Central bank

Bank of Korea cuts rates, growth forecast on Trump tariff policy

Government bond yields fell across the board as BOK chief says policymakers share the view of two or three rate cuts this year

By Feb 25, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s central bank on Tuesday cut interest rates while sharply reducing its economic growth forecast as lingering political turmoil following December's martial law decree and looming tariffs from US President Donald Trump are expected to derail Asia's fourth-largest economy.

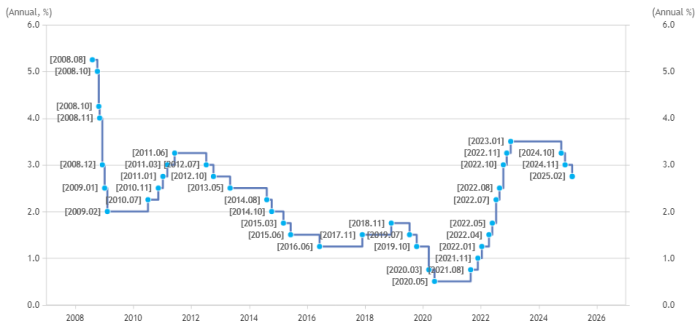

The Bank of Korea (BOK) lowered its policy interest rate by a quarter percentage point to 2.75%, the lowest since August 2022, in a unanimous decision as widely expected.

The central bank also slashed its economic growth forecast for this year to 1.5% from the previous 1.9% published in November. The latest forecast is also lower than the monetary authority’s prediction announced last month that the economy was likely to grow 1.6-1.7% this year. The economy expanded 2.0% last year.

“Trends in domestic demand recovery and export growth are forecast to be lower than previously expected due to deteriorating economic sentiment and US tariff policies,” the BOK said in a statement.

“It is judged that inflation stabilization has continued, while domestic economic growth is projected to remain low for some time.”

South Korean government bond yields fell across the board after the remarks.

The highly liquid South Korean government’s three-year bond yield dipped 1.4 basis points to 2.596%, while the five-year debt yield lost 1.9 bps to 2.698%, according to the Korea Financial Investment Association. The 10-year yield skidded 2.8 bps to 2.797%.

FURTHER CUTS, BUT NOT IMMINENT

BOK Governor Rhee Chang-yong said the central bank’s policymakers share the financial market’s view that the central bank is likely to lower the benchmark interest rate two or three times this year, including the latest cut.

Rhee said the BOK may not rush into further easing, however.

“Four out of six monetary policy board members said the policy rate is likely to remain at 2.75% in the next three months as they expressed concerns over the rapidly exhausting room for further rate cuts amid high uncertainties in the domestic and external policy environment,” Rhee told reporters after the rate cut.

“The remaining two said it is necessary to leave the door open to lower the rate below 2.75% in the next three months.”

The policy consists of seven members including Rhee, who chairs the committee.

Analysts focused more on the possibilities of further cuts than the timing of easing.

“The economy is facing more downside than upside risks as the revised forecast reflects expectations of two or three more rate cuts,” said Baek Yoon-min, a fixed-income analyst at Kyobo Securities Co. in a note.

“The monetary policy path supports further rate cuts, given inflation and growth,” Baek said, adding that the central bank is expected to lower policy borrowing costs by 25 bps each in the second and third quarters to 2.25%.

The BOK lowered its core inflation forecast for 2025 to 1.8% from the previous 1.9% while maintaining its headline inflation prediction at 1.9%. That compared with the central bank’s long-term target of 2%.

SLOWER EXPORT GROWTH

Rhee said the economy is facing more risks from Trump’s protectionistic policies.

“The latest growth forecast reflected the growing uncertainties over the US tariff policies since US President Donald Trump took office, while domestic developments such as the martial law decree were a significant factor (to lower the growth prediction) in January,” Rhee said.

South Korea’s Constitutional Court is expected to decide whether to remove President Yoon Suk Yeol from office permanently or reinstate him next month. Yoon was impeached by lawmakers over his stunning and short-lived imposition of martial law on Dec. 3.

The BOK slashed its forecast for the trade-dependent economy’s 2025 goods export growth to 0.9% from the previous 1.5%.

Trump said on Monday his tariffs on Canada and Mexico are starting next month while stressing more broadly that his intended “reciprocal” tariffs are on track to begin as soon as April.

Earlier this month, Trump announced moves to impose 25% tariffs on all steel and aluminum imports coming into the US "without exceptions or exemptions” while planning to charge similar duties on semiconductors, automobiles and other products.

South Korea is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc. – as well as the world’s No. 3 carmaker – Hyundai Motor Co. and Kia Corp. together.

The BOK warned South Korea’s economic growth could slow further to 1.4% his year if the US tariff policy sparks a global trade war.

“In a pessimistic scenario of reciprocal retaliatory actions between the US and other countries, global trade would contract sharply and uncertainty surrounding trade policy would increase, significantly slowing domestic exports and investment,” BOK said in a separate report.

The central bank cut facility investment and private consumption growth forecasts for this year to 2.6% and 1.4%, respectively, from the previous 3% and 2%.

Write to Jin-gyu Kang and Dong-Wook Jwa at josep@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EconomyS.Korea’s economy grows 2.0% in 2024; Q4 GDP below forecast

EconomyS.Korea’s economy grows 2.0% in 2024; Q4 GDP below forecastJan 23, 2025 (Gmt+09:00)

2 Min read -

Business & PoliticsYoon becomes first S.Korean sitting president to be formally arrested

Business & PoliticsYoon becomes first S.Korean sitting president to be formally arrestedJan 19, 2025 (Gmt+09:00)

2 Min read -

Central bankBOK lowers growth forecasts to bolster rate cut expectations

Central bankBOK lowers growth forecasts to bolster rate cut expectationsJan 20, 2025 (Gmt+09:00)

3 Min read -

Business & PoliticsKorea sharply cuts 2025 growth forecast, opens door for extra budget

Business & PoliticsKorea sharply cuts 2025 growth forecast, opens door for extra budgetJan 02, 2025 (Gmt+09:00)

4 Min read -

Business & PoliticsSouth Korea president to lift martial law after Parliament rejects move

Business & PoliticsSouth Korea president to lift martial law after Parliament rejects moveDec 04, 2024 (Gmt+09:00)

6 Min read -

Central bankBOK makes 1st back-to-back rate cut since 2009 global crisis

Central bankBOK makes 1st back-to-back rate cut since 2009 global crisisNov 28, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN