Korean chipmakers

S.Korea's chip pioneer Amkor aims to rule packaging sector

Amkor tops global outsourced semiconductor assembly and test industry for automotive semiconductors

By Jun 18, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The history of semiconductors in South Korea, a global tech powerhouse with the world’s two largest memory chipmakers, Samsung Electronics Co. and SK Hynix Inc., started as Amkor Technology Inc. introduced the industry in the country 55 years ago.

Amkor, currently the world’s No. 2 semiconductor packaging company, aims to top the sector dominated by Taiwan rivals including industry leader ASE Holdings. Those competitors have been benefiting from global foundry giant Taiwan Semiconductor Manufacturing Co.’s (TSMC) move to establish a domestic semiconductor industry ecosystem.

Amkor is striving to expand its market share in the rapidly growing semiconductor packaging industry amid intensifying competition. Chipmakers and their customers are taking note of advanced packaging technologies that increase performance through efficient arrangements of existing semiconductors as the global semiconductor industry struggles to improve chip performance with ultra-fine processes.

Samsung launched a package turnkey service for contract chip manufacturing this year, while TSMC increased spending to improve its own packaging competitiveness.

Amkor’s technology is so well recognized that there was a rumor that Samsung may acquire the company to strengthen its packaging business.

HISTORY OF SOUTH KOREA’S SEMICONDUCTOR INDUSTRY

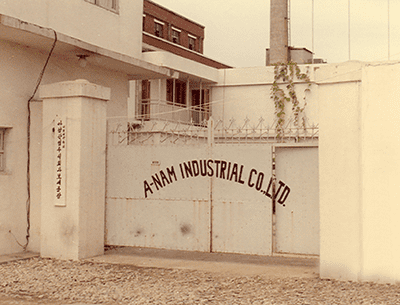

Amkor, currently headquartered in Tempe, Arizona, was founded as Anam Industrial Co. in March 1968 in Seoul, then a production base, by the late Honorary Chairman Kim Hyang-Soo. His eldest son Kim Joo-Jin, the company’s current chairman, set up Amkor, a research and development unit, in the US. Anam and Amkor have focused on the packaging business since their foundation.

Anam, which early on had only seven employees, received its first order in 1970 and exported semiconductors in the form of metal cans to the US. Its overseas sales grew to $210,000 in 1972 and the honorary chairman won the Gold Tower Order of Industrial Merit, South Korea’s best award for a person who greatly contributed to the country’s industrial development, in 1973.

The company achieved rapid growth based on trust. Its factory in Seoul was flooded after the overflow of the Han River in early 1970 and Anam employees dried wet facilities with hair dryers to meet the delivery date. The company also secured staff trust as it did not cut jobs during the oil crisis in the 1970s and economic downturns in the 1980s.

The late Kim advised Lee Byung-chul, the late chairman and founder of Samsung Group to make inroads into the memory chip industry in the early 1980s, saying a major conglomerate should handle the business that required large-scale investments in facilities.

Many of Anam’s employees left for Samsung, which was becoming hugely successful in the business, but the founder of the semiconductor packaging company was happy.

“It is unfortunate but good in the big picture as people from my company will lead the development of the semiconductor industry everywhere,” he was quoted as saying.

HIT BY ASIAN FINANCIAL CRISIS

The late Kim targeted the system semiconductor business to expand its business portfolio.

He shifted the company’s business structure to focus on the foundry sector in 1998 when Amkor’s growth potential was recognized with its listing on Nasdaq.

The 1997-98 Asian financial crisis, however, dampened the plan as Anam made massive investments. Amkor faced strong opposition from US shareholders as it bought a 42.6% stake in Anam.

Amkor took over Anam’s packaging business while Dongbu Electronics, currently DB HiTek Co., which produced 5,000 wafers a year in 1997, acquired Anam’s foundry division with an annual wafer capacity of 30,000 units.

GLOBAL TOP SEMICONDUCTOR PACKAGING PLAYER

After the hardship, Amkor grew to a company generating some 9 trillion won ($7.1 billion) in annual sales from 20 manufacturing facilities with more than 30,000 employees in eight countries.

The company aims to rule the global semiconductor packaging industry by improving technology competitiveness, said the president of its South Korean unit last month, which nearly tripled sales to 4.5 trillion won in 2022 from 1.7 trillion won in 2019.

The South Korean unit, which operates semiconductor packaging and testing facilities with some 7,300 staff in the country, leads the expansion of packaging production facilities in Asia. Amkor is scheduled to complete a plant in Vietnam in September with a plan to start its mass production in the fourth quarter.

“Amkor is building semiconductor packaging and test facilities in Vietnam with an aim to develop the country as a semiconductor back-end process hub,” said Ji JongRip, president of the South Korean unit.

Amkor plans to invest $800 million this year in new equipment and technology for high-tech packaging production to secure sustainable growth and competitiveness.

The company is concentrating on semiconductor packaging for automobiles as the global car industry is rapidly growing with electric vehicles and future mobility.

“We developed cutting-edge technology based on active investment and became the world’s top OSAT company for automotive semiconductors,” said an Amkor official, referring to the outsourced semiconductor assembly and test.

Such business, along with launches of new premium smartphones and long-term growth in wearable devices, are expected to improve Amkor’s earnings further, industry sources said.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Korean chipmakersAmkor to top semiconductor packaging sector with better tech

Korean chipmakersAmkor to top semiconductor packaging sector with better techMay 17, 2023 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung Elec launches foundry package turnkey service

Korean chipmakersSamsung Elec launches foundry package turnkey serviceApr 14, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN