Energy

S.Korean transformers invade US market on surging demand

HD Hyundai Electric, Hyosung secure more orders with eco-friendly products, fast deliveries; LS Electric mulls building a US factory

By Aug 04, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s heavy electrical equipment makers are expanding their presence in the US, the world’s second-largest electricity consumer, as they are winning more orders there, taking advantage of the growing demand for transformers and other electric vehicle charging and renewable energy devices.

HD Hyundai Electric Co., a unit of the world’s No. 2 shipbuilder HD Hyundai Co., and Hyosung Heavy Industries Corp. already sold out products to be delivered by 2025 on surging orders, while LS Electric Co. bagged major supply deals in the second quarter to make inroads into the US market.

HD Hyundai Electric, formerly Hyundai Electric & Energy Systems Co., and Hyosung are operating their US factories at more than their nameplate capacities with overtime work at night and on weekends, according to industry sources in Seoul on Friday.

“Those companies increased exports from South Korea as they could not meet demand with US production only,” one of the sources said.

Customers in the US placed orders in advance to secure products for delivery in 2026. Such demand allowed Hyosung to raise prices of electrical devices such as transformers and circuit breakers by 20% from the levels two years before. HD Hyundai Electric ramped up selling prices this year and last.

Despite such price hikes, HD Hyundai Electric inked deals of a combined $510 million in the US during the second quarter, up 44.9% from a year earlier. Hyosung’s order backlogs rose 11.6% to $212 million in the country as of the end of the first quarter.

DEMAND JUMPS

Demand for electrical equipment surged in the US as the country needs to replace aged infrastructure for power transmission and distribution. About 70% of distribution transformers are older than the device’s average lifespan of 25 years as of 2020, according to the US Department of Energy.

The installations of facilities for renewable energy such as solar power increased, ramping up the need for transformers to transmit electricity to consumers. The home EV charger market is also rising thanks to rapid demand growth for the clean automobiles.

South Korean makers will benefit from increasing state governments’ policies requiring eco-friendly insulators for transformers.

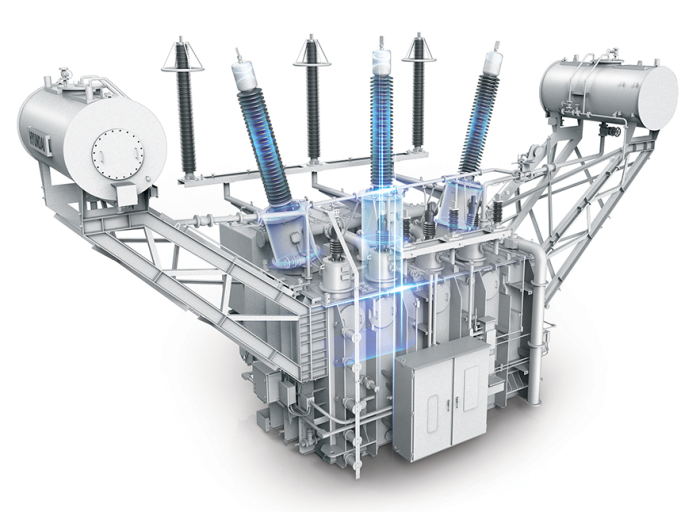

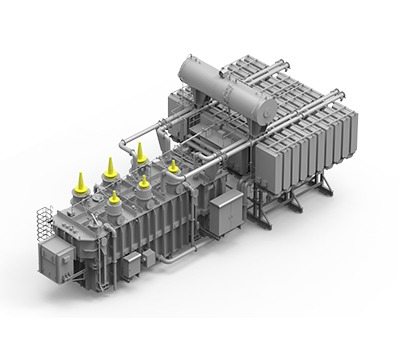

HD Hyundai Electric is using its own eco-friendly insulating oil for the devices, while Hyosung introduced eco-friendly transformers.

FAST DELIVERY OF CUSTOMIZED TRANSFORMERS

Transformer manufacturers usually make customized products for each buyer, while customers often seek suppliers that can meet their requirements and delivery dates. Consumers in the electrical device market tend not to change suppliers as operating stability is important for the equipment.

South Korean producers are regarded as reliable suppliers in the industry, given their order track records, industry sources said.

“It usually takes 10 months to deliver transformers after orders are received, but we ship the products to loyal customers within seven to eight months,” said a Hyosung official. “We are concentrating on our existing customers although new buyers are scrambling for our products.”

LS Electric has forayed into the US market, taking advantage of the construction of new factories for other South Korean companies such as Hyundai Motor Co. and LG Energy Solution Ltd.

Orders from the US made up 28% of LS Electric’s total contracts of 450 billion won bagged in the second quarter.

The company exports products from South Korea as it does not have a US plant.

“We have yet to deal with local companies in the US, but customers appreciate our relatively short delivery periods,” said an LS Electric official. “We are also considering building a factory in the US.”

Write to Hyung-Kyu Kim at khk@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Electric vehiclesHyundai ties up with LG, SK for $5.3 bn US EV cell plants

Electric vehiclesHyundai ties up with LG, SK for $5.3 bn US EV cell plantsApr 21, 2023 (Gmt+09:00)

2 Min read -

BatteriesLG Energy to build $5.6 billion battery complex in Arizona

BatteriesLG Energy to build $5.6 billion battery complex in ArizonaMar 24, 2023 (Gmt+09:00)

3 Min read -

EnergyKorea’s Hyundai Electric wins $86 mn transformer deal in US

EnergyKorea’s Hyundai Electric wins $86 mn transformer deal in USJan 31, 2023 (Gmt+09:00)

1 Min read -

Electric vehiclesHyundai Motor to boost US presence with $5.5 bn new Georgia EV plant

Electric vehiclesHyundai Motor to boost US presence with $5.5 bn new Georgia EV plantOct 26, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN