Korean SMEs

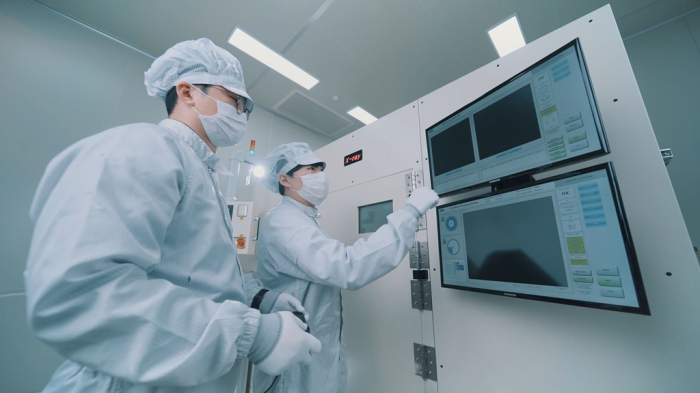

Korea’s SFA Engineering aims for top spot in smart factory market

The automated machine maker expects strong orders from battery makers and retailers this year

By May 09, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SFA Engineering Corp., a small South Korean equipment maker, has for decades been known for its automated machines used in the manufacture of display panels.

But over the past four years, the company has spent more than 100 billion won ($78.5 million) developing a business model for automated factories, often dubbed smart factories, in the semiconductor, electric vehicle battery and logistics businesses.

“When you say you’re an automation company, that usually means a company that turns a specific manufacturing process into an automated system. But we can automate the entire process, creating a genuine smart factory. We’re one of the few that can make it happen,” said Kim Young-min, chief executive of SFA Engineering.

A smart factory integrates the entire processes of manufacturing, including planning, design, production, distribution and sales with the help of artificial intelligence and the internet of things to produce goods with minimum costs and time.

A growing number of companies across industries are adopting a smart factory system because such digitalized facilities drastically cut production costs while improving productivity and quality and reducing industrial accidents.

Launched in 1998 as a spin-off from the automation division of Samsung Aerospace, which later merged into Korea Aerospace Industries Ltd., SFA Engineering now offers a full range of automation solutions that include consulting, system design, installation and after-sales service to Korean and overseas clients on a turnkey basis.

DEMAND FROM BATTERY MAKERS, RETAILERS TO RISE

Its local customers also include retailers such as E-Mart24 Inc., the convenience store arm of retail giant Shinsegae, and BGF Retail Co., which operates CU, Korea’s largest convenience store chain.

DY Holdings Co., formerly Dongyang Elevator Co., is the largest shareholder of SFA Engineering with a 40.98% stake, followed by Samsung Display Co., which owns 10.15% of the automation equipment maker.

Last year, SFA Engineering posted 188.9 billion won in operating profit on revenue of 1.56 trillion won.

“This year, we expect higher orders than last year’s deal (worth 804.1 billion won) on the back of strong demand from battery makers and retailers,” said CEO Kim.

The company’s non-display business orders have risen to 70% of its entire contracts from around 10% in 2016, he said.

According to Shinhan Investment Corp., SFA Engineering is forecast to post 222.4 billion won in operating profit on sales of 1.89 trillion won this year, close to its record results in 2017 when it reported an operating profit of 236.1 billion won on sales revenue of 1.9 trillion won.

Shares of SFA Engineering, listed on the tech-heavy Kosdaq, finished down 1.2% at 38,400 won on Monday, compared with the broader market’s 2.6% fall. Its affiliate SFA Semicon Co. closed down 3.4% at 6,170 won.

A GROWING LIST OF SMART FACTORY ADOPTERS

Korean companies, big and small, are rapidly adopting a smart factory system to lower costs and improve productivity.

LG Electronics Inc. said last September it plans to turn all six production lines at its main plant in Korea into a smart factory by 2024.

Hyundai Motor Co. is also innovating its electric vehicle manufacturing processes.

The top Korean automaker said last year that it is making its latest IONIQ5 EV at a highly automated smart factory, adopting artificial intelligence and robotics technology.

According to global research firm MarketsAndMarkets, the size of the global smart factory market will rise at an annual average rate of 11% to $134.8 billion by 2026 from $80.1 billion in 2021.

Write to Byung-Keun Kim at Bk11@hankyung.com

In-Soo Nam edited this article.

More to Read

-

ElectronicsLG Electronics turns home appliance plant into smart factory

ElectronicsLG Electronics turns home appliance plant into smart factorySep 16, 2021 (Gmt+09:00)

2 Min read -

Electric vehiclesRobots, AI replace human workers at Kia’s EV6 manufacturing factory

Electric vehiclesRobots, AI replace human workers at Kia’s EV6 manufacturing factoryNov 22, 2021 (Gmt+09:00)

1 Min read -

-

Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment center

Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment centerJul 05, 2021 (Gmt+09:00)

4 Min read -

Electric vehiclesHyundai innovates EV manufacturing with smart factory system

Electric vehiclesHyundai innovates EV manufacturing with smart factory systemJul 02, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN