Earnings

SK Innovation’s battery sales at record high, production yield improved

SK On’s first talk of battery output efficiency shows its confidence in product quality, analysts say

By May 04, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Innovation Co. said on Thursday its battery affiliate SK On Co. posted record quarterly sales following a facility ramp-up in the US to meet rising demand from electric vehicle makers.

SK On has also seen a meaningful improvement in its battery manufacturing efficiency, or production yields, contributing to enhanced profitability and product quality, the company said.

SK On, spun off from its parent SK Innovation last year, posted its largest revenue of 3.3 trillion won ($2.5 billion) in the three months that ended on March 31, up 429.7 billion won from the previous quarter.

The company attributed its sales growth to the start of its second battery factory in the US state of Georgia late last year.

The battery business, however, posted a quarterly operating loss of 344.7 billion won in the first quarter after reflecting higher one-off charges, including employee bonuses and a brief suspension of its US plant related to batteries supplied to Ford Motor Co., it said.

Company executives said while its battery business remains in the red, its production efficiency at new factories has improved, meaning fewer defects in battery cells.

FIRST TALK OF PRODUCTION YIELDS IN PUBLIC

“Our overall battery plant manufacturing yield in the first quarter has improved compared to the previous quarter. We’ll continue to make efforts to enhance our production efficiency, which will result in higher profitability,” SK On’s Chief Financial Officer Kim Kyung-hoon said on a conference call with analysts after its earnings announcement.

SK On said its improved battery production yield contributed 57.7 billion won in profit to its parent SK Innovation’s overall operating profit.

Industry officials said it is the first time SK On has publicly discussed its battery production efficiency.

The company has been plagued by relatively low manufacturing yields at its plants in Georgia and Hungary.

In early February, SK briefly halted a battery production line at its Georgia plant after Ford’s electric pickup F-150 Lightning caught on fire while conducting pre-delivery quality checks. SK resumed operations of the production line in late February.

SK On supplies battery cells to Ford, Volkswagen AG and Hyundai Motor Co.

SK has been aggressively expanding battery facilities worldwide, with an aim to emerge as one of the top three players.

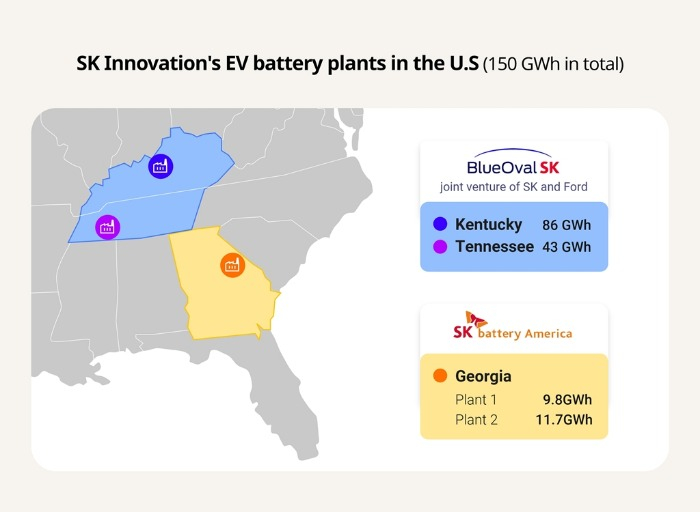

In September 2021, SK Innovation said it and its US partner Ford will spend a combined $11.4 billion to build battery plants in Tennessee and Kentucky through their joint venture BlueOval SK.

Last November, SK also said it is building a 2.5 trillion won battery plant with Hyundai Motor in Georgia.

CFO Kim said he expects SK On’s profit to improve in the second quarter as it plans to reflect the US tax credits in its earnings.

Under the Inflation Reduction Act, eligible battery makers can receive tax benefits, known as the advanced manufacturing production credit (AMPC), which includes a $35 tax credit per 1 kilowatt-hour produced by a battery cell and a $45 tax credit per 1 kWh battery module manufactured in North America.

CHINA REOPENING TO BOOST REFINING BUSINESS

SK Innovation, which owns Korea’s top oil refiner SK Energy Co., said its first-quarter sales increased 17.7% year on-year to 19.14 trillion won, while its operating profit declined 77.3% to 375 billion won in the same period. But it swung from an operating loss of 764.9 billion won in the previous quarter.

Its first-quarter petroleum chemical business was helped by higher refining margins and improved profit spread of its paraxylene (PX) products, it said.

SK Innovation said its “solid” refining margins are set to continue in the second quarter thanks to China’s reopening and the start of the summer driving season.

Write to Hyung-Kyu Kim and Nan-Sae Bin at khk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesSK On to spend $352 million to mass produce solid-state batteries by 2028

BatteriesSK On to spend $352 million to mass produce solid-state batteries by 2028Apr 24, 2023 (Gmt+09:00)

2 Min read -

Future mobilitySK Innovation invests an extra $50 million in US clean energy firm Amogy

Future mobilitySK Innovation invests an extra $50 million in US clean energy firm AmogyMar 23, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK On resumes Ford F-150 Lightning battery production line

BatteriesSK On resumes Ford F-150 Lightning battery production lineFeb 21, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK On-Ford Motor EV battery joint venture breaks ground in Kentucky

BatteriesSK On-Ford Motor EV battery joint venture breaks ground in KentuckyDec 06, 2022 (Gmt+09:00)

3 Min read -

BatteriesSK Innovation, Ford to invest $11.4 billion to build largest EV battery JV

BatteriesSK Innovation, Ford to invest $11.4 billion to build largest EV battery JVSep 28, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN