Earnings

Lotte Chemical projects recovery in Q2 after 4th consecutive loss in Q1

Its operating loss stood at $19.7 mn in Q1, but its aggressive battery materials expansion is set to prop up its business overall

By May 11, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Lotte Chemical Corp. suffered its fourth consecutive operating loss in the first quarter due to a prolonged petrochemical slowdown amid the global economic downturn but its bet on battery materials is expected to rescue it in the second quarter, the company said on Thursday.

The South Korean petrochemical major swung to a consolidated operating loss of 26.2 billion won ($19.7 million) in the January-March period from a 56.5 billion won profit in the same period last year, the company said in a regulatory filing.

It was the fourth straight quarterly loss since the second quarter of last year but narrower than the 416.3 billion won loss the previous quarter.

Sales in the first quarter shrank 9.5% on-year to 4.9 trillion won, while net profit nearly doubled to 226.7 billion won.

Lotte Chemical, however, projects a turnaround for the current second quarter as the petrochemical industry is entering its peak season, which is expected to shore up its profitability, the company said.

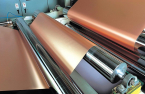

It also pictures a rosy outlook for its battery materials business given its takeover of the world’s fourth-largest copper foil producer Iljin Materials Co. last year.

BATTERY MATERIALS BUSINESS TO LEAD TURNAROUND

With the copper foil producer, now renamed Lotte Energy Materials Co., now under its wings, the company has revised up its rechargeable battery materials sales target for 2030 to about 7 trillion won from the initial 5 trillion won.

“We have revised up the sales contribution from the battery materials business to the total sales target of our new growth drivers for 2030,” Kim Min-woo, head of Lotter Chemical’s strategy and planning division, said during an earnings call on Thursday.

Lotte Chemical is expected to complete the addition of its local battery organic solvent production facilities in the second half of this year and the first half of next year in phases, Kim added.

The company is currently reviewing not only the US but also other regions for facility expansion, said Kim, adding that the construction of a cathode foil plant in the US is underway without delay.

The company is also exploring various opportunities in the cathode and anode businesses, he said.

The earnings of Lotte Energy Materials will be reflected from the second quarter, according to the parent company.

Lotte Chemical’s capital expenditures for this year are set at 6.4 trillion won, and of which 2.9 trillion won was already spent, including 2.4 trillion won paid to complete the acquisition of Lotte Energy Materials, the company said. It has earmarked 3.8 trillion won for new facility expansion and other investments.

Its Basic Chemical division overseeing olefin and aromatics production reported 28.5 billion won in operating profit in the first quarter on sales of 2.7 trillion won thanks to stable raw materials prices and improved market conditions in anticipation of a recovery in the Chinese economy.

Advanced Materials earned 45.5 billion won in operating income on sales of 1 trillion won after stabilized raw materials and sea freight costs more than offset the drop in product prices.

Write to Mi-Sun Kang at misunny@hankyung.com

Sookyung Seo edited this article.

More to Read

-

PetrochemicalsLotte Chem to sell Pakistan unit for $156 mn to finance other projects

PetrochemicalsLotte Chem to sell Pakistan unit for $156 mn to finance other projectsJan 16, 2023 (Gmt+09:00)

2 Min read -

Korean Innovators at CES 2023Lotte Chem to raise sales 65% with more advanced materials

Korean Innovators at CES 2023Lotte Chem to raise sales 65% with more advanced materialsJan 09, 2023 (Gmt+09:00)

2 Min read -

EarningsLotte Chemical posts deficit for second straight quarter

EarningsLotte Chemical posts deficit for second straight quarterNov 09, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsLotte Chemical, Bain Capital among bidders for Korea’s Iljin Materials

Mergers & AcquisitionsLotte Chemical, Bain Capital among bidders for Korea’s Iljin MaterialsJul 01, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN