Korea’s Growth Champions 2024 by Statista, Korea Economic Daily

The list is the first of its kind in South Korea compiled and jointly ranked by Statista and The Korea Economic Daily

By Dec 11, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Statista, the world’s leading data and intelligence company, has teamed up with The Korea Economic Daily to identify South Korea’s fastest-growing companies and publish the first edition of Korea’s Growth Champions, with lodging company Handys leading the pack.

Korea’s largest economic and business daily newspaper by revenue on Monday announced the list of Korea’s Growth Champions 2024, some 150 Korean companies – startups and small and medium-sized enterprises (SMEs) – that have taken big leaps in revenue during the COVID-19 pandemic.

This is Statista's first such list in Korea, and The Korea Economic Daily was chosen as the Hamburg, Germany-based intelligence giant’s partner for its first Growth Champions project in Asia’s fourth-largest economy.

They together picked the finalists among hundreds of Korea-headquartered candidates after reviewing companies’ revenue growth rates from 2019 to 2022 for about four months late this year.

The frontrunner of Korea’s Growth Champions 2024 is Seoul-based lodging company Handys, which runs short-term and long-term accommodatios under the brand Urban Stay across South Korea. It boasts a compound annual growth rate (CAGR) of 281% over the four years.

ASEADO, a face mask manufacturer, is the runner-up with a 246% CAGR, followed by logistics company Colosseum with 216%.

Companies across the board made the list. Information technology (IT) companies claimed the lion’s share with 47 companies, chased by the manufacturing sector with 12, advertising and marketing with 12, electrical and electronics with 10, scientific and technical services with eight, food and beverages with eight and entertainment with seven.

The announcement of Korea’s Growth Champions 2024 publicly endorses the exceptional performances of fast-growth companies in the country and promotes those trailblazers' innovative ideas and business models.

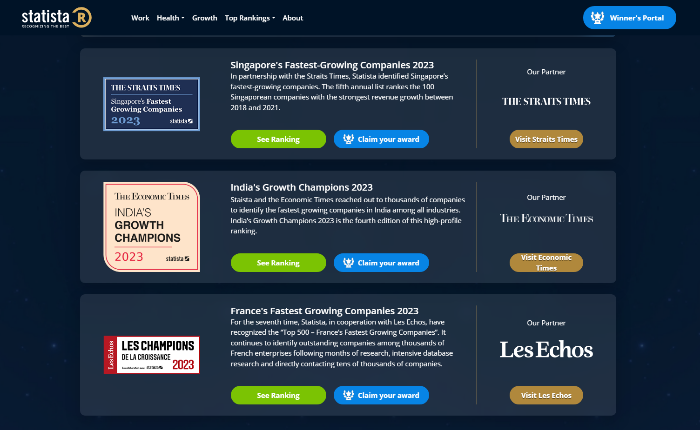

Statista works with prominent media partners across the world to present lists of Growth Champions in different countries.

B2B SAAS LEADS NEW INDUSTRIAL TREND

The average CAGR of the 150 companies on the list of Korea’s Growth Champions 2024 was estimated at 65.48%, and their average revenue for last year was 54.6 billion won ($41.4 million). The average number of their employees was 112.

Gig economy and business-to-business software as a service (B2B SaaS) have emerged as promising industries after related startups have recorded rapid growth since 2019, the list showed.

The growth of the B2B SaaS market was exceptional during the pandemic, which prevented face-to-face interaction and elevated demand for work automation.

Because it is subscription-based, the initial cost of SaaS installation is cheaper than conventional software, further enticing its demand.

It has recently introduced a tool that enables chat and phone-based customer services and marketing services in its messenger service.

Checkup Inc., the developer of a facility and safety management system for commercial properties, high-end residences, hotels and government buildings, also showed off a CAGR of 100% over the same period.

Olim Planet, the operator of a SaaS program enabling metaverse transformation, and AI digital document and SaaS service provider Synapsoft also joined Korea’s Growth Champions 2024.

Statista forecasts that the global B2B SaaS market will grow to $232.3 billion in 2024 from $85.7 billion in 2018.

GIG ECONOMY AND AUTONOMOUS DRIVING LOOK PROMISING

Amid the thriving gig economy, companies targeting freelancers have also boomed.

Kmong, Korea’s leading freelancer marketplace operator, saw its revenue added to 28.6 billion won in 2022 from 2019 at a 56% CAGR. Founded in 2012, the company has raised more than 45 billion won in total from investors.

It is considered the pioneer of the Korean freelancer marketplace, followed by latecomers Soomgo and Tal-Ing.

Goorm, the provider of AI and software developer training programs, has also joined Korea’s Growth Champions 2024 after recording a 105% CAGR over the same period.

The global gig economy is estimated to reach $455.2 billion in 2023, up 80% from 2019 before the pandemic, according to Statista. It forecasts that freelancers will account for about 50.9% of the US labor market in 2027.

The autonomous driving sector has also posted solid growth, the list showed.

Sales of Smart Radar System, the manufacturer of imaging radar sensors, increased at a CAGR of 72%. It received the CES Innovation Award earlier this year for its 4D radar technology and joined Korea’s tech-heavy secondary Kosdaq market in August.

The CAGR of automotive LiDAR developer SOSLAB and autonomous parking solution developer VEStellaLab was 87% and 82%, respectively, according to Korea’s Growth Champions.

Those top-ranking companies on the list have recently succeeded in raising massive funds on expectations for further growth in their business.

Cloud service provider Okestro, which ranks ninth, raised 130 billion won in a Series B funding round this month. Saige Research, an AI-powered quality inspection service developer, garnered 15.5 billion won in funding in September, while fintech service developer Habit Factory and Wad, the operator of the restaurant reservation platform Catch Table, raised 20.6 billion won in November and 30 billion won in July, respectively.

METHODOLOGY

The contest of Korea's first-ever Growth Champions was only competed for by Korea-based companies with a revenue of 150 million won or more in 2019 and 1.5 billion won or more in 2022.

Those whose revenue growth was driven by one-off gains from non-operation activities like mergers or acquisitions and that are affiliates or subsidiaries of other companies were banned from applying.

The ranking was determined by CAGR from 2019 to 2022.

Korea’s Growth Champions 2024 also includes even those that did not apply for the race but met all criteria after the regulatory filings of more than 400 listed companies were reviewed to improve credibility.

Statista’s portal offering statistics and business-relevant data boasts 23 million unique users per month, 2,500,000 registered users and 23,000 corporate customers, according to the company.

Statista accreditation is globally recognized as an index and awarded jointly with each country’s high-profile media, including The Straits Times in Singapore and Lejecos in France. It also has been working with The Financial Times for Growth Champions projects in Africa, the US, Europe and Asia.

Those on Korea’s Growth Champions 2024 must pay for the use of the Growth Champions logo, but they can advertise their inclusion on the list as part of their ad campaigns free of charge.

Write to Jung-Rak An, Jong-Woo Kim and See-Eun Lee at jran@hankyung.com

Sookyung Seo edited this article.

-

Korean startupsKorea's startup ecosystem lags behind peers in global investments

Korean startupsKorea's startup ecosystem lags behind peers in global investmentsNov 30, 2023 (Gmt+09:00)

1 Min read -

Korean startupsKOTRA to support K-startups in European expansion

Korean startupsKOTRA to support K-startups in European expansionNov 29, 2023 (Gmt+09:00)

1 Min read -

Korean startupsMiddle East, land of opportunity for Korean startups

Korean startupsMiddle East, land of opportunity for Korean startupsNov 22, 2023 (Gmt+09:00)

4 Min read -

Korean startupsKorean AI startups Allganize, Neurophet raise over $35 mn

Korean startupsKorean AI startups Allganize, Neurophet raise over $35 mnNov 08, 2023 (Gmt+09:00)

2 Min read -

Korean startupsS.Korea’s startups see Sept. investment surge 85%

Korean startupsS.Korea’s startups see Sept. investment surge 85%Oct 26, 2023 (Gmt+09:00)

1 Min read