S.Korea's early stage VC funding down amid dearth of targets

Some early stage VC firms are going abroad in hunt for investment targets and encouraging young talent to start businesses

By Jul 19, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Early stage startup funding has plummeted in South Korea as venture capitalists shifted to late-stage venture firms with stable business models amid the drought in venture capital funding, leading would-be startup builders to seek jobs at Big Tech companies.

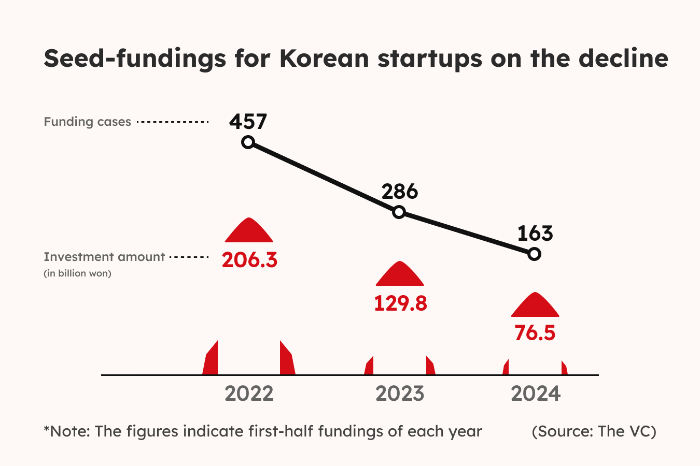

Seed funding in domestic startups contracted to 76.5 billion won ($55.2 million) in the first half of this year, down sharply from 129.8 billion won in the same period of last year, according to The VC, a venture capital industry tracker.

That compared with 206.4 billion won funneled into domestic startups for seed money in the first half of 2022.

Investments in seed-funding rounds for venture firms plunged to 163 cases in the January-June period, from 286 in the year-earlier period. In the first half of 2022, seeding funding for South Korean startups stood at 457 cases.

The size of seed funding has shrunk, as well. AIZ Entertainment, an AI-based platform, was the only domestic startup that raised over 10 billion won for seed money in the first half of this year.

The company, founded in late 2023 by Namkoong Whon, former chief executive of Kakao Corp., aims to create fandom for entertainment content. It attracted 16.0 billion won, the biggest seed funding a Korean startup raised in the first half of this year.

That compared with the 13.3 billion won that The Origin raised in the same period of 2023, one of the big seed investments in domestic startups last year.

The Origin manages intellectual property rights for content creators and their adaptation into different platforms.

In the same period of 2022, ISKRA, a Korean blockchain-based gaming developer, received 42.0 billion won in seed funding.

Venture capital industry watchers said that startup investors are prioritizing exits over early stage investments after raising their exposure to fledgling venture companies in their boom years.

Fundings for domestic startups in seed and series A rounds have declined to 926.4 billion won in the first half of this year, compared with 1.28 trillion won a year before.

Those early stage startup fundings took up 76% of total venture capital fundings raised in the country in the first half of this year, down from around 80% each in 2022 and 2023.

“There are growing concerns that the venture ecosystem will shrink as initial investments, once called the ‘flower of venture investment,’ are slowing down,” said a venture capitalist.

“In the past, there were many cases of starting a business after seeing a senior or colleague grow it into a unicorn company, but now there is no clear role model.”

DEARTH OF INVESTMENT TARGETS

Some venture capitalists blame a dearth of startups for the drop in early stage startup investments.

“No college students are willing to start a business, so we have to chase them down and encourage them to start a business,” said a venture capital company official.

Behind the drop in startup building is rapid technology advancement particularly in the fields of AI and robotics that would start-up builders find difficult to catch up with.

In the online platforms area already dominated by existing players, there is also little space to squeeze in.

“Pessimism is spreading that even startups with good ideas will find it difficult to survive in the current environment,” the startup investor added.

Still, venture capital companies are aggressive in hunting for early-stage startups.

Kakao Ventures Corp. has built a system that automatically detects the usage of its app designed for new startup builders and notifies its investment team.

The venture capital arm of South Korea’s top mobile platform Kakao Corp. also doesn’t bother visiting US college campuses in search of startups even in their pilot stages and monitoring job postings for venture firms.

Future Play, a Korean early stage startup investor, is actively participating in startup competitions held at universities at home and abroad.

Startup accelerator D.Camp, founded by Korean financial institutions, hosts a demo day every month to pick startups with innovative business models.

According to Startup Alliance Korea’s recent survey of startup employees, 47.2% of the respondents said they were willing to start their own business, compared with 58.0% in 2022.

Among job seekers polled by the startup data provider, 45.5% of the respondents expressed their interest in setting up a company in 2023, down from 51.0% in 2022.

Write to Eun-Yi Ko at koko@hankyung.com

Yeonhee Kim edited this article.

-

Bio & PharmaSamsung Elec invests in US bio startup Element Biosciences

Bio & PharmaSamsung Elec invests in US bio startup Element BiosciencesJul 12, 2024 (Gmt+09:00)

1 Min read -

-

-

Artificial intelligenceAI plagiarism detection startup Muhayu eyes IPO in 2026

Artificial intelligenceAI plagiarism detection startup Muhayu eyes IPO in 2026Jul 03, 2024 (Gmt+09:00)

1 Min read -

Korean startupsAsia's largest startup fair NextRise 2024 held in Seoul

Korean startupsAsia's largest startup fair NextRise 2024 held in SeoulJun 13, 2024 (Gmt+09:00)

1 Min read -

Artificial intelligenceNvidia co-leads Series A round for AI startup Twelve Labs

Artificial intelligenceNvidia co-leads Series A round for AI startup Twelve LabsJun 05, 2024 (Gmt+09:00)

2 Min read -

Korean startupsKT offers reverse pitches to pick startup partners

Korean startupsKT offers reverse pitches to pick startup partnersMay 30, 2024 (Gmt+09:00)

1 Min read -

Korean startupsKorean AI startups yet to join global unicorn club

Korean startupsKorean AI startups yet to join global unicorn clubMay 27, 2024 (Gmt+09:00)

2 Min read -

Artificial intelligenceConversational AI startup Rapeech attracts $4.4 mn investment

Artificial intelligenceConversational AI startup Rapeech attracts $4.4 mn investmentMay 20, 2024 (Gmt+09:00)

1 Min read -

-

Artificial intelligenceNaver D2SF invests in image generation AI startup

Artificial intelligenceNaver D2SF invests in image generation AI startupMay 08, 2024 (Gmt+09:00)

1 Min read -

Korean startupsStartups bet on affluent Gen X in Korea’s senior living market

Korean startupsStartups bet on affluent Gen X in Korea’s senior living marketMay 08, 2024 (Gmt+09:00)

2 Min read -

Upcoming IPOsKorea’s vision AI startup Superb AI eyes IPO in H1, 2026

Upcoming IPOsKorea’s vision AI startup Superb AI eyes IPO in H1, 2026Apr 18, 2024 (Gmt+09:00)

2 Min read -

Artificial intelligenceKorea's AI startup Upstage raises $72 mn for global expansion

Artificial intelligenceKorea's AI startup Upstage raises $72 mn for global expansionApr 16, 2024 (Gmt+09:00)

3 Min read -

Korean startupsKorean startup CEOs away from home lead global expedition

Korean startupsKorean startup CEOs away from home lead global expeditionApr 12, 2024 (Gmt+09:00)

4 Min read -

-

-

Korean startupsBig Tech engineers rush to Korea’s AI chip startups as potential looms

Korean startupsBig Tech engineers rush to Korea’s AI chip startups as potential loomsMar 20, 2024 (Gmt+09:00)

4 Min read -

Korean startupsForeign venture funding for Korean startups picks up

Korean startupsForeign venture funding for Korean startups picks upMar 12, 2024 (Gmt+09:00)

2 Min read -

Korean startupsKakao Ventures invests in AI optimization startup Omelet

Korean startupsKakao Ventures invests in AI optimization startup OmeletFeb 29, 2024 (Gmt+09:00)

2 Min read -

-

Venture capitalKorean startups feel bite of funding drought in H1

Venture capitalKorean startups feel bite of funding drought in H1Jul 07, 2023 (Gmt+09:00)

3 Min read -

Korean startupsSeoul to build world's largest startup campus by 2030

Korean startupsSeoul to build world's largest startup campus by 2030Jun 21, 2023 (Gmt+09:00)

2 Min read -

Korean startupsProfit matters for survival of startups amid investment drought

Korean startupsProfit matters for survival of startups amid investment droughtFeb 07, 2023 (Gmt+09:00)

3 Min read