Economy

Korea’s weak exports add to Trump tariff risk woes

Exports fell 4.7% in January-February; sales to China and the US declined 8.1% and 4.3%, respectively

By Mar 02, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s exports in the first two months skidded as sales to the world’s two largest economies China and the US fell, adding to concerns that Asia’s fourth-largest economy could lose momentum amid looming tariffs from US President Donald Trump, data showed on Saturday.

Exports fell 4.7% to $101.7 billion in January-February from a year earlier, according to the Ministry of Trade, Industry and Energy.

Overseas sales edged up 1% to $52.6 billion in February after reporting the first drop since September 2023 in January due to holidays.

The Lunar New Year holiday fell Jan. 27-30, or Monday-Thursday, while some companies such as automakers closed on Jan. 31 to extend the festival to a full week. In 2024, the holiday was celebrated Feb. 9-12.

The data bodes ill for the trade-dependent economy, given the growing risks of a global trade war, analysts said.

Trump said on Thursday tariffs of 25% on Mexican and Canadian goods are set to take effect on March 4, while also threatening to impose an additional 10% on Chinese imports on the same date.

Last month, he announced moves to impose 25% tariffs on all steel and aluminum imports into the US "without exceptions or exemptions” while planning to charge similar duties on semiconductors, automobiles and other products.

South Korea is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc. – as well as the world’s No. 3 carmaker – encompassing both Hyundai Motor Co. and Kia Corp.

EXPORTS TO CHINA, US DOWN

South Korea's exports to China and the US fell in the first two months of the year.

Sales to China, Korea’s top overseas market in 2024, slumped 8.1% to $18.7 billion in January-February from a year earlier due to weaker semiconductor exports.

Shipments to the US fell 4.3% to $19.2 billion during the two months.

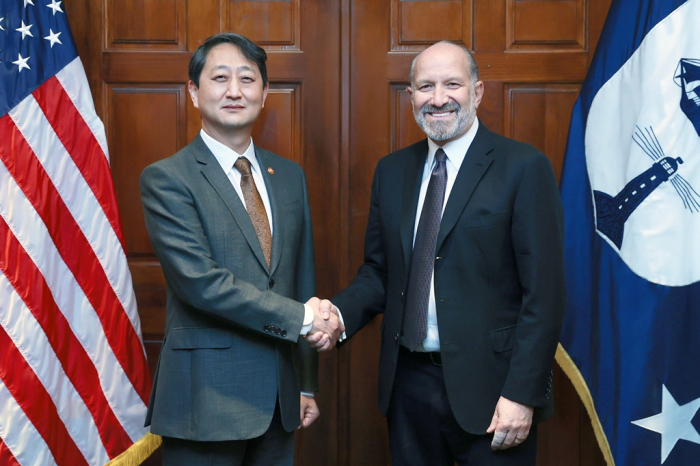

South Korea’s Minister of Trade, Industry and Energy Ahn Dukgeun last week met US Commerce Secretary Howard Lutnick, Interior Secretary Doug Burgum and US Trade Representative Jamieson Greer to request a tariff exemption, according to Seoul.

SEMICONDUCTORS DOWN, AUTOMOBILES STABILIZE

South Korea’s Semiconductor exports dipped 0.2% to $19.8 billion in the first two months of 2025 from a year earlier with their overseas sales in February down 3%, according to the trade ministry.

Lower prices for general-purpose products such as NAND flash chips overshadowed strong demand for premium items including high-bandwidth memory (HBM) chips, hurting overall semiconductor exports, the ministry said.

On the other hand, auto exports showed one sign of stabilization.

Overseas sales of vehicles jumped 17.8% in February thanks to strong demand for hybrids and internal combustion engine models, the ministry said.

Auto exports fell 2.7% in the first two months of the year, according to the ministry data.

Write to Ji-Eun Ha at hazzys@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Central bankBank of Korea cuts rates, growth forecast on Trump tariff policy

Central bankBank of Korea cuts rates, growth forecast on Trump tariff policyFeb 25, 2025 (Gmt+09:00)

4 Min read -

EconomyKorean exports snap 15 months of gains in Jan despite higher chip sales

EconomyKorean exports snap 15 months of gains in Jan despite higher chip salesFeb 02, 2025 (Gmt+09:00)

2 Min read -

ElectronicsLG mulls US plant expansion to deal with Trump 2.0 tariffs

ElectronicsLG mulls US plant expansion to deal with Trump 2.0 tariffsJan 14, 2025 (Gmt+09:00)

3 Min read -

AutomobilesHyundai Mobis to boost US production to cope with Trump

AutomobilesHyundai Mobis to boost US production to cope with TrumpJan 12, 2025 (Gmt+09:00)

2 Min read

Comment 0

LOG IN