Electric vehicles

Tesla Korea’s profit, sales fall on new subsidy plans, lack of models

The US EV giant's Korean sales decline has intensified with its rivals' fortified EV lineups

By Apr 12, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Tesla Inc.’s South Korean business has been worsening in recent months due to the lack of new models launched in the country amid Seoul’s new subsidy policy, which favors domestic vehicles.

Tesla Korea on Wednesday said in a regulatory filing that it posted 15.1 billion won ($11.4 million) in operating profit on sales of slightly more than 1 trillion won in 2022, down 7.2%, respectively, from the previous year.

Its net profit declined 29.2% to about 10 billion won, it said.

Tesla Korea’s weak performance compares with its parent company’s 2022 operating profit of $13.66 billion, more than double its year-earlier profit.

The top US electric vehicle maker’s Korean sales have been on a steady slide.

According to Korea’s automobile market tracker CarIsYou, the number of new Tesla vehicle registrations stood at 14,571 in 2022, down 18.3% from the year prior. With that figure, Tesla ranked fifth among imported cars in terms of sales in Korea.

Tesla Korea’s sales decline has intensified this year, with its first-quarter new car registrations cut in half from the year-earlier period to 1,303 units.

Industry officials said Tesla has been slow to launch new models in Korea while its rivals, including Mercedes-Benz, BMW and Audi, as well as local automakers such as Hyundai Motor Co. and Kia Corp. are expanding their EV lineup.

“Korea’s strengthened EV subsidy plans are also working against Tesla and other imported vehicles,” said an industry official.

SEOUL’S NEW EV SUBSIDY PLANS

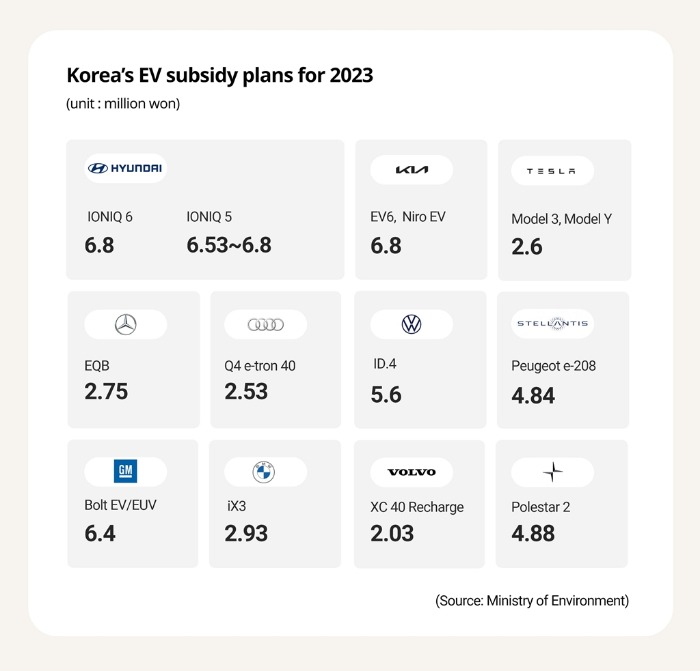

Korea is revising its electric vehicle subsidy plan in a way that favors local cars such as the Hyundai IONIQ 6 over imported vehicles, including the Tesla Model 3, to address discrepancies in tax benefits granted by the US and Chinese governments in their countries.

Under new subsidy rules prepared by Korea’s Ministry of Environment, the government plans to provide EV subsidies differently based on levels of vehicle performance, after-sales service infrastructure and battery energy density.

Given that foreign EV makers operate fewer charging and other service centers in Korea, some of the importers, especially Tesla, are expected to lose their price competitiveness under the new subsidy policy.

Under the revised criteria, any electric car with a price tag of 85 million won or more will be excluded from subsidies, dealing a blow to Tesla’s premium models.

Tesla has been one of the top beneficiaries of Korea’s hefty EV subsidies.

The government said the new subsidy standard is also aimed at improving the after-sales service infrastructure across the country.

According to Korea’s National Tax Service, Tesla Korea was forced to pay 25.1 billion won in corporate tax after a tax probe last year.

But the company categorized the tax payment as accounts receivable rather than expenses on its financial statements, according to domestic accounting industry sources.

“If Tesla Korea treated it in accordance with accounting rules, the company likely posted a net loss last year,” said an industry official.

Write to Nan-Sae Bin at binthere@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Business & PoliticsKorea’s new EV subsidy plan favors Hyundai over Tesla, other imports

Business & PoliticsKorea’s new EV subsidy plan favors Hyundai over Tesla, other importsFeb 03, 2023 (Gmt+09:00)

4 Min read -

Electric vehiclesS.Korea fines Tesla $2.2 mn for alleged false advertising

Electric vehiclesS.Korea fines Tesla $2.2 mn for alleged false advertisingJan 03, 2023 (Gmt+09:00)

2 Min read -

Electric vehiclesTesla sweeps local EV subsidies as Korean firms at disadvantage in US

Electric vehiclesTesla sweeps local EV subsidies as Korean firms at disadvantage in USAug 22, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai’s IONIQ 6 travels faster, farther than Tesla Model Y, Mercedes EQS

Electric vehiclesHyundai’s IONIQ 6 travels faster, farther than Tesla Model Y, Mercedes EQSJul 14, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN