Economy

S.Korea confirms economic slowdown, recession concerns loom

Recession fears grow after the Korean government admits to a slowdown for the first time

By Feb 17, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The South Korean finance ministry on Friday confirmed that the country’s economy has slowed, mired in stubbornly high inflation and sluggish exports, a key growth driver of Asia’s fourth-largest economy.

It is the first time for the Korean government to assess that the country’s economy has slowed since June last year when the Ministry of Economy and Finance first flagged a possible economic slowdown in its monthly economic assessment report, called the Green Book. In January it said, “Slowdown concerns are growing.”

The Korean won lost as much as 1.5% to 1,303.8 per dollar on Friday, its weakest since December 20, 2022 in the Seoul foreign exchange market. Korea's main stock index Kospi dropped 1% to end at 2,451.21.

The finance ministry on Friday blamed still-high inflation and the export slump for the lethargic economy.

“Inflation remains still high, and domestic consumption recovery is slowing. A persistent slump in exports and deteriorating business sentiment indicate an economic downturn,” the ministry said in the report released on the same day.

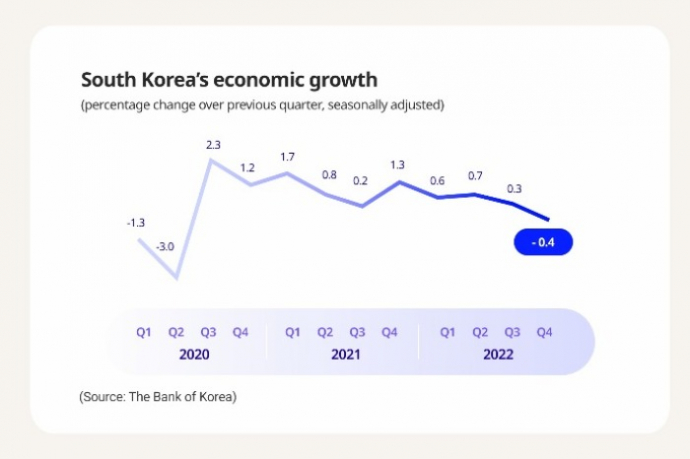

The economic slowdown adds to Korea’s recession woes after the country suffered its first economic contraction in two and a half years in the fourth quarter of 2022 due to sluggish export and weak domestic demand.

The Korean economy shrank by a seasonally adjusted 0.4% in the October-December period last year from the previous three months. The last time the country’s gross domestic product (GDP) retreated was in the second quarter of 2020 in the aftermath of the global COVID-19 outbreaks.

If a country suffers an economic contraction for two consecutive quarters, it is considered to have entered a recession.

NO SIGN OF RECOVERY IN EXPORTS, DEMAND

In January, Korea’s headline inflation accelerated 5.2% on-year, mainly driven by a series of hikes in utility bills and the winter cold spell. High energy bills further dampened domestic consumption, making the recovery slow.

The weak demand deepened concerns about the country's economy amid no sign of recovery in exports.

Exports tumbled 16.6% on-year in January, and daily average exports based on the number of working days in the first 10 days of February already dropped 14.5%. The country’s key export item semiconductor shipments plunged by more than 40% for two successive months.

The country added jobs at the slowest pace in 22 months, with 411,000 new jobs. Housing prices last month also dropped 1.49% from a month earlier.

Global uncertainties linger, with no sign of an imminent end to the Russia-Ukraine war and global monetary tightening moves, despite looming expectations for the reopening of China’s economy and a soft landing for the global economy, the finance ministry said.

The Korean government will go all out to reinvigorate the country’s exports and investment while stabilizing consumer prices, it added.

BOK RATE DECISION IN THE SPOTLIGHT

As the government confirmed the slowdown, eyes are on the next rate decisions by the Korean central bank in the coming months.

The Bank of Korea in January raised the policy rate by a quarter point to 3.5% in its seventh consecutive rate hike since April last year. It was the first time that the Korean central bank has delivered seven interest rate hikes in less than a year.

But BOK Governor Rhee Chang-yong on that day signaled a further cut in its economic growth forecast for 2023 just two months after the bank revised it down to 1.7% in November of last year, raising expectations that the central bank may moderate the speed of its rate hikes.

With the government’s latest report on economic trends, expectations could grow that the central bank may withdraw from monetary tightening although economists expect that it is unlikely to happen soon, given the big rate gap between Korea and the US, a trigger to capital flight from Korea.

The Bank of Korea will make this year’s second rate decision on Feb. 23. Some market analysts expect that the bank would keep the rate unchanged after taking cues from recent economic data.

“Exports already reversed direction last year, and then domestic consumption has recently shown signs of faltering,” Lee Seung-han, director of the finance ministry’s economic analysis division, said during a press conference on Friday, adding that the slowdown trend, however, is in line with the ministry’s earlier projection of a recovery in the second half of this year, following the pre-warned slowdown since last year until the first half.

But it remains to be seen whether the Korean economy would bottom out later this year amid lingering uncertainties on the global front.

The state-run think tank Korea Development Institute (KDI) already revised down the country's growth rate to 1.1% from the previous 1.4%, suggesting the country would grapple with a slowdown longer than the government’s expectations.

The country's economic rebound hinges on various external factors, especially any trickle-down effect of China’s economic reopening. If such an effect remains weak, the Korean economy would feel the pinch of the slowdown throughout the year.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EconomyKorean jobs up by 22-month low of 411,000 in Jan, with signs of cooling

EconomyKorean jobs up by 22-month low of 411,000 in Jan, with signs of coolingFeb 15, 2023 (Gmt+09:00)

2 Min read -

EconomyTreasury yield falls signal BOK's looser grip on inflation

EconomyTreasury yield falls signal BOK's looser grip on inflationFeb 13, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s trade outlook dismal in Feb with stagnant exports

EconomyS.Korea’s trade outlook dismal in Feb with stagnant exportsFeb 13, 2023 (Gmt+09:00)

2 Min read -

EconomyKorea’s inflation picks up 5.2% in January on high utility prices

EconomyKorea’s inflation picks up 5.2% in January on high utility pricesFeb 02, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea likely to suffer recession as Jan exports tumble

EconomyS.Korea likely to suffer recession as Jan exports tumbleFeb 01, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN