Korean startups

Foreign venture funding for Korean startups picks up

South Korean startups in the content and healthcare sectors are in the spotlight of overseas venture capital firms

By Mar 12, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean startups raising funds from overseas venture capital firms nearly doubled in the first two months of this year from a year ago, heightening expectations that the prolonged startup funding winter is nearing its end.

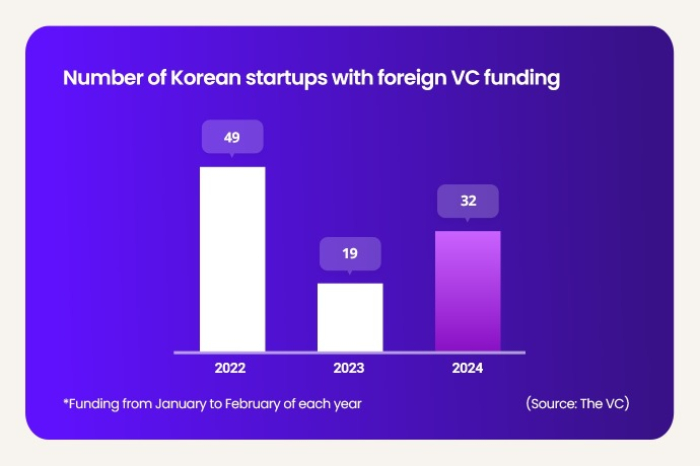

According to Seoul-based startup industry tracker The VC on Monday, the number of Korean startups garnering foreign venture funding stood at 32 in the January-February period of this year, increasing 1.7-fold from the same period last year.

Over the same time, the total funding amount more than doubled to 177.4 billion won ($135.3 million) from 74.5 billion won.

The latest inflow of foreign venture capital could be a sign of venture capital’s reviving appetite for Korean startups, said venture capital industry observers.

The total number of Korean startups raising funds from foreign venture capital firms more than halved to 120 in 2023 from 257 in 2022 and 241 in 2021.

“Foreign VC funding in Korea also stagnated in terms of value last year,” said an official from the local VC industry. “The recent inflow (of startup funding) signals positive momentum to the market.”

HEALTHCARE AND CONTENT STARTUPS IN THE SPOTLIGHT

Clify, the Seoul-based operator of the business-to-business mental healthcare platform Clify, raised funds from 500 Global, a San Francisco-based early stage venture fund and seed accelerator, as well as Dunamu & Partners, a Korean venture capital firm, in a seed funding round on Monday.

Other Korean healthcare startups, genome profiling solution provider Genome Insight and AI diagnostic solution company Mediwhale, have also raked in investment from overseas venture capital firms.

Elice, a Korean startup offering an all-in-one digital learning platform for teachers and corporations, in January secured 20 billion won in funding led by Vertex Growth, a growth-stage venture capital fund anchored by Vertex Holdings, a subsidiary of the global investment company Temasek.

In the same month, Korea’s leading online travel platform operator My Real Trip also raised 75.6 billion won from multiple investors, including global growth investment firm BRV Capital Management and Paris-based Korelya Capital.

Startups that have garnered the biggest funding from offshore venture capital, however, were those in the content industry, according to Startup Alliance Korea, a Korean government-backed nonprofit organization created to bolster the Korean startup ecosystem.

Story Protocol, a US-based startup managing intellectual property on the blockchain, in September last year raised $54 million in a funding round led by a16z crypto, part of Silicon Valley-based venture Andreessen Horowitz.

Story Protocol was co-founded by Korean national Seung Yoon “SY” Lee, former global strategy officer at Kakao Entertainment Corp., and Jason Levy, former director at Pocket Gems.

However, to foster foreign venture investment in Korean startups, Korea should amend some startup-related rules like the one that limits the influence of follow-on investors, suggested Yoon Gun-soo, the chairman of the Korea Venture Capital Association, noting that such regulation makes foreign investors hesitant to invest in Korean startups.

Write to Eun-Yi Ko at koko@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean startupsKorean learning platform Elice raises $14.9mn from Vertex

Korean startupsKorean learning platform Elice raises $14.9mn from VertexJan 17, 2024 (Gmt+09:00)

1 Min read -

Korean startupsKorean startups join hands amid dwindling funding, acceleration support

Korean startupsKorean startups join hands amid dwindling funding, acceleration supportSep 06, 2023 (Gmt+09:00)

4 Min read -

Korean startupsKKR leads $190 mn Series C funding of fashion platform Musinsa

Korean startupsKKR leads $190 mn Series C funding of fashion platform MusinsaJul 19, 2023 (Gmt+09:00)

1 Min read -

Venture capitalKorean startups feel bite of funding drought in H1

Venture capitalKorean startups feel bite of funding drought in H1Jul 07, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN