Korean chipmakers

SK Hynix’s HBM exports plummet, now susceptible to seasonal demand

Analysts expect SK and Samsung’s HBM chip shipments to fall in the first quarter

By Feb 10, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Exports of SK Hynix Inc.'s multi-chip packages (MCP), including high-bandwidth memory (HBM) AI chips, are rapidly dropping as the South Korean chipmaker faces growing competition amid a global economic slowdown.

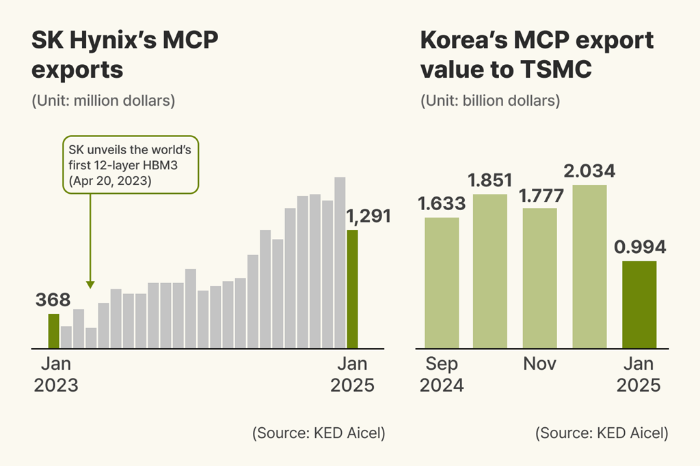

According to Korean alternative data platform KED Aicel on Monday, SK Hynix’s MCP exports from its chip plants in Icheon and Cheongju reached $1.29 billion in January.

The latest export value represents a 105.7% increase from the year-earlier period, but a 29.8% decline from the previous month. When adjusted for working days, the January figure was down 19.3% from December.

The on-month decline is the sharpest since the company developed the world’s first 12-layer HBM3 chip in April 2023.

MCP usually refers to HBM and mobile memory – both categorized as high-capacity chips.

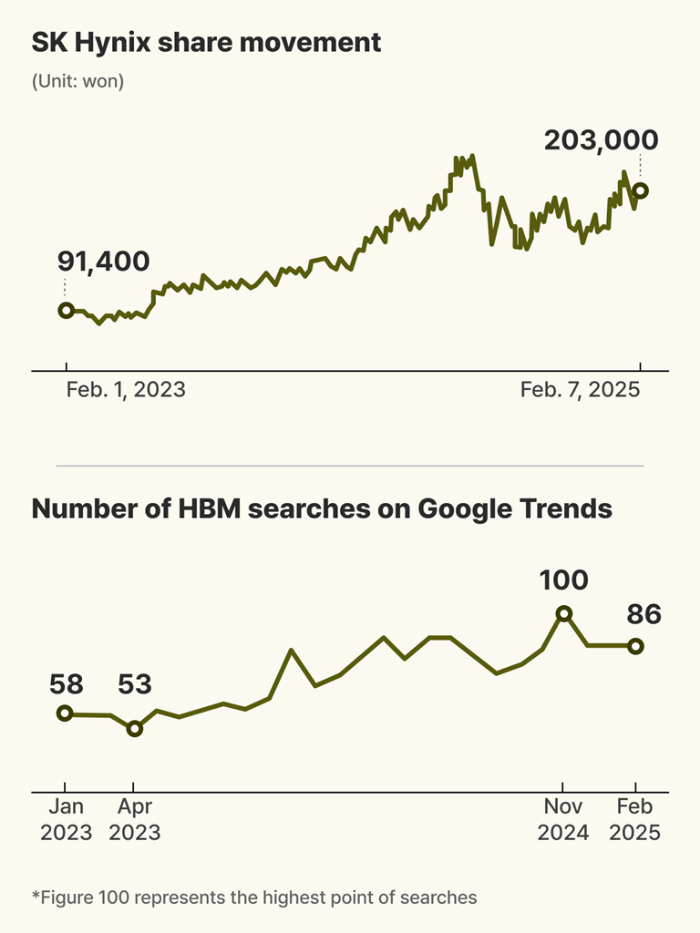

Analysts said the monthly sales decline is a sign that advanced HBM chips, which used to be in high demand throughout the year, have become more susceptible to seasonal demand fluctuations.

CHIP EXPORTS TO TSMC CUT IN HALF

KED Aicel data showed Korea’s MCP exports to Taiwan, home to the world’s top foundry or contract chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC), stood at $994 million in January – the lowest value since May 2024. January’s exports were down 51.1% from $2.03 billion in December.

HBM chips, used in AI-focused graphics processing units, are typically sent to Taiwan’s TSMC for packaging before moving to end clients such as Nvidia Corp.

“The sharp decline in January MCP exports shows that AI chips are now being affected by seasonality,” said a chip industry official.

KED Aicel is the alternative data service brand of Hankyung Aicel, renamed from Aicel Technologies Inc. after The Korea Economic Daily acquired the data firm from US-based policy and global intelligence provider FiscalNote Holdings Inc. for $8.50 million last October.

HBM SHIPMENTS TO FALL IN Q1

Analysts expect the HBM market to become even more sensitive to seasonal trends in the coming quarters.

“Seasonality has emerged even in the HBM market,” said iM Securities analyst Song Myung-seop in a research note.

He said SK Hynix's HBM shipments in the first quarter will likely decline by over 10% from the fourth quarter of 2024.

He expects SK’s DRAM and NAND chip shipments to decrease by 12% and 18%, respectively, over the same period.

Shinyoung Securities analyst Park Sang-wook said: “Global HBM demand will double this year compared to last year. In the first quarter, however, HBM sales will decline from the previous quarter, weighed down by tightened US trade restrictions on China.”

KED Aicel data showed January's combined MCP exports from Samsung Electronics Co.'s chip plants in Pyeongtaek, Yongin, Suwon, Choenan and Asan dropped 62.3% from the previous month.

COOLING INTEREST IN GOOGLE SEARCHES ON HBM

People’s interest in HBM also seems to be waning.

According to Google Trends, searches containing HBM as a keyword peaked in November 2023 and have since decreased by more than 10%.

HBM searches on Google in November 2023 were nearly double those in April 2023.

One of the most commonly searched keywords alongside HBM has been SK Hynix.

Search data from platforms such as Google, Naver and YouTube is often considered a leading indicator of people looking for investment opportunities.

“Google Trends data is a valuable tool to understand shifts in consumer interest and market trends. The strong upward trajectory of HBM-related searches has recently slowed,” said Park I-kyung, a data analyst at Hankyung Aicel.

Write to Tae-Ho Lee at thlee@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Tech, Media & TelecomSouth Korea’s alternative data pioneer KED Aicel in full force

Tech, Media & TelecomSouth Korea’s alternative data pioneer KED Aicel in full forceFeb 03, 2025 (Gmt+09:00)

4 Min read -

EarningsSK Hynix surpasses Samsung with record-high profit in Q4

EarningsSK Hynix surpasses Samsung with record-high profit in Q4Jan 23, 2025 (Gmt+09:00)

2 Min read -

Korean Innovators at CES 2025SK Hynix to collaborate with Nvidia on Cosmos physical AI platform: Chey

Korean Innovators at CES 2025SK Hynix to collaborate with Nvidia on Cosmos physical AI platform: CheyJan 09, 2025 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soars

Korean chipmakersSK Hynix chief says no delay in 12-layer HBM3E supply as demand soarsOct 23, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boom

Korean chipmakersSamsung, SK Hynix up the ante on HBM to enjoy AI memory boomSep 04, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN