Korean startups

Rebellions CEO aims to outrival Qualcomm within a decade

The startup, coveted by globally known venture capitalists, plans to mass produce ATOM AI chips early next year

By Apr 10, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Artificial intelligence is the talk of the tech world, particularly with the rise of the worldwide sensation OpenAI’s ChatGPT, the generative AI chatbot.

Alongside the growing popularity of AI chatbots, shares of system chipmakers and chip designers such as Nvidia Corp. and Qualcomm Technologies Inc. have also risen sky-high as their chips that enable rapid computation at back-end data centers are essential to running chatbot systems properly.

Rebellions Inc., a three-year-old South Korean AI chip design startup, was nobody in the fast-growing AI tech world until it recently beat much bigger rivals in a chip performance test known as MLPerf.

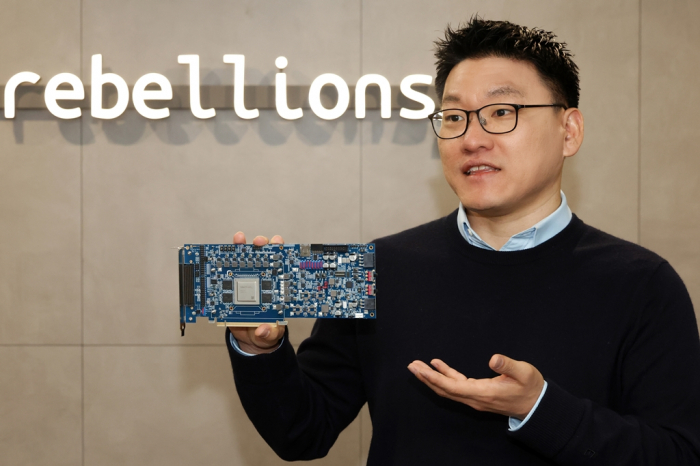

In the latest MLPerf test, Rebellions’ AI chip, ATOM, performed the best, proving itself fastest in processing large language and vision models.

ATOM’s processing speed was up to 3.4 times faster than the same class chips by Qualcomm and Nvidia. This means that ChatGPT operated on an ATOM-fitted computer delivers the quickest answers to its users.

“This achievement was a victory for the Korean semiconductor ecosystem, created in collaboration with the likes of foundry player Samsung Electronics Co. and local chip designer SEMIFIVE,” Park Sung-hyun, co-founder and chief executive of Rebellions, said in a recent interview with The Korea Economic Daily.

He noted that two years ago when there was a dire chip shortage across industries, Samsung and SEMIFIVE were willing to manufacture the prototype of the much smaller startup’s ATOM chips.

“Korea is where excellent foundry players such as Samsung and chip design houses such as SEMIFIVE thrive, allowing AI chip startups like us to grow into global companies,” he said.

CRISIS

Korea’s semiconductor industry is in a quandary, according to industry pundits.

The country’s chip product exports declined 34.5% in March from the year-earlier period.

Samsung, the world’s largest memory chipmaker, last week posted its worst quarterly results in more than a decade with its first-quarter operating profit plunging 96% from a year ago.

Korea is home to the world’s two largest memory chipmakers – Samsung and SK Hynix Inc. But Korean chipmakers are insignificant in the system-on-chip business, which includes AI chips.

Korean companies account for a mere 3% of the more lucrative and less volatile system chip market, according to industry data.

The ascent of AI chip startups such as Rebellions is good news to Korea, which is seeking to foster the fabless and non-memory chip sectors.

Unlike general-purpose system chips such as central processing units (CPUs) and graphics processing units (GPUs), an AI chip such as Rebellions’ ATOM is an integrated circuit specially designed to run machine learning programs, a key function in generative chatbots.

ACTIVE FUNDRAISING

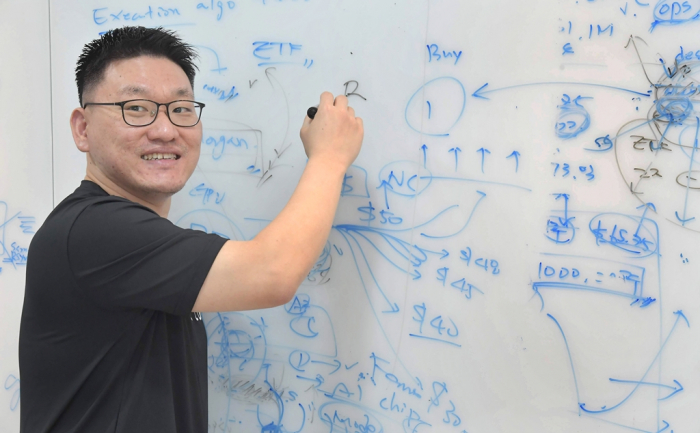

Rebellions was co-founded in September 2020 by CEO Park Sung-hyun, a former quant developer at global investment bank Morgan Stanley and Elon Musk’s aerospace company SpaceX, and Chief Technology Officer Oh Jin-wook who previously designed AI chips at IBM. Chief Product Officer Kim Hyo-eun was a former deep learning technology developer at AI medical device maker Lunit Inc.

In December 2021, Rebellions unveiled ION, a finance AI chip – the world’s fastest at the time.

Since its establishment three years ago, the company has received over 100 billion won ($76 million) in investments from venture capitalists and institutional investors, including Singapore’s sovereign wealth fund Temasek, Pavilion Capital, KT Corp., the state-run Korea Development Bank, Kakao Ventures, Shinhan Capital, KB Investment and Mirae Asset Venture Investment Co.

MASS PRODUCTION OF ATOM IN Q1 2024

Veteran developers from British fabless chip company Arm Inc., Samsung and SK Hynix have joined the startup over the past couple of years.

CEO Park said the company plans to kick off mass production of ATOM chips with Samsung’s 5-nanometer foundry technology in the first quarter of next year.

“No matter how excellent our chip performance is, we need to gain the validation and trust of our clients who are accustomed to using chips made by Nvidia and Qualcomm. We’re confident about obtaining our customers’ trust,” he said.

He said potential clients such as Google and Microsoft are seeking meetings with Rebellions and they are arranging talks over the next few months.

Rebellions also plans to install ATOM chips in KT’s ultra-large AI service MI:DEUM, which is set to launch by the end of the year.

CEO Park doesn't hide his ambition to grow Rebellions bigger than AI chip giants such as Nvidia and Qualcomm.

“I will grow our company to outrival Qualcomm within a decade. We may eventually try to acquire Qualcomm. Who knows?,” he said.

Write to Joo-Wan Kim and See-Eun Lee at kjwan@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersS.Korean AI chip fabless Rebellions beats global chip giants in MLPerf tests

Korean chipmakersS.Korean AI chip fabless Rebellions beats global chip giants in MLPerf testsApr 07, 2023 (Gmt+09:00)

4 Min read -

EarningsSamsung’s chip output cut: Boon for industry, price rebound

EarningsSamsung’s chip output cut: Boon for industry, price reboundApr 07, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, AMD extend partnership for next-generation graphic chips

Korean chipmakersSamsung, AMD extend partnership for next-generation graphic chipsApr 06, 2023 (Gmt+09:00)

3 Min read -

Artificial intelligenceS.Korean AI chip developer Rebellions releases Atom SoC

Artificial intelligenceS.Korean AI chip developer Rebellions releases Atom SoCFeb 13, 2023 (Gmt+09:00)

1 Min read -

Korean startupsRebellions to join pre-unicorn list via Series A Funding

Korean startupsRebellions to join pre-unicorn list via Series A FundingMay 10, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN