Big Tech engineers rush to Korea’s AI chip startups as potential looms

Startups are emerging as the "land of opportunity" for engineers seeking both wealth and growth potential

By Mar 20, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Big Tech engineers are flocking to South Korea’s promising startups specializing in artificial intelligence chips, a fast-growing sector in the semiconductor design and manufacturing business.

More often than not, starting a career at a startup and then moving to a large company is the routine for job seekers. But the trend is changing as chip experts and engineers see greater growth potential in smaller, specialized companies, analysts said.

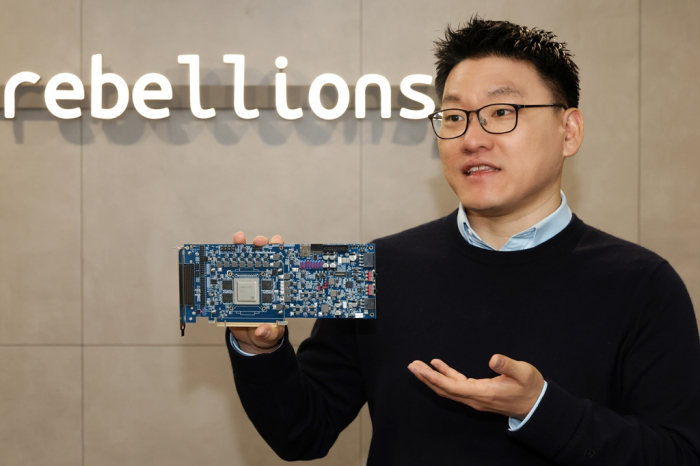

According to industry officials on Wednesday, Korean fabless AI chip design startup Rebellions Inc. recently put up a hiring notice, which attracted more than 500 applicants, mostly from large domestic companies such as Samsung Electronics Co., SK Hynix Inc., LG Electronics Inc., Naver Corp. and Netmarble Corp. as well as foreign firms, including AMD and ASML.

Sources said Rebellions wants to hire some 30 engineers, meaning the competition ratio is about 17 to 1.

Other Korean AI chip startups, including HyerAccel, Alsemy and Mobilint, are also in the middle of hiring new talent, posting relatively high competition ratios, sources said.

Mobilint is Korea’s first to develop an intelligent semiconductor, edge-type neural processing unit, optimized for deep learning via image recognition in 2016. The startup’s chips are used in CCTVs, drones and self-driving cars.

HyperAccel, founded in January 2023, develops a latency processing unit (LPU), an AI chip specialized for transformer-based large language models (LLMs).

Alsemy is a developer of AI-based semiconductor device modeling software, called EDA.

JUMP INTO A HIRING RACE

Some mid-size startups such as AI chip designer FuriosaAI Inc., Sapeon Inc. and DeepX have already increased the number of their staff to grow their businesses.

FuriosaAI, founded in 2017 by engineers from Samsung, Apple, Qualcomm, AMD, Google and Amazon.com, is a system chip designer known for silicon chip Warboy.

Sapeon, spun off from Korea’s top mobile carrier SK Telecom Co. in April 2022, designs AI semiconductors for data centers.

DeepX, established in 2018, specializes in application-specific AI semiconductors and develops AI chips for edge devices such as routers, routing switches and integrated access devices.

“A chip expert with work experience of 10 years at Samsung recently moved to a startup as its chief technology officer. Startups are emerging as a land of opportunity among semiconductor engineers,” said an industry official.

Global Big Tech engineers are also heading to Korea.

In 2022, Kim Jang-woo, an electrical and computer engineering professor at Seoul National University, established MangoBoost Inc., an AI chip startup, after hiring top engineers from Samsung, Naver, Intel and Microsoft.

A chief engineer, who oversaw the development of an AI accelerator at Intel, is now the head of MangoBoost’s US corporation.

MOVE TRIGGERED BY MEMORY SLOWDOWN

Analysts said a slowdown in the global memory chip market over the past few years has triggered moves from big companies to much smaller but promising startups.

Samsung Electronics, the world’s top memory chipmaker, paid no performance bonuses for its chip business employees last year after posting huge losses in its semiconductor business.

“Many people sought jobs at large companies for a big salary and some turned their eyes to startups for a vision and growth potential. That is now a thing of the past. Some startups now offer an annual salary similar to that of a large company plus stock options,” said a Korean startup executive.

While the Korean venture capital market is currently going through “an investment winter,” investment funds are flowing into the land of opportunity.

In January, Rebellions raised $124 million in a Series B funding round, bringing its total fundraising to date since its inception in 2020 to over $200 million, the largest fundraising ever of a Korean semiconductor startup.

FuriosaAI raised 80 billion won ($60 million) in its latest fundraising from venture capitalists in the second half of 2023 while MangoBoost raised 72.7 billion won in a Series A investment round last September.

“The venture capital market is still going through tough times, but AI semiconductor companies with great growth potential are an exception,” said a venture capitalist in Seoul.

According to Wanted Lab Inc., a recruitment platform frequently used by startups, the number of job postings decreased from 8,498 in May 2023 to 4,981 in January this year.

Korea's tourism platform unicorn Yanolja and Zigbang, which provides real estate search and transaction services, last year received voluntary retirement requests from their employees to cut costs.

Write to Joo-Wan Kim at kjwan@hankyung.com

In-Soo Nam edited this article.

-

Tech, Media & TelecomWanted Lab, Digital Hearts to support S.Korean, Japanese startups

Tech, Media & TelecomWanted Lab, Digital Hearts to support S.Korean, Japanese startupsFeb 29, 2024 (Gmt+09:00)

1 Min read -

Artificial intelligenceNvidia challenger Sapeon unveils new AI chip for data centers

Artificial intelligenceNvidia challenger Sapeon unveils new AI chip for data centersNov 16, 2023 (Gmt+09:00)

2 Min read -

Artificial intelligenceRebellions teams up with IBM for ATOM AI chip quality test

Artificial intelligenceRebellions teams up with IBM for ATOM AI chip quality testSep 25, 2023 (Gmt+09:00)

2 Min read -

Korean startupsS.Korean AI chip developer DeepX ready to take on Nvidia: CEO

Korean startupsS.Korean AI chip developer DeepX ready to take on Nvidia: CEOMay 18, 2023 (Gmt+09:00)

3 Min read -

Korean startupsRebellions CEO aims to outrival Qualcomm within a decade

Korean startupsRebellions CEO aims to outrival Qualcomm within a decadeApr 10, 2023 (Gmt+09:00)

4 Min read -

Tech, Media & TelecomFuriosaAI speeds up development of next-gen AI chip with Hugging Face

Tech, Media & TelecomFuriosaAI speeds up development of next-gen AI chip with Hugging FaceFeb 22, 2023 (Gmt+09:00)

2 Min read -

Venture capitalKorea’s venture capital firms poised to grow, no bubble seen in market

Venture capitalKorea’s venture capital firms poised to grow, no bubble seen in marketDec 15, 2020 (Gmt+09:00)

6 Min read -

Korean chipmakersFadu, Mobilint emerge as S.Korea's system chip startup dark horses

Korean chipmakersFadu, Mobilint emerge as S.Korea's system chip startup dark horsesNov 24, 2020 (Gmt+09:00)

2 Min read