Digital healthcare, robot, AI chip startups among VCs’ 2024 top picks

The Korea Economic Daily survey shows more than two-thirds of VCs plan to raise their investment size this year

By Jan 03, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Startups that specialize in digital healthcare, robots and artificial intelligence chips are among South Korea-based venture capital firms’ top investment targets for this year, a survey showed on Wednesday.

According to a Korea Economic Daily survey of 33 executives and partners at Korea’s leading VCs and accelerators, a majority of the respondents said they would seek investment opportunities in tech-related new growth sectors.

In the medical and digital healthcare sector, they picked Welt Corp. as a promising startup.

Welt, a spinoff of Samsung Electronics Co., is known for WELT-I, a cognitive digital therapeutic device.

Digital therapeutic devices are software-based medical devices that provide evidence-based therapeutic interventions for the prevention, management and treatment of medical disorders or diseases.

Another promising startup they picked is MediWhale, which developed DrNoon, a digital healthcare device that predicts cardiovascular, renal and metabolic disease risk using retinal biomarkers or non-invasive retinal scans.

MediWhale is widely expected to go public this year through an initial public offering.

A third pick by the surveyed VC and accelerator executives in the digital healthcare segment is LIVSMED, a maker of surgery equipment, including laparoscopic instruments.

The fourth one is Neurophet, a Korean startup developing AI-powered medical solutions for brain diseases.

Neurophet has developed AI software that can analyze and detect side effects in Alzheimer’s disease therapies, using its flagship AI analysis technologies, Neurophet AQUA and Neurophet SCALE PET.

ROBOTS, AUTONOMOUS DRIVING

In the robot sector, Aniai was among the top picks.

The company has developed a labor solution for quick-service restaurants by building a robotic kitchen.

Aniai is Korea’s first to develop AI-powered robots that grill burger patties or dispense sauce in restaurants as well as a cloud system for kitchen operations and food quality control.

In the autonomous driving segment, Bitsensing, which designs and develops cutting-edge imaging radar technology solutions for the ultimate smart cities and connected experience, was the top pick.

The company said its radar sensor, combined with cameras, can track 256 vehicles simultaneously.

AI CHIPS

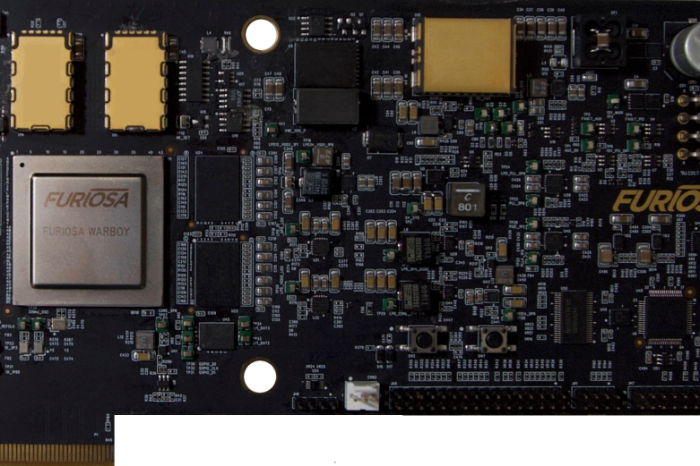

In the fabless semiconductor segment, FuriosaAI and Rebellions were two companies the respondents selected as this year’s promising startups.

Established in 2017, FuriosaAI designs silicon chip Warboy and produces such chips under a foundry contract with Samsung Electronics.

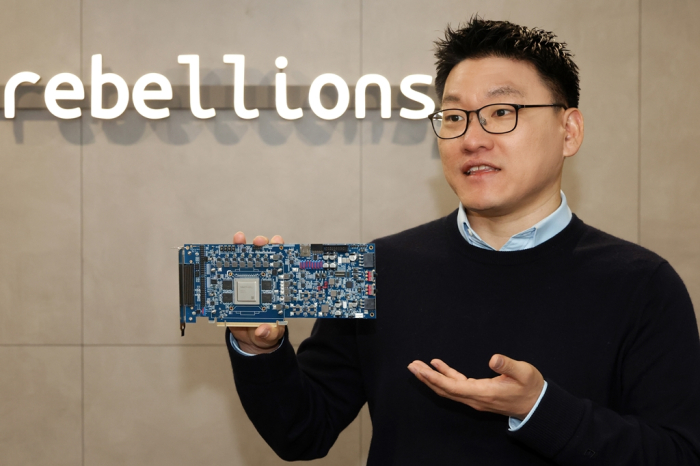

Rebellions, another AI chip design startup established in 2020, is led by elite engineers who previously worked at leading US tech firms such as IBM, Intel and SpaceX.

Other tech firms in which Korean VCs show interest include EN2CORE Technology, which makes devices to reduce green-house gases using plasma technology; energy storage system (ESS) companies Standard Energy and H2; ICTK, which specializes in Internet of Things (IoT) security chips; and SM Lab, a battery material startup.

SM Lab is a battery research arm of the state-run Ulsan National Institute of Science and Technology (UNIST).

PLATFORM STARTUPS

Expectations are also rising that platform startups will return to investor focus as they gradually emerge from the “investment winter” that started in the second half of 2021.

Unicorn platforms such as e-commerce giant Coupang and online fashion platform Musinsa, as well as startups poised to scale up, are expected to attract attention from venture capitalists.

Other startups in which the respondents showed interest are PRND, the operator of used car trading platform Hey Dealer; WAD, which runs Catchtable, an app-based real-time restaurant reservation service platform; and Jobis & Villains, a startup that operates the “3o3” tax return service.

‘INVESTMENT WINTER OVER THIS YEAR’

The Korea Economic Daily survey showed seven out of 10 respondents plan to expand the size of their venture and startup investments this year.

Slightly more than 36% of the respondents said they would raise their investment by more than 20% this year.

Despite lingering concerns about an economic slowdown, they have built up funds and are ready to spend amid an industry outlook of easing monetary policy bias and lower borrowing costs.

About 90% of the respondents said they expect the “investment winter” to be over this year. Some 42% said they expect investments will revitalize as early as the first half.

More than half of the respondents said they expect to see signs of a domestic economic recovery in the first half of 2025 while 24.2% said they expect a recovery in the latter part of this year.

Write to Jong-Woo Kim and Lan Heo at jongwoo@hankyung.com

In-Soo Nam edited this article.

-

Artificial intelligenceRebellions teams up with IBM for ATOM AI chip quality test

Artificial intelligenceRebellions teams up with IBM for ATOM AI chip quality testSep 25, 2023 (Gmt+09:00)

2 Min read -

Artificial intelligenceNeurophet strives to be first mover in fight against Alzheimer’s

Artificial intelligenceNeurophet strives to be first mover in fight against Alzheimer’sMay 24, 2023 (Gmt+09:00)

3 Min read -

Bio & PharmaWelt gets second digital therapeutic device approval in S. Korea

Bio & PharmaWelt gets second digital therapeutic device approval in S. KoreaApr 19, 2023 (Gmt+09:00)

1 Min read -

Korean startupsRebellions CEO aims to outrival Qualcomm within a decade

Korean startupsRebellions CEO aims to outrival Qualcomm within a decadeApr 10, 2023 (Gmt+09:00)

4 Min read -

Korean startupsPatty-cooking robotics startup Aniai completes seed funding

Korean startupsPatty-cooking robotics startup Aniai completes seed fundingFeb 21, 2023 (Gmt+09:00)

1 Min read -

BatteriesSM Lab develops cathode with 98% nickel, industry’s highest density

BatteriesSM Lab develops cathode with 98% nickel, industry’s highest densityAug 18, 2021 (Gmt+09:00)

2 Min read -

Korean startupsKorean startup FuriosaAI's Warboy overtakes Nvidia

Korean startupsKorean startup FuriosaAI's Warboy overtakes NvidiaSep 23, 2021 (Gmt+09:00)

2 Min read