Earnings

LG Energy Q3 profit more than doubles on higher sales; shares jump

LG Energy will cut its capex by reducing investments in new capacity expansions in North America to ease investment losses

By Oct 28, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

LG Energy Solution Ltd., the world’s third-largest battery maker, said its quarterly operating profit more than doubled from the previous three months on the back of higher sales of products for electric vehicles and energy storage systems (ESS). The rosy news, which pushed up its share price, comes despite a prolonged global slowdown in the clean vehicles sector.

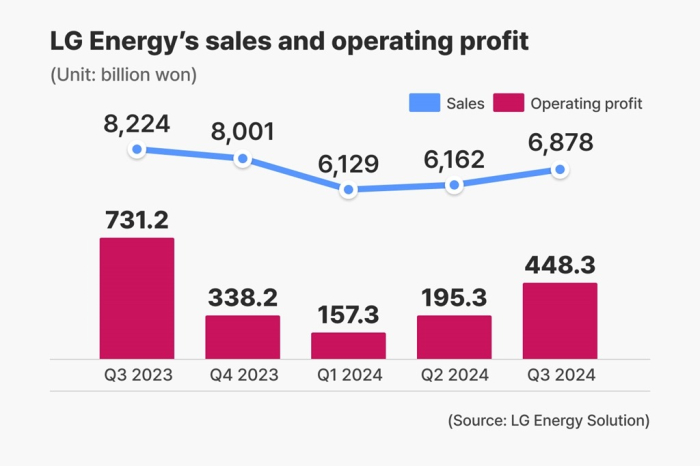

LG Energy on Monday reported an operating profit of 448.3 billion won ($323.6 million) in the third quarter on a consolidated basis, 129.5% higher than 195.3 billion won in the April-June period, with sales up 11.6% on-quarter to 6.9 trillion won.

The South Korean battery maker said its latest quarterly profit fell 38.7% from a year earlier as revenue slid 16.4% over the same period.

Excluding tax benefits under the US Advanced Manufacturing Production Credit (AMPC) program, LG Energy would have logged an operating loss of 17.7 billion won in the third quarter, far smaller than the shortfall of 252.5 billion won.

“We significantly improved profitability compared with the previous quarter as higher shipments of EV and ESS batteries raised overall operating rates, and lower metal prices reduced unit costs,” LG Energy Chief Financial Officer Lee Chang Sil said during an earnings call.

LG Energy’s share price ended up 2.3% to 416,500 won on Korea’s main bourse, far outpacing the Kospi's overall 1.1% gain.

TO CUT CAPEX AMID CAUTIOUS OUTLOOK

The supplier to Tesla Inc., the world’s No. 2 EV maker, plans to cut capital expenditures next year as it offered cautious views on the fourth quarter and 2025 given the protracted slowdown in the eco-friendly car market.

“Sales in the fourth quarter are likely to fall if the prices of raw materials such as lithium fall. It is difficult to improve profitability further in the fourth (quarter) from the third on weaker sales of batteries with high profits,” said an LG Energy official.

“We will be cautious over the next year due to the many uncertainties, even though global automakers plan to launch new EVs.”

Operating rates at LG Energy's battery-making plants in China and the US, the world’s No. 1 and No. 3 EV markets, respectively, are unlikely to improve in the fourth quarter as major automakers are set to cut inventories ahead of the year-end, according to the company.

LG Energy plans to “significantly” reduce investments in new manufacturing facilities next year, Lee said.

“We aim to cut investment losses by reducing new capacity expansion in North America where investments are concentrated and preventing excessive capacities,” said the CFO. “We will optimize asset management and minimize spending on facility investments except for essential ones, in addition to slowing down investments.”

EXPANDS CUSTOMER BASE, PRODUCT PORTFOLIOS

LG Energy is expanding its customer base and product portfolios to recover earnings amid the protracted slowdown in the clean car market.

Earlier this month, the battery unit of Korea’s fourth-largest conglomerate LG Group signed deals to supply batteries exceeding 160 gigawatt-hours (GWh) to German luxury carmaker Mercedes-Benz AG and US automaker Ford Motor Co.

LG Energy aims to recover its EV battery business with the high-end 4680 battery — so named for its 46-millimeter diameter and 80-mm length — mid-priced high-voltage mid-nickel products and cheap lithium iron phosphate (LFP) models.

The company is in talks with EV makers about supplying the 4680 models as its battery plant in Korea is set to launch mass production of samples, said another company official.

The 4680 battery is being heralded as a game-changer in the battery industry. It is known to boost energy density by five times and output by six times compared with the conventional 2170 type and boost EVs' mileage by an average of 16%.

LG Energy is also negotiating with clients seeking large volumes of batteries for electric grids in North America, for long-term supply deals as the ESS market is expected to grow by more than 20% per year on average through 2028.

Write to Hyung-Kyu Kim at khk@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

BatteriesLG Energy to supply batteries for Ford's electric commercial vehicles

BatteriesLG Energy to supply batteries for Ford's electric commercial vehiclesOct 15, 2024 (Gmt+09:00)

3 Min read -

BatteriesLG Energy to supply EV batteries to Mercedes-Benz in N.America

BatteriesLG Energy to supply EV batteries to Mercedes-Benz in N.AmericaOct 08, 2024 (Gmt+09:00)

2 Min read -

BatteriesLG Energy aims to more than double sales to $50 billion by 2028

BatteriesLG Energy aims to more than double sales to $50 billion by 2028Oct 07, 2024 (Gmt+09:00)

4 Min read -

EarningsLG Energy’s Q2 profit hurt by EV slowdown, expects Q4 improvement

EarningsLG Energy’s Q2 profit hurt by EV slowdown, expects Q4 improvementJul 08, 2024 (Gmt+09:00)

3 Min read -

BatteriesLG Energy wins estimated $1 bn ESS battery deal from Qcells

BatteriesLG Energy wins estimated $1 bn ESS battery deal from QcellsMay 17, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN