Food & Beverage

Korea’s makgeolli market hits brakes amid whiskey fad

S.Korea’s traditional rice wine breweries saw their operating profit fall in 2023 from 2022, marking the first drop since 2021

By Apr 09, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The market growth of South Korea’s traditional milky and often sweet rice wine, makgeolli, has slowed after the country’s younger generations’ makgeolli craze has waned in line with a change in their palates preferring distilled spirits, especially whiskey and Scotch whisky.

The shift in trends for alcoholic drinks among the country’s trendsetters in their 20s and 30s dragged down the earnings of Korean makgeolli brewing companies last year.

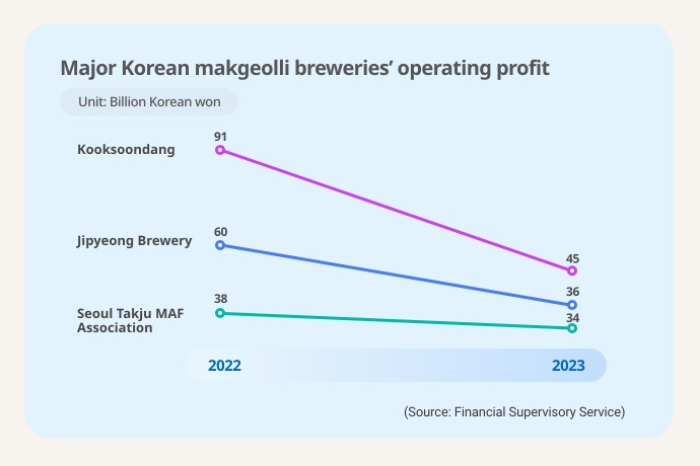

According to corporate regulatory filings to the Financial Supervisory Service on Monday, Kooksoondang’s operating profit for 2023 was halved to 4.5 billion won ($3.3 million) from the prior year on sales of 70.5 billion won, down 5.5% on-year.

The company blamed a fall in both local sales and exports for lower profitability.

The poor performance comes after the Korean makgeolli producer enjoyed a surge in earnings during the COVID-19 pandemic, which made home drinking normal due to frequent lockdowns and bans on gatherings and drinking traditional alcoholic drinks a sassy trend among younger generations.

The K-culture boom driven by binge-watching Netflix shows during the pandemic also contributed to a jump in exports of Korea’s traditional rice wine to overseas markets.

Kooksoondang’s exports soared more than 70% to 13.7 billion won in 2022 from 2020.

WHISKEY FAD OVERTAKES THE MAKGEOLLI CRAZE

But its growth has hit the brakes after the country’s whiskey boom took off last year among younger generations, and demand for fruit liqueur has risen abroad.

According to the Korea Customs Service, makgeolli exports dropped 10% to 13,982 tons last year from its peak of 15,396 tons in 2022.

To offset softening demand at home, Korean makgeolli breweries rushed to ship more makgeolli to overseas markets where its demand has been also on the decline, intensifying competition among Korean makgeolli products abroad and hurting their profitability, said an industry official.

With declining sales at home and abroad, Seoul Takju MAF Association, the country’s No. 1 makgeolli Jangsu seller, saw its operating profit down 10.4% on-year last year, while another major makgeolli company Jipeyong Brewery’s profit also plummeted more than 40% over the same period.

Jipyeong Brewery, which opened Korea’s largest makgeolli brewing facility last year in anticipation of strong exports, has hit a snag in its plan to advance into major global markets such as the US and Japan this year due to the subdued demand for makgeolli and a delay in the development of new drinks.

To revive younger generations’ appetite for traditional alcoholic beverages, the country’s makgeolli breweries are actively adding new drinks to their product portfolios, such as mixed makgeolli drinks like whiskey highball drinks by Seoul Takju and fruity makgeolli by Kooksoondang.

MILKY RICE WINE WITH A LONG HISTORY

Makgeolli is Korea’s traditional unrefined rice wine, with a history of a thousand years.

It is a mixture of steamed rice, yeast and water, left to ferment for a few weeks in a clay pot. It used to be brewed at home across Korea with families making unique recipes for their own consumption.

After many ups and downs throughout Korean history, makgeolli’s recent fad was revived by the younger generations in their 20s and 30s, who embraced the traditional milky rice wine as a retro but hip drink during the pandemic.

But amid the growing popularity of distilled spirits and highball drinks among young people in Korea, the country’s makgeolli industry is facing a new challenge.

The country’s whiskey imports in the first 10 months of 2023 increased 26.7% from the same period of the previous year to 26,937 tons, nearly tantamount to Korea’s total whiskey imports for the whole of 2022 and showing no sign of receding.

Write to Hun-Hyoung Ha at hhh@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Food & BeverageUnwavering whiskey fad in Korea, held up by mass-market spirits

Food & BeverageUnwavering whiskey fad in Korea, held up by mass-market spiritsDec 08, 2023 (Gmt+09:00)

3 Min read -

Food & BeverageWine bubble bursts in S.Korea as whisky frenzy grows

Food & BeverageWine bubble bursts in S.Korea as whisky frenzy growsJul 19, 2023 (Gmt+09:00)

2 Min read -

Korean foodKooksoondang to export limited edition makgeolli to Japan in four years

Korean foodKooksoondang to export limited edition makgeolli to Japan in four yearsJun 16, 2023 (Gmt+09:00)

2 Min read -

Korean foodKorea's Kooksoondang sees its makgeolli exports surpass $10 mn mark

Korean foodKorea's Kooksoondang sees its makgeolli exports surpass $10 mn markMar 21, 2023 (Gmt+09:00)

1 Min read -

Food & BeverageS.Korea's brewery Seoul Jangsu forms marketing tie-up with fashion industry

Food & BeverageS.Korea's brewery Seoul Jangsu forms marketing tie-up with fashion industryMar 21, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN