Economy

BOK chief says aging without assets key challenge to S.Koreans

BOK Governor Rhee Chang-yong says elderly S.Koreans may suffer from a lack of assets while Japanese seniors will enjoy wealth

By Jul 14, 2023 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

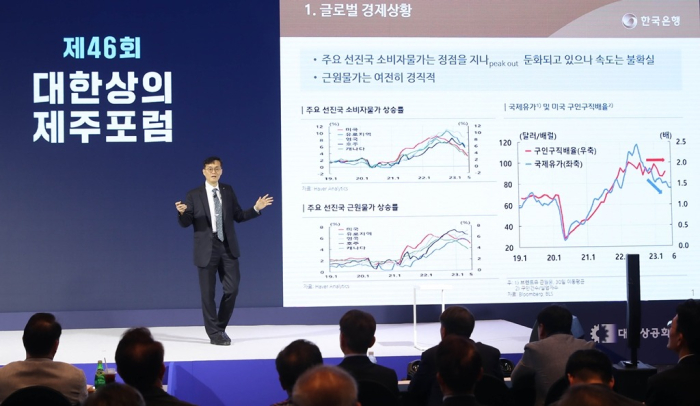

JEJU -- South Korea’s central bank chief on Friday warned of the growing risk of aging without assets in Asia’s fourth-largest economy as the country has failed in its structural reforms due to a heavy dependence on China, the rigid labor market and resistance from the establishment.

Bank of Korea Governor Rhee Chang-yong reaffirmed that the central bank is unlikely to cut its policy interest rate this year due to sustained uncertainty over inflation and household lending.

“Elderly South Koreans may suffer from a lack of assets while Japanese seniors will enjoy wealth,” Rhee said at a business forum hosted by the Korea Chamber of Commerce and Industry on the resort island of Jeju.

“Some argued that we caught up with Japan, but that’s about income. Japan has much more assets. Japan invested a lot in overseas markets based on large-scale current account surpluses earned from the 1970s to the 1990s,” he said when asked to compare the economies of the neighboring countries.

South Korea is likely to face a more severe economic slowdown in the longer term without structural reforms than Japan’s recession, given the faster aging and declining population in the peninsular nation, Rhee said.

“The Japanese economy has significantly improved as the falling birthrate and aging has slowed down while the country has utilized many foreign workers and women,” he said.

Rhee said South Korea still has much to be hopeful about as the country is more dynamic than Japan.

“Korean youth are much more dynamic, driving the rapid development of K-pop,” he stressed. “I hope to do our utmost with the advantages for a quick recovery without suffering a similar hardship to that of Japan for 20 years.”

FAILS IN INDUSTRIAL REFORMS

Rhee said South Korea’s industry has failed in structural reforms as local companies enjoyed easy growth relying on China, the world’s second-largest economy.

He has said the South Korean economy is no longer supported by the country considering the sustained decline of its exports to the mainland.

“Our exports to China have been falling since 2017 not because of the conflict between the US and China but because of the weakening competitiveness of South Korean companies,” he said. “We had not predicted China would catch up with us because we got used to the economic boom in China for more than a decade and just enjoyed easy profits there.”

That delayed the industrial restructuring to shift the focus to the service sector from the manufacturing sector.

“Companies were just satisfied with low labor costs and a big market in China when the country’s economy grew more than 7-8% instead of switching to new businesses,” Rhee said. “They earned a lot of money but lost time, which was supposed to be used for upgrades of their industries to another level.”

“Chinese companies are now even producing smartphones,” he said, suggesting the intensifying competition with South Korean makers. Korea is home to the world’s second-largest smartphone maker Samsung Electronics Co.

Local companies are seeking to diversify overseas markets with great interest in other countries such as India and Indonesia, he added.

RIGID LABOR MARKET, ESTABLISHMENT

South Korean companies faced issues with the rigid labor market and the establishment although they are seeking new businesses for future growth, Rhee said.

“Our labor market is not favorable. Once you get a job, it becomes your lifetime job,” he said. “If the battery industry changes, jobs need to move to other sectors. But it is a problem (not to have such a system).”

“We need a system to allow more job cuts and a government social safety net to protect people who are fired, during their unemployment.”

Rhee also cited resistance from the establishment, such as academia, as a hurdle to structural reforms.

“We need new talent for new industries but universities maintain majors of the past because professors don’t want to reduce the number of students,” Rhee said. “Students are not majoring in sectors where there is growing demand for talent but rather study subjects based on the quota of departments decided by professors.”

Such practices may prevent the development of new businesses, he said.

Rhee called for the role of entrepreneurs to create new growth engines.

“The fiscal and monetary policies do not form growth engines for new changes but restructuring does,” he said. “Successful restructuring will help us get over our aging and low birthrate issues.”

DO NOT EXPECT RATE CUT THIS YEAR

Rhee reiterated that the central bank is unlikely to reduce interest rates this year.

“Do not expect a cut too much as it is tough to say (the BOK) will lower rates for the time being. “We will adjust interest rates and look at the situation on a macro scale by year-end.”

The BOK on Thursday kept the door open for another interest rate hike after leaving the policy borrowing cost unchanged at 3.50% for a fourth consecutive meeting.

Financial market investors and analysts have been expecting the central bank to lower the base interest rate for economic recovery as inflationary pressure has eased.

Headline inflation in June dropped for a fifth straight month to a 21-month low of 2.7%.

“Many people seemed to think it is time to cut interest rates. But the BOK remains cautious as inflation may accelerate to 3.5% by year-end given factors such as the base effect.”

Rhee predicted the domestic economy to rebound despite uncertainties over its speed.

“The US and Chinese economies are two main supports for our exports. The US economy is expected to grow more than expected, which is good news to us,” he said.

“On the other hand, China remains unstable, keeping uncertainties over growth in the second half or next year.”

Write to Jeong-Soo Hwang and Jin-gyu Kang at hjs@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Central bankBOK keeps door open for another rate hike on Fed, debts

Central bankBOK keeps door open for another rate hike on Fed, debtsJul 13, 2023 (Gmt+09:00)

3 Min read -

EconomyS&P expects BOK to cut rate by 100 bps in 2024 for growth

EconomyS&P expects BOK to cut rate by 100 bps in 2024 for growthJul 12, 2023 (Gmt+09:00)

2 Min read -

-

-

EconomyS.Korea's economy no longer supported by China: BOK head

EconomyS.Korea's economy no longer supported by China: BOK headMay 22, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN