Chip shortage worsens, keeps Samsung execs on edge

By Apr 19, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

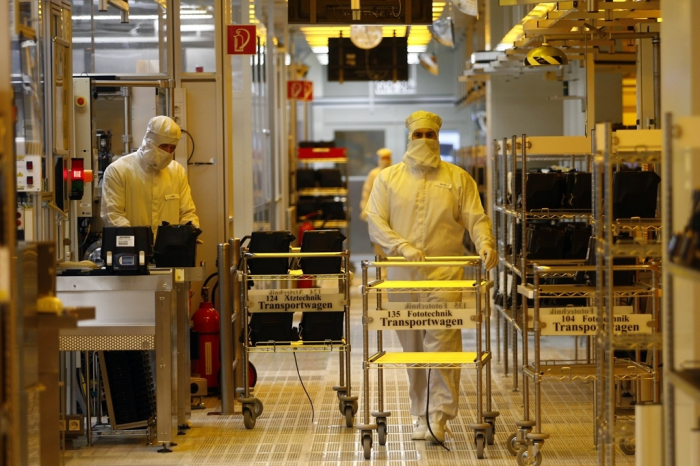

The global chip shortage, which began with declining supply of automotive chips, is crippling swaths of industries beyond the electronic devices sector, prompting even executives of Samsung Electronics Co. to go all out to procure semiconductors for TVs and smartphones.

According to the information technology industry on Apr. 19, the chip shortage is disrupting supply chains across industries in Korea, with automakers and appliance makers idling some of their factories.

The worsening situation is a particularly heavy blow to smaller manufacturers, which lack the negotiating power to directly buy semiconductors from chipmakers.

A closed-circuit television (CCTV) maker in Seoul is said to be struggling to secure microcontroller units (MCUs), the price of which has jumped more than sixfold to $50 a unit from around $8 last year.

The CCTV manufacturer, which usually buys the MCUs -- that work as the brain in a variety of electronic gadgets -- through distributors, says it can hardly secure the chips even at a much higher price.

“Our inventories are quickly depleting but there’s hardly anything we can do,” said an executive at the CCTV maker.

A local medical equipment supplier said the MCU sector has turned into a seller’s market, where the seller wields the pricing power owing to a shortage of products available for sale.

“We even contacted STMicroelectronics to directly place orders for MCUs. But we’re hearing that the lead time from production to delivery has increased to 40 weeks. For some products, it is more than two years,” said an official of the company.

SAMSUNG, LG UNDER CONSTRAINTS

Big companies such as Samsung and LG Electronics Inc. are also reeling from the worsening chip shortage.

The two Korean home appliance giants are said to be slashing their production of TVs and some home electronics goods by up to 20% due to short supply of displayer driver IC (DDI) chips and power management integrated circuit (PMIC) chips.

Globally, Hewlett-Packard Co. (HP) is struggling to meet chip demand for computers, while Hangzhou Robam Appliances, a leading Chinese household appliance manufacturer, is delaying its launch of new ovens by at least four months due to the shortage of chips.

Last week, Han Jong-hui, president of Samsung Electronics' display business, embarked on an unscheduled trip to Taiwan in an effort to secure a stable supply of DDI chips.

Before that, Roh Tae-moon, head of Samsung's mobile division, flew to the US in mid-March to discuss the procurement of application processor (AP) chips with Qualcomm Technologies Inc.

“Prices are no longer a determining factor. Those who can procure needed chips in a stable manner will emerge as the winners,” said a procurement official at a Korean conglomerate.

BLACK MARKET THRIVES

For the auto industry, one of the first sectors hit by the global chip shortage, the situation is getting worse.

General Motors and Ford are temporarily idling several North American factories over the supply issue.

In Korea, GM said last week it is briefly suspending two of its three plants in the country because of chip shortages.

Hyundai Motor Co. and affiliate Kia Corp. are also putting some of their local plants on hold, compromising production of the Sonata and Grandeur sedans.

“Some Chinese companies are collecting chips from the black market at prices five to six times higher than before,” said an industry official.

Mark Liu, executive chairman of Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest foundry chipmaker, said some of its contract clients had placed orders more than double their earlier volumes, exacerbating the chip shortage.

“The higher prices of components, including chips, will likely lead to increased prices on finished products,” said a Korean electronics good maker.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

-

Chip summitSamsung walks tightrope on US investment; invited to White House talks

Chip summitSamsung walks tightrope on US investment; invited to White House talksApr 12, 2021 (Gmt+09:00)

4 Min read -

M&AsChinese PE firm pays $1.4 bn to take over Magnachip Semiconductor

M&AsChinese PE firm pays $1.4 bn to take over Magnachip SemiconductorMar 28, 2021 (Gmt+09:00)

2 Min read -

Foundry competitionIntel’s jump into foundry sets off alarm bells for Samsung, TSMC

Foundry competitionIntel’s jump into foundry sets off alarm bells for Samsung, TSMCMar 24, 2021 (Gmt+09:00)

3 Min read -

Samsung ElectronincsSamsung says to overtake TSMC with efficient, right-time investment

Samsung ElectronincsSamsung says to overtake TSMC with efficient, right-time investmentMar 18, 2021 (Gmt+09:00)

3 Min read -

Memory competitionSamsung, SK Hynix at crossroads, challenged by underdogs

Memory competitionSamsung, SK Hynix at crossroads, challenged by underdogsMar 14, 2021 (Gmt+09:00)

4 Min read -

Semiconductor shortagesQualcomm chip shortage may squeeze global smartphone production

Semiconductor shortagesQualcomm chip shortage may squeeze global smartphone productionMar 08, 2021 (Gmt+09:00)

3 Min read