Economy

Korea’s household, business loans on upswing in September

Household debt rose for the sixth consecutive month, while business loans jumped at the fastest pace

By Oct 12, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

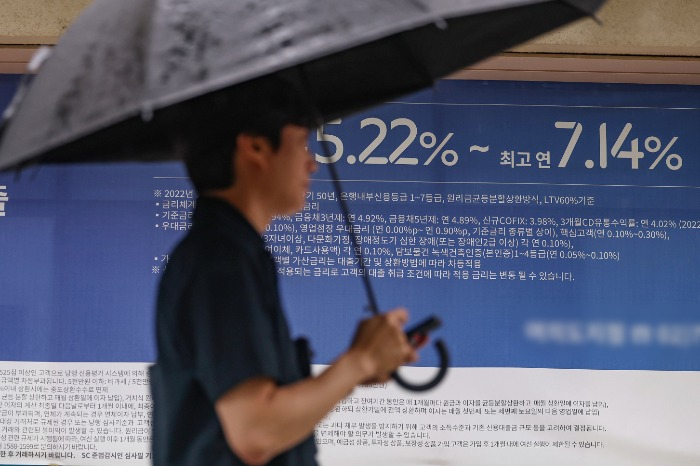

South Korea’s household debt continued to rise for the sixth consecutive month in September despite stricter regulations on mortgages, while business loans climbed at a record-high rate for the month, spurring concerns about corporate financial health.

Korean commercial banks’ outstanding balance of household loans increased 4.9 trillion won ($3.6 billion) to 1,079.8 trillion won in September from the previous month, extending the growth streak for six months in a row, according to data released by the Bank of Korea on Thursday.

Household borrowing remained on a downward trend since late last year but in April this year started rebounding with a gain of 2.3 trillion won. Since then, it has remained on the upward track.

The growth, however, slowed down in September from a month ago when it rose by 6.9 trillion won. Mortgage loans added 6.1 trillion won to 833.9 trillion won last month, slower than the previous month on tighter lending rules and shorter working days, while other loans dropped 1.3 trillion won to 244.7 trillion won.

Still, last month's mortgage increase was the second biggest for September after the 6.7 trillion won gain in 2020.

In October, home loan growth is expected to pick up speed as the country enters its most popular moving season, autumn, and after more homes changed hands in August than July, said a BOK official.

HIGHER BUSINESS LOANS AND DELINQUENCY RATE

The outstanding balance of banks’ business loans in September also zoomed 11.3 trillion won from the previous month, the biggest-ever on-month gain for the month.

In a high interest rate environment, companies seemingly have shifted away from debt sales to bank loans to secure capital.

The fast rise in business loans stoked concerns about the financial soundness of local small and medium-sized enterprises.

According to BOK data obtained by Representative Yang Kyung-sook of the opposition Democratic Party, banks’ delinquency rate on SME loans ticked up to 0.33% in the second quarter this year from 0.31% in the first quarter and 0.25% in the fourth quarter of last year.

SME loans jumped 6.4 trillion won last month from the prior month, while loans to larger conglomerates climbed 4.9 trillion won over the same period.

As both household and business loans remain on the upswing, eyes are on the next monetary policy meeting by Korea’s central bank slated for Oct. 19.

The BOK has vowed to reduce the country’s high household debt and left the door open to raising the base interest rate by 25 basis points.

Write to Do-Won Lim at van7691@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EconomyKorea expects inflation to ease from Oct after 5-month high

EconomyKorea expects inflation to ease from Oct after 5-month highOct 05, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK chief’s top mission: Soft landing for household debt

Central bankBOK chief’s top mission: Soft landing for household debtAug 24, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK leaves door open for another quarter-point rate rise

Central bankBOK leaves door open for another quarter-point rate riseMay 25, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN