Game IPs

Korean game firms target global market with IP portfolio

By Feb 17, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The growth of South Korea's game industry this year is likely to be led by new titles created by cashing in on the intellectual property of popular games, such as Dungeon Fighter, Seven Knights and Blade & Soul, according to industry sources on Feb. 17.

This year, Nexon Co., the first domestic game company to top 30 trillion won ($27 billion) in market capitalization, plans to launch Dungeon Fighter Mobile, a mobile version of its online PC game Dungeon Fighter, which had raised around $15 billion in sales as of the end of 2019 since its launch in 2005.

Initially, Nexon had planned to release the mobile version in China last year, but the company hit a roadblock due to a Chinese regulation imposing a curfew on online gaming for minors.

Another major Korean game developer Netmarble Corp. is also set to showcase a new title, Seven Knights Revolution, based on the existing IP of the company's popular mobile game Seven Knights.

Seven Knights, launched in 2014, became the highest-grossing game app on the local app marketplace in the year of its release. In 2016, the game also became the third highest-grossing game app on Japan’s Apple app store.

Currently, NCSoft's Lineage M, the latest in the hit Lineage series, is the top-grossing mobile game app in Korea.

KOREAN GAME FIRMS: LITTLE EFFORT IN IDENTIFYING NEW IP

This year, Krafton Inc., the label behind the global blockbuster game PlayerUnknown’s Battlegrounds (PUBG), will unveil a new shooter game based on the previous IP. In 2017, the company sold over 70 million PC and console versions of PUBG, with over 600 million mobile downloads.

Also, Com2uS Corp. is preparing to roll out a new game based on its previous hit, Summoners War, which reported over 2 trillion won in sales when launched in 2014. The company will unveil Summoners War: Lost Centuria in the second quarter of this year.

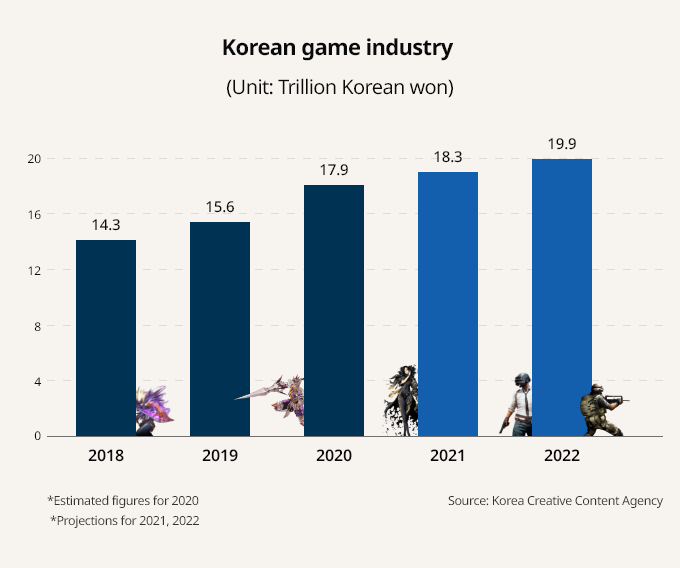

Korea’s game market size is projected to exceed 18 trillion won this year, driven by game enthusiasts who have remained loyal consumers since the days of arcade games. Industry researchers say longtime game aficionados led to the rise of the domestic game industry.

However, some industry watchers say that Korean game firms lack effort in developing new IPs, and their tendency to exhaust previous IPs may become an obstacle in the long run.

Domestic game firms tend to actively utilize their IP portfolio because it guarantees success to some degree. Among the top 10 highest-grossing mobile game apps in Korea, around six games are based on IPs that have already performed well.

"Becoming too dependent on the merits of existing IPs, such as fewer risks of failure and less marketing costs, will eventually make it difficult for companies to prepare for when the popular IP runs its course," said a game industry official.

Write to Joo-wan Kim at kjwan@hankyung.com

Danbee Lee edited this article.

More to Read

-

-

K-pop platformNCSoft’s UNIVERSE fuels competition in K-pop entertainment platforms

K-pop platformNCSoft’s UNIVERSE fuels competition in K-pop entertainment platformsJan 19, 2021 (Gmt+09:00)

3 Min read -

Kakao, NCSoft likely to lead record-breaking earnings in 2021

Kakao, NCSoft likely to lead record-breaking earnings in 2021Jan 03, 2021 (Gmt+09:00)

3 Min read -

K-contentK-content companies set to rule 2021 stock market after breakneck growth

K-contentK-content companies set to rule 2021 stock market after breakneck growthDec 14, 2020 (Gmt+09:00)

3 Min read -

Mobile gamesS.Korean games, entertainment eye China return after 3-year ban

Mobile gamesS.Korean games, entertainment eye China return after 3-year banDec 04, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN