Lotte Chemical, Bain Capital among bidders for Korea’s Iljin Materials

Despite interest from global private funds, the sale seems to be losing steam as big spenders' interest wanes amid the weak market

By Jul 01, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The much-touted sale of a controlling stake in Iljin Materials Co., a leading South Korean battery materials maker, is flagging as big spenders are showing less interest amid the weak local stock market.

According to investment banking sources on Friday, Lotte Chemical Corp., US private investment firm Bain Capital and a few unidentified strategic investors are among the initial bidders for a 53.3% Iljin Materials stake up for grabs.

Citigroup Global Markets, which is handling the stake sale, is expected to reveal short-listed contenders as early as next week with a view to choosing the final buyer by August, the sources said.

The sale of Iljin Materials had been touted as one of this year’s biggest deals in the Korean M&A market until recently, but interest is waning as big Korean companies related to the battery materials business are said to have dropped their bids due to funding difficulties amid weak economic conditions, according to the people.

Shares of Iljin Materials were hovering around 93,900 won in late May when news of the stake sale was known to the market, but the stock has fallen 27% since then to close at 68,500 won on Friday.

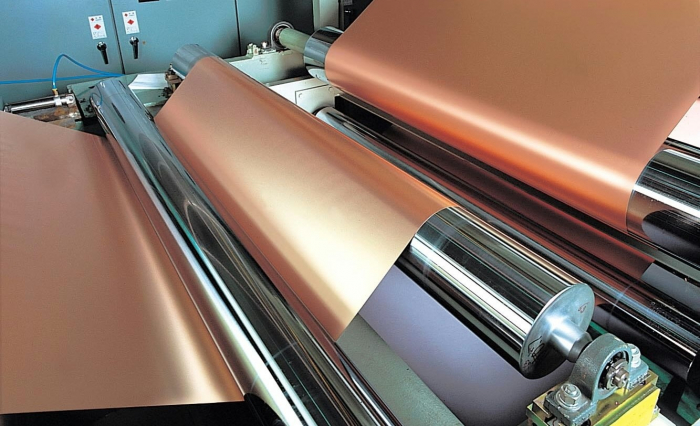

Iljin, the maker of elecfoil, a thin copper foil used for cathode collectors in rechargeable lithium batteries, hopes to sell the company’s management rights including a 53.3% stake held by its Chief Executive Heo Jae-Myeong, the second son of the parent Iljin Group’s founder and Chairman Heo Jin-gyu.

MAY END UP WITH WEAKER PROCEEDS

Industry officials said CEO Heo wants to fetch around 3 trillion won ($2.4 billion) from the sale of his stake, but he may end up with less money given weakening interest in the company.

Based on Friday’s closing price, the company’s entire enterprise value stands at 3.16 trillion won.

Lotte Chemical, one of the strong contenders, earlier said it plans to invest 4 trillion won in the battery materials business by 2030. Lotte, via its affiliate Lotte Fine Chemical Co., has already invested 300 billion won in another battery materials firm Solus Advanced Materials Co.

“Iljin is a good company but it may be coming on the block at a bad time. The buyer and the seller may find it hard to reach a deal,” said an industry official.

The global elecfoil market is forecast to grow rapidly to 1.5 million tons by 2025 from 300,000 tons in 2020, according to industry estimates.

MARKET RUMORS

Iljin’s majority stake sale plan, made public last month, sparked various market chatter, including talk of a family feud, as the company had been expanding its business in Korea and abroad.

The company said in May it plans to build a 500 billion won battery materials plant in Spain, its first production base in Europe, as part of a Volkswagen Group-led 70 billion-euro ($73 billion) project to turn Spain into a European EV hub.

While some industry watchers said the CEO put his stake up for sale amid a family dispute over management control, others said the expected huge facility investment required on a continuous basis might have forced the owner of the mid-sized company to sell the electfoil business and pursue another business with the proceeds.

Iljin’s recent deal with Samsung SDI Co. could raise the company’s enterprise value ahead of the stake sale.

Last week, Samsung, one of Korea’s leading battery makers, said it has clinched an 8.5 trillion won deal to secure 60% of its elecfoil needs from Iljin until 2030.

Write to Chae-Yeon Kim, Jun-Ho Cha and Si-Eun Park at Why29@hankyung.com

In-Soo Nam edited this article.

-

BatteriesPOSCO Chemical, Britishvolt sign initial deal for battery materials

BatteriesPOSCO Chemical, Britishvolt sign initial deal for battery materialsJun 30, 2022 (Gmt+09:00)

1 Min read -

BatteriesSamsung SDI inks $6.6 bn deal for 60% of elecfoil needs

BatteriesSamsung SDI inks $6.6 bn deal for 60% of elecfoil needsJun 24, 2022 (Gmt+09:00)

2 Min read -

BatteriesPOSCO, SK On forge strategic tie-up in rechargeable battery business

BatteriesPOSCO, SK On forge strategic tie-up in rechargeable battery businessJun 16, 2022 (Gmt+09:00)

1 Min read -

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JV

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JVJun 02, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsIljin Materials aims to complete stake sale in August

Mergers & AcquisitionsIljin Materials aims to complete stake sale in AugustMay 30, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsWhy Iljin Materials' CEO has put a majority stake up for sale

Mergers & AcquisitionsWhy Iljin Materials' CEO has put a majority stake up for saleMay 24, 2022 (Gmt+09:00)

3 Min read -

BatteriesKorea’s Iljin to build $391 mn battery materials plant in Spain

BatteriesKorea’s Iljin to build $391 mn battery materials plant in SpainMay 17, 2022 (Gmt+09:00)

1 Min read