Korean startups

Jay-Z’s Roc Nation to invest $5 mn in S.Korea’s Musicow

The US entertainment mogul’s company will rise to No. 2 shareholder of the Korean music copyright trading platform

By Nov 04, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

US entertainment tycoon Jay-Z’s Roc Nation is expected to invest about $5 million in Musicow Inc., South Korea’s music copyright trading platform pioneer, to become the Korean startup’s No. 2 shareholder, betting big on fractional investments in music copyrights.

According to investment banking industry sources on Monday, Roc Nation is expected to sign an agreement to acquire about a 20% stake in Musicow US, the American unit of the Korean music copyright trading platform operator, for about $5 million in mid-November.

“(Roc Nation) will be the second-largest shareholder (of Musicow US) after Musicow’s Korean headquarters (with a 70% stake),” said an IB official close to the matter who refused to be identified.

Roc Nation is said to have made it clear in the stake purchase agreement that it is a strategic investor with more involvement in the Korean startup’s management.

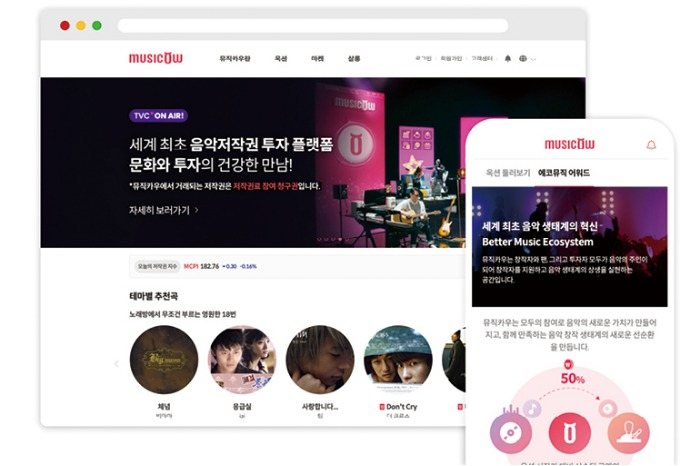

Founded in 2016, Musicow introduced the world’s first fractional investment platform for music copyright trading.

It pays a lump sum to creators of music tracks for claims to request copyright fees. It then splits the claim rights into small fractions and puts them up for auction. Half the gains from the auction deals go to the artists.

Investors in the music claim rights earn profits from the music copyrights, similar to dividends paid to stock investors for shareholding. Individual investors can also trade ownership of copyright claims through the platform.

The Korean startup launched its US operation in 2022 with a 6 billion won ($4.4 million) investment from Hanwha Systems Co.

The US operation plans to begin a music copyright trading service in the US, the world’s largest recorded music market valued at $17.1 billion, this month.

Despite its huge music industry, the US market for individual trading of music copyrights is still in the fledgling stages, with much room for growth.

JAY-Z KNOWS THE BUSINESS

The market’s growth potential is said to have grabbed the attention of Jay-Z, one of the most successful artists in hip-hop history, who has also become one of the first hip-hop artists to achieve billionaire status in the US, said industry sources.

He won 24 Grammy awards for songs such as ‘Empire State of Mind’ and ‘Run This Town.’ He is the world’s richest hip-hop musician worth $2.5 billion, according to Forbes. He is richer than Taylor Swift, the world’s richest female celebrity with a net worth of $1.6 billion.

In 2008, Jay-Z founded Roc Nation, an entertainment company that operates music labels and manages some of the world’s most recognizable names, from Rihanna and Megan Thee Stallion to Lil Uzi Vert and Big Sean. The company offers similar services for sports stars.

In addition to the entertainment business, Jay-Z built his wealth empire with successful startup investments.

In 2013, Jay-Z invested $2 million in Uber Technologies Inc., and his stake valuation was estimated to have leaped to $70 million after the ride-hailing app operator went public in 2019.

In 2015, he bought the tech company Aspiro and its subsidiary, the streaming company Tidal, for $56 million together with other artists. But four years later, he sold his majority stake in the music streaming service to Square, owned by Twitter (now X) founder Jack Dorsey, for a whopping $297 million in cash and stock.

Together with US alternative investment giant Blackstone Inc., Oprah Winfrey and Natalie Portman, Jay-Z also invested $200 million in stakes in Swedish oat milk producer Oatly in 2020.

More than a decade ago, financial titan Warren Buffett praised the Brooklyn-born rapper as one of the greatest investors and predicted that young people would turn to Jay-Z for financial guidance.

With his first investment in a Korean company, Jay-Z is betting on the growth of fractional investments in music copyrights in the US, said market analysts, adding that the popularity of Korean pop music is another reason to invest in the Korean startup.

Once the Musicow service begins in the US, copyrights of Korean pop songs are also expected to trade in the country, an IB official said.

Excluding Jay-Z's investment, Musicow has thus far drawn 224 billion won from various investors since its inception. Its other investors include STIC Investments Inc., Korea’s state-run Korea Development Bank, Hana Financial Investment Corp., LB Investment Inc. and Premier Partners LLC.

Write to Tae-Hoon Lee at beje@hankyung.com

Sookyung Seo edited this article.

More to Read

-

RegulationsFractional investing to gain traction in Korea with green light from FSC

RegulationsFractional investing to gain traction in Korea with green light from FSCJul 31, 2023 (Gmt+09:00)

3 Min read -

Korean startupsMusic copyright trading platform Musicow attracts $46 mn from STIC

Korean startupsMusic copyright trading platform Musicow attracts $46 mn from STICMay 23, 2023 (Gmt+09:00)

2 Min read -

Culture & TrendsKorea's Musicow to lead fractional IP ownership globally

Culture & TrendsKorea's Musicow to lead fractional IP ownership globallyFeb 20, 2023 (Gmt+09:00)

2 Min read -

RegulationsKorea to legalize security token for fractional investment

RegulationsKorea to legalize security token for fractional investmentFeb 06, 2023 (Gmt+09:00)

3 Min read -

-

Korean startupsHanwha, Musicow to launch JV in US for copyright trading abroad

Korean startupsHanwha, Musicow to launch JV in US for copyright trading abroadDec 10, 2021 (Gmt+09:00)

2 Min read -

Korean startupsMusic copyright trading platform Musicow revitalizes Korea’s startup scene

Korean startupsMusic copyright trading platform Musicow revitalizes Korea’s startup sceneNov 22, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN