S.Korea’s top 4 financial holding firms cheer upbeat Q1 results

Shinhan, Hana, Woori and KB have managed to shake off the fallout from last year’s ELS fiasco

By Apr 25, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s top four financial holding companies – Shinhan, KB, Hana and Woori – reported stellar earnings for the first quarter, turning the corner from last year's equity-linked securities (ELS) debacle.

According to regulatory filings by Shinhan Financial Group Co., Hana Financial Group and Woori Financial Group Co. on Friday, the total net profit of the country’s four leading financial holding companies, including KB Financial Group Inc. that reported its results the day earlier, reached 4.93 trillion won ($3.4 billion) in the January-March period, 16.8% higher than the year previous.

That marks a record high for their combined first-quarter results.

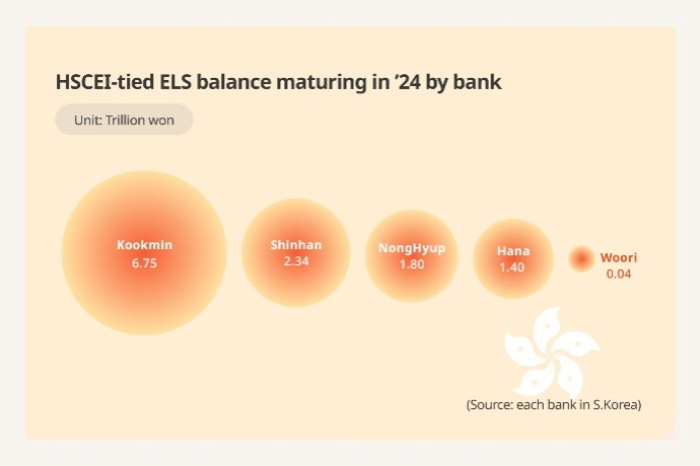

The strong results were largely driven by a plunge in their allowances for losses from investments in the Hang Seng China Enterprises Index (HSCEI)-tied high-risk debt instruments last year.

A year ago, they set aside a total loss provision of 1.32 trillion won to compensate the HSCEI-linked investment losses for retail investors.

Excluding the one-off effect of the reserves, their total net profit, however, decreased 610 billion won over the same period, largely due to a fall in commission fee income from non-banking operations.

INTEREST INCOME ADDS; NON-INTEREST GAIN FALLS

Their combined interest income inched up 2.3% on-year to 10.64 trillion won in the quarter.

But over the same period, their commission fee income declined 5.3% to 2.89 trillion won due to a fall in commission fees from credit card transactions and securities brokerage amid the economic downturn.

Citing the downward trend in non-interest income gains, market analysts warned that Korean financial companies would grapple with deteriorating profitability through this year.

Reflecting the gloomy outlook, the four financial firms saw their net interest margin (NIM), a key measure of banking profitability, contract in the first quarter compared to a year earlier.

KB Financial’s NIM dropped from 2.11% to 2.01% over the period, while Shinhan Financial, Hana Financial and Woori Financial’s NIM fell from 2.0% to 1.91%, from 1.77% to 1.69% and from 1.74% to 1.7%, respectively.

But the country’s mounting household debts and growing concerns about the economy will likely restrain households and businesses from borrowing from financial companies this year, boding ill for financial institutions’ profitability.

In anticipation of higher delinquency rates this year, the four financial firms have already bumped up their loan loss provisions.

Their total allowance for loan losses for the first quarter jumped 26.7% on-year to 1.83 trillion won.

“The biggest challenge we face this year is ensuring financial soundness,” Chun Sang-yung, vice president and chief financial officer of Shinhan Financial, said during an earnings video call on Friday.

KB LEADS THE PACK IN Q1

By company, KB Financial displayed the most robust performance in the first three months of this year.

Its net profit surged 62.9% to 1.69 trillion won from the same period of the previous year after shaking off an 862 billion won allowance set aside for the HSCEI-linked investment losses a year ago.

KB Financial's flagship unit, KB Kookmin Bank, was one of the top sellers of the HSCEI ELS products.

Shinhan Financial posted a net profit of 1.49 trillion won, up 12.6% from a year earlier, while Hana Financial's profit added 9.1% to 1.13 trillion won.

Woori Financial, however, saw its net profit contract 25.2% to 615.6 billion won after it spent 169 billion won on its voluntary retirement program in the first quarter.

Write to Eui-Jin Jeong, Jin-Seong Kim and Hyun-Ju Jang at justjin@hankyung.com

Sookyung Seo edited this article.

-

EarningsKB Financial logs 61% profit growth, rebounding from ELS fiasco

EarningsKB Financial logs 61% profit growth, rebounding from ELS fiascoApr 24, 2025 (Gmt+09:00)

1 Min read -

Shareholder valueHana Financial to boost corporate value by raising shareholder returns

Shareholder valueHana Financial to boost corporate value by raising shareholder returnsFeb 27, 2025 (Gmt+09:00)

2 Min read -

Business & PoliticsWoori Financial CEO Yim Jong-yong should stay for governance: FSS chief

Business & PoliticsWoori Financial CEO Yim Jong-yong should stay for governance: FSS chiefFeb 19, 2025 (Gmt+09:00)

3 Min read -

EarningsShinhan Bank reclaims top spot as S.Korea’s leading lender

EarningsShinhan Bank reclaims top spot as S.Korea’s leading lenderFeb 07, 2025 (Gmt+09:00)

2 Min read -

Korean stock marketKorean banks stop ELS sales after HSCEI debacle

Korean stock marketKorean banks stop ELS sales after HSCEI debacleJan 31, 2024 (Gmt+09:00)

4 Min read -

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELS

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELSJan 22, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS sale

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS saleJan 08, 2024 (Gmt+09:00)

5 Min read