the OLED display, which uses BH components, inside the car to check the road view taken by the cameras.

The German automaker Audi also started to use BH’s products for screen displays in the back seats of the vehicles.

“OLED displays have become increasingly prevalent among both traditional and electric vehicles, fueling more global automakers to purchase our products”, commented Lee.

BH also shared that cables that connect EV battery cells to each other have become a new business area of the company.

Previously, a bulk of cables called a “wiring harness” tied the EV battery cells together. But after BH invented -- for the first time in Korea -- an FPCB-based alternative cable, Audi and Volvo chose BH as its preferred supplier.

As the new cable is much lighter than the harness-type cables used previously, BH expects increased sales volume as well as more new customers from the auto industry in the second half of 2021.

ADDING 5G TO SMARTPHONE PORTFOLIO

BH is also acting fast within its traditional turf, the smartphone industry, to win the rapidly expanding 5G segment. The number of 5G smartphones sold in the global market was around 300 million last year, and is projected to nearly double in 2021.

The company’s success in the segment is exemplified by the development of a 5G antenna component previously dominated by Japan’s Murata Manufacturing.

The FPCB of polyimide-based antenna component, used by Samsung’s latest 5G smartphones, is manufactured by BH itself, while the module is produced by its subsidiary DK Tech Co.

BH added that it plans to produce components for 5G repeaters that connect smartphones to base stations, starting from the second half of 2021.

The company also expects upward momentum in 2021, with its CEO calling for “a great year ahead," as Apple continues to expand the use of OLED screens among its smartphone products and other devices. BH expects a significant increase in supply volume to the US company.

Financial analysts project that BH will be able to generate annual revenue of 900 billion won for 2021 with a 7% operating margin.

Lee remarked: “BH will continue to look into the future with a focus on the 5G network, EV batteries and EV components.”

Write to Byung-Keun Kim at bk11@hankyung.com

Daniel Cho edited this article.

-

New EV modelHyundai Motor debuts all-electric IONIQ5 as EV battle rages on

New EV modelHyundai Motor debuts all-electric IONIQ5 as EV battle rages onFeb 23, 2021 (Gmt+09:00)

3 Min read -

-

Hyundai reveals interior images of EV model IONIQ 5

Hyundai reveals interior images of EV model IONIQ 5Feb 15, 2021 (Gmt+09:00)

2 Min read