Korean chipmakers

SK Hynix may block Kioxia-Western Digital merger

After the merger, Western Digital could wield power in Kioxia, in which the S.Korean chip maker holds a major stake

By Oct 18, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean memory chip giant SK Hynix Inc. is rumored to be frowning on the integration of Japan’s Kioxia Holdings Corp. with US-based Western Digital Corp.’s memory chip operations due to concerns that it would cause it to lose control in its future collaboration with the Japanese memory chip partner.

The Nikkei on Wednesday reported that SK Hynix is “reluctant to back” Kioxia’s merger with Western Digital’s memory chip operations.

Kioxia and Western Digital have been in talks to merge amid the prolonged memory chip industry downturn.

Their mainstay product is NAND memory chips used in personal computers and smartphones for data storage. But the global economic slowdown has dampened demand.

For the integration, Western Digital will separate its memory chip business to unite it with Kioxia under a to-be-created holding entity.

SK HYNIX’S APPROVAL IS A MUST

The two companies, however, must get the nod from SK Hynix for their marriage as the latter holds a major stake in Kioxia indirectly via its investment in the Bain Capital Private Equity-led consortium formed to buy the Japanese flash memory manufacturer, formerly Toshiba Corp.’s memory chip unit, in 2018.

SK Hynix has invested a total 395 billion yen ($2.6 billion) in Kioxia, of which 129 billion yen was spent to own Kioxia’s convertible bonds, which could allow the Korean chip maker to take Kioxia’s equity stake of up to 15%, and the remaining 266 billion yen in one of Bain Capital-led funds investing in Kioxia.

In January, SK Hynix Chief Executive Officer Park Jung-ho said that the Korean chip maker’s stake in the Japanese chip maker would reach about 40% if its CBs were converted into shares.

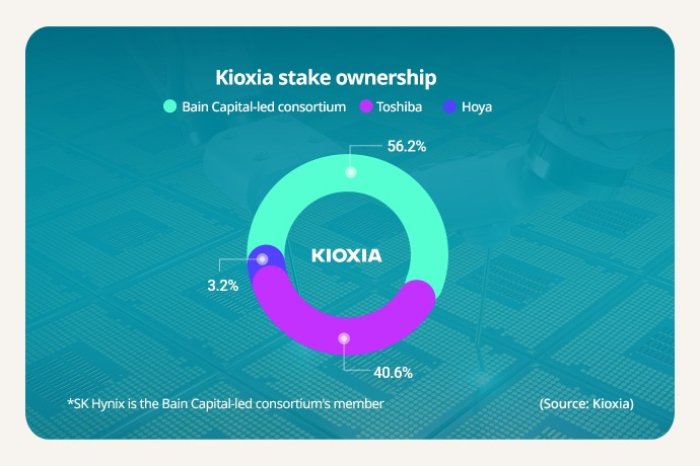

The Bain Capital-led consortium controls 56.2% of Kioxia, while Toshiba and Hoya own 40.6% and 3.2%, respectively.

Regarding the Japanese media report, SK Hynix said, “It has not yet decided whether to approve (the deal).”

If the Korean shareholder disapproves of the merger, the Kioxia-Western Digital integration deal will collapse.

The Japanese and US memory makers are said to be in the final stages of their merger talks and negotiating with lenders to finance the deal. SK Hynix’s decision is expected to affect their talks with financial institutions.

Uncertainty over their integration remains until the Korean memory giant confirms its stance.

LESSER INFLUENCE

Following the merger, Kioxia is projected to own 49.9% of the holding company, while Western Digital has 50.1%. They also plan to list the new holding company, which could enable SK Hynix to later cash out of its investment in Kioxia.

As of end-June, Kioxia’s equity stake value was estimated at 5 trillion won ($3.8 billion).

Despite such a handsome equity gain, SK Hynix is said to be uncomfortable with the idea that Western Digital would wield power in Kioxia following the integration.

The Korean memory is known to have decided to invest in Kioxia for future collaboration with the Japanese memory maker. Some even argue that SK Hynix should seek an M&A chance with Kioxia.

But Western Digital’s merger with Kioxia would limit SK Hynix’s business options with Kioxia in the future.

If Kioxia and Western Digital merge, their combined share in the global NAND memory market would also jump to be on par with or bigger than that of current leader Samsung Electronics Co., which commanded 31.1% as of the second quarter of this year.

The second and fourth-largest Kioxia and Western Digital controlled 19.6% and 14.7%, respectively, while No. 3 SK Hynix took 17.8%, according to market tracker TrendForce.

The Kioxia-Western Digital union would lead to SK Hynix falling far behind the new memory titan.

PLAN B

Japanese media reported that SK Hynix is seeking to team up with SoftBank Group as an alternative to the merger with Western Digital.

SoftBank owns British chip designer Arm Holdings and is striving to nurture artificial intelligence as its core growth driver.

However, the Korean chip maker has denied the report.

Western Digital considered acquiring Kioxia in early 2021 but that fell through.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean chipmakersNAND chips may sustain double-digit price drops in Q4

Korean chipmakersNAND chips may sustain double-digit price drops in Q4Sep 27, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chips

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chipsFeb 04, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix outplays Kioxia as world’s No.2 smartphone NAND flash maker

Korean chipmakersSK Hynix outplays Kioxia as world’s No.2 smartphone NAND flash makerJul 11, 2021 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsSK Hynix ponders fate of Kioxia stake after bids by Micron, WDC

Mergers & AcquisitionsSK Hynix ponders fate of Kioxia stake after bids by Micron, WDCApr 02, 2021 (Gmt+09:00)

2 Min read -

Chipmaker Kioxia to raise 85.3 bn yen in Japan IPO; SK Hynix to retain stake

Chipmaker Kioxia to raise 85.3 bn yen in Japan IPO; SK Hynix to retain stakeAug 29, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN