LG Energy’s Q2 profit hurt by EV slowdown, expects Q4 improvement

LG is switching battery lines to make ESS cells while clinching an LFP deal with Renault to overcome an EV chasm

By Jul 08, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

LG Energy Solution Ltd., one of the world’s top three battery makers, on Monday posted a smaller quarterly profit, hurt by sluggish global electric vehicle (EV) sales.

The South Korean company and industry officials expect an earnings improvement as early as the fourth quarter, however, amid signs of a gradual upswing in EV sales and stabilizing battery raw materials prices.

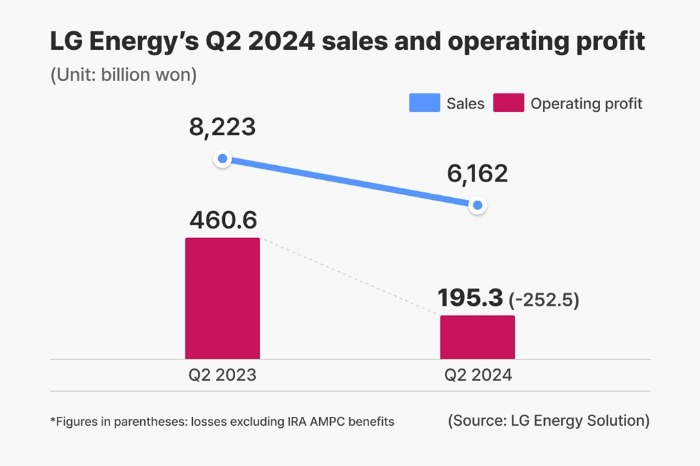

LG’s preliminary operating profit reached 195.3 billion won ($141 million) on a consolidated basis in the second quarter, down 58% from 460.6 billion won in the year-earlier period.

Consolidated sales were 6.16 trillion won, down 30% from 8.77 trillion won a year ago, the company said in a regulatory filing.

LG’s quarterly operating profit and sales rose 24% and 0.5% from the previous quarter, respectively.

The latest operating profit came in below the market consensus of 233.7 billion won.

“A decline in lithium and other metal prices slashed our battery prices, on top of lower battery demand from automakers,” said an LG Energy official.

LG plans to announce finalized second-quarter results, including net profit and divisional performance, later this month.

GAINS FROM US TAX BREAKS

The April-to-June quarter results showed LG earned 447.8 billion won in tax breaks under the US Inflation Reduction Act (IRA), which took effect last year.

Were it not for the US tax benefits, LG would have posted an operating loss of 252.5 billion won in the second quarter, worse than the first quarter’s loss of 31.6 billion won excluding US tax breaks extended to battery firms under the Advanced Manufacturing Production Credit (AMPC) program.

Under the AMPC program, eligible battery makers can receive tax benefits, including a $35 tax credit per 1 kilowatt-hour produced by a battery cell and a $10 tax credit per 1 kWh battery module manufactured in North America.

LG is one of the major beneficiaries of the IRA and AMPC programs because the company has the largest battery manufacturing capacity in the US among global battery players.

Last year, LG Energy collected 676.8 billion won in such benefits, about a third of its total operating profit.

Industry watchers said LG will likely witness a sales decline this year, weighed down by its weak performance in Europe.

The company is expected to post about 30 trillion won in sales this year, down from 33.7 trillion won in 2023.

‘EV CHASM’

Battery makers are suffering from a slower-than-expected global EV uptake, dubbed a “chasm," amid insufficient charging infrastructure and other inconveniences related to EV driving.

Last month, LG Energy said it would suspend the construction of a battery plant in Arizona, citing weak demand.

The company, however, said it is proactively responding to an EV slowdown by switching some of its EV battery facilities to instead produce energy storage system (ESS) batteries.

LG is also ramping up the production of low-cost LFP, or lithium ion phosphate batteries, for which demand is growing from Tesla Inc. and other EV makers.

Earlier this month, the company said it had signed a deal to supply LFP battery cells to France’s Renault Group for use in low-end electric cars made by Renault’s EV unit Ampere.

Under the five-year contract, LG will provide LFP batteries to Ampere from late 2025 through 2030, with a total capacity of some 39 GWh — enough to supply 590,000 EVs.

The deal’s value wasn’t known, but industry watchers said it would be in the trillions of won, or multi-billion dollars.

Korea’s three major battery makers — LG Energy, SK On Co. and Samsung SDI Co. — have focused on expensive nickel-cobalt-manganese (NCM) cells. But they are now shifting gears to produce low-end LFP cells on growing demand.

LFP batteries have so far been made by Chinese companies, including Contemporary Amperex Technology Co. Ltd. (CATL), the world’s top battery maker, and BYD Co.

LG is also an active battery player in the US, where it operates its own battery plants as well as a joint venture, Ultium Cells LLC, with General Motors.

Write to Hyung-Kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

-

BatteriesLG Energy signs multi-billion-dollar LFP battery deal with Renault

BatteriesLG Energy signs multi-billion-dollar LFP battery deal with RenaultJul 02, 2024 (Gmt+09:00)

3 Min read -

BatteriesTime to revive innovator spirit: LG Energy Solution CEO

BatteriesTime to revive innovator spirit: LG Energy Solution CEOJul 04, 2024 (Gmt+09:00)

3 Min read -

BatteriesLG Energy halts Arizona battery plant building on weak EV sector

BatteriesLG Energy halts Arizona battery plant building on weak EV sectorJun 28, 2024 (Gmt+09:00)

2 Min read -

RegulationsLG Energy vows to get tough on battery patent infringement cases

RegulationsLG Energy vows to get tough on battery patent infringement casesApr 24, 2024 (Gmt+09:00)

4 Min read -

BatteriesLG Energy, GM’s 2nd Ultium Cells plant begins production in Tennessee

BatteriesLG Energy, GM’s 2nd Ultium Cells plant begins production in TennesseeApr 02, 2024 (Gmt+09:00)

2 Min read -

BatteriesLG Energy to produce 4680 batteries in August for Tesla, others: CEO

BatteriesLG Energy to produce 4680 batteries in August for Tesla, others: CEOFeb 15, 2024 (Gmt+09:00)

4 Min read -

BatteriesLG Energy to supply $748 million worth of batteries to Japan’s Isuzu Motors

BatteriesLG Energy to supply $748 million worth of batteries to Japan’s Isuzu MotorsJan 26, 2024 (Gmt+09:00)

1 Min read