Korean chipmakers

SK Hynix to exit image sensor market to focus on AI chips

The South Korean HBM chip leader forayed into the image sensor market in 2007 but lags far behind its bigger rivals

By Mar 06, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SK Hynix Inc. will shutter its image sensor business as the South Korean memory giant doubles down on the development of premium artificial intelligence memory chips.

SK Hynix announced its decision to discontinue the image sensor business during an internal meeting with employees of its CMOS image sensor (CIS) division on Thursday.

“Shifting the capabilities we’ve built in the image sensor business to AI memory will enhance our position as a global leader in the AI-driven semiconductor era,” the company said in a statement.

Following the decision, the memory chip giant will reassign hundreds of CIS employees to its AI memory business.

The decision comes as SK Hynix positions itself at the forefront of the booming AI chip market, where demand for cutting-edge memory solutions is rapidly accelerating.

It is the global leader in high-bandwidth memory (HBM), a crucial component for AI applications, including AI servers and advanced computing systems.

As the lead HBM supplier to Nvidia Corp., SK Hynix plans to deliver 12-layer HBM4 chips, the most advanced AI chips available, to the world’s largest AI chip designer six months earlier than its initial schedule of early 2026.

TOO BIG TO CATCH UP

SK Hynix entered the image sensor market in 2007 and bolstered its presence after acquiring Korean image sensor developer SiliconFile Technologies Inc. a year later.

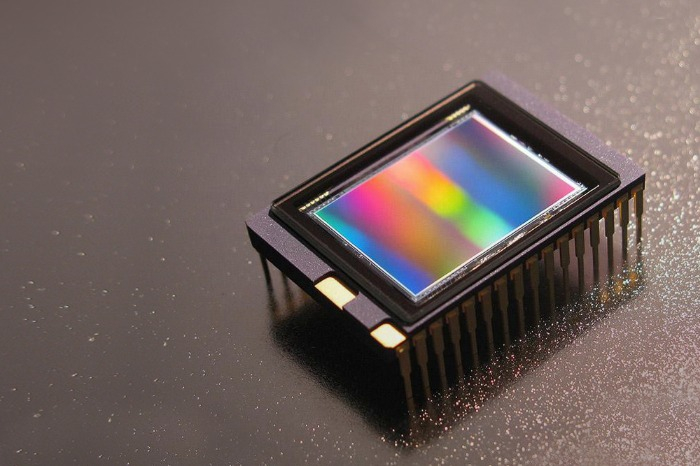

CIS converts the light coming through the lens into a digital signal and displays it as an image. It is widely used in cameras for electronic devices, including smartphones, tablets, digital cameras and smart TVs, as well as security cameras and systems, medical applications and automobiles.

In 2019, SK Hynix opened a CIS-dedicated research and development center in Japan and launched its own image sensor brand, Black Pearl.

However, the highly competitive image sensor space, long dominated by Japan’s Sony Semiconductor Solutions Corporation (SSS) and its cross-town rival Samsung Electronics Co., has proven difficult to penetrate.

Sony led the market in 2024 with 45% share, followed by Samsung with 19%, leaving SK Hynix with limited room for growth.

Struggles to secure major customers, coupled with mounting pressure to improve profitability, have prompted internal calls to scale back or abandon its CIS business entirely.

SK Hynix expects its expertise in logic semiconductor design and customized product development gained from its image sensor operations to help the company strengthen its AI memory chip development capabilities.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean chipmakersSK Hynix to produce HBM4 on 3 nm foundry process in 2025

Korean chipmakersSK Hynix to produce HBM4 on 3 nm foundry process in 2025Dec 03, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersNvidia asks SK Hynix to bring forward HBM4 supply by 6 months

Korean chipmakersNvidia asks SK Hynix to bring forward HBM4 supply by 6 monthsNov 04, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soars

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soarsOct 23, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix mass-produces 12-layer HBM3E for Q4 shipment

Korean chipmakersSK Hynix mass-produces 12-layer HBM3E for Q4 shipmentSep 26, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boom

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boomSep 04, 2024 (Gmt+09:00)

3 Min read -

ElectronicsSamsung Electronics unveils new smartphone image sensors

ElectronicsSamsung Electronics unveils new smartphone image sensorsJun 27, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN