US survey findings on chip shortage rattle global chipmakers

The DOC could ask major players such as Samsung, SK Hynix and TSMC to submit more key data, including sensitive information

By Jan 26, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

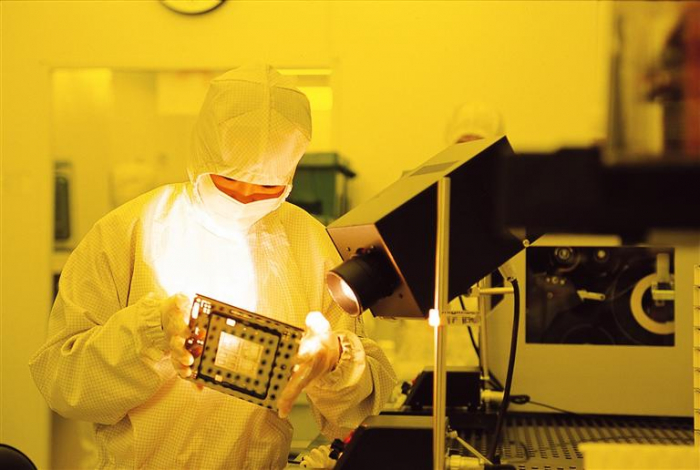

The US government’s release on Tuesday of its findings on the reasons behind the global chip shortage is raising concerns among chipmakers, with the government vowing to engage the industry on specific problem-solving to ease supply disruptions.

Over the next few weeks, the US Department of Commerce could request extra business information from major non-US chipmakers such as Samsung Electronics Co., SK Hynix Inc. and Taiwan Semiconductor Manufacturing Co., analysts said.

“Leading foundry players have their production facilities in the US. If requested by the US government to offer even sensitive business information, they will have no other choice but to respond,” said a chip industry official.

Announcing the results of its survey the DOC launched in September of 2021 on 150 semiconductor-related companies around the globe, US Commerce Secretary Gina Raimondo said on Tuesday that the world is undergoing an ongoing chip drought thanks to a "perfect storm" of factors.

PERFECT STORM

While citing the industry view that chip supply chain constraints could last into the second half of this year, the DOC said it will capitalize on the latest information it obtained to engage the chip industry on node-specific problem-solving in the coming weeks.

“We will also look into claims about unusually high prices in these nodes,” the department said in a statement.

Late last year, Samsung and SK Hynix, the world’s two largest memory chipmakers, and their global peers submitted their key internal data, excluding sensitive information, to the DOC.

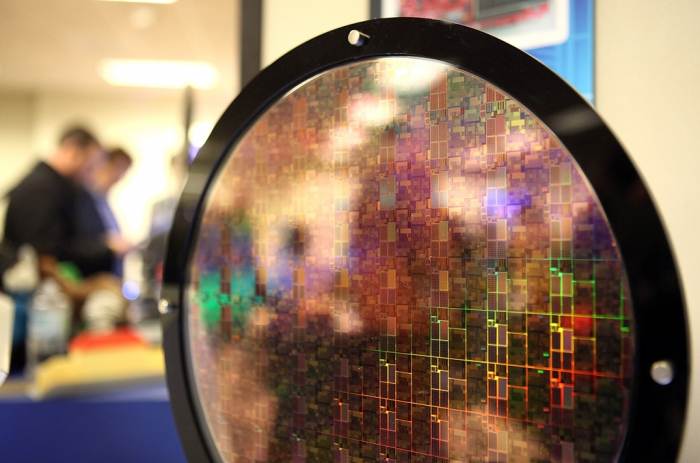

The findings disclosed on Tuesday showed companies’ chip inventory fell to fewer than five days in 2021 from 40 days in 2019, although semiconductor fabrication lines were operating at over 90% utilization, an incredibly high level, it said.

The DOC’s summary of its information showed that certain nodes of microcontrollers, analog chips and optoelectronic chips are particularly facing an acute supply shortage.

Samsung and SK Hynix are largely making advanced, high-density chips, keeping the production of legacy analog chips to a minimum.

Among the industries suffering the most was the automotive manufacturing sector, causing several automakers to intermittently shut down facilities due to the chip shortage, resulting in higher car prices.

The US government’s likely move to look further into global chipmakers comes after major foundry players such as TSMC and Samsung last year raised chip prices by 30% amid rising demand from carmakers for use in their autonomous vehicles and electric cars.

“Major chipmakers may face further requests from the DOC to submit internal data, including pricing information,” said an industry official.

Write to Shin-Young Park and Byung-Uk Do at nyusos@hankyung.com

In-Soo Nam edited this article.

-

AutomobilesGlobal carmakers deliver unfinished cars due to chip shortage

AutomobilesGlobal carmakers deliver unfinished cars due to chip shortageNov 15, 2021 (Gmt+09:00)

3 Min read -

AutomobilesChip shortage slams Korean carmakers’ new car rollouts

AutomobilesChip shortage slams Korean carmakers’ new car rolloutsOct 06, 2021 (Gmt+09:00)

3 Min read -

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortage

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortageApr 28, 2021 (Gmt+09:00)

3 Min read -

Semiconductor shortagesChip shortage worsens, keeps Samsung execs on edge

Semiconductor shortagesChip shortage worsens, keeps Samsung execs on edgeApr 19, 2021 (Gmt+09:00)

3 Min read -

Factory suspensionGM Korea to halt 2 main plants next week on automotive chip shortage

Factory suspensionGM Korea to halt 2 main plants next week on automotive chip shortageApr 15, 2021 (Gmt+09:00)

2 Min read -

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chains

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chainsFeb 15, 2021 (Gmt+09:00)

2 Min read