Korean listed firmsŌĆÖ Q4 results miss forecast by big margin

South Korean companies are expected to grapple with weak earnings until the first quarter in 2023

By Feb 10, 2023 (Gmt+09:00)

Macquarie Korea Asset Management confirms two nominees

Deutsche Bank's Korea IB head quits after country head resigns

S.Korea's LS Materials set to boost earnings ahead of IPO process

Hanwha buys SŌĆÖpore Dyna-MacŌĆÖs stake for $73.8 mn from Keppel

Netmarble sells stake in BTS label HYBE stake for $161 mn

Weak demand from a global economic slump took a big toll on South Korean companies in the fourth quarter of last year, making many of them miss earnings projections by a big margin and raising concerns about their earnings in the first quarter of this year.

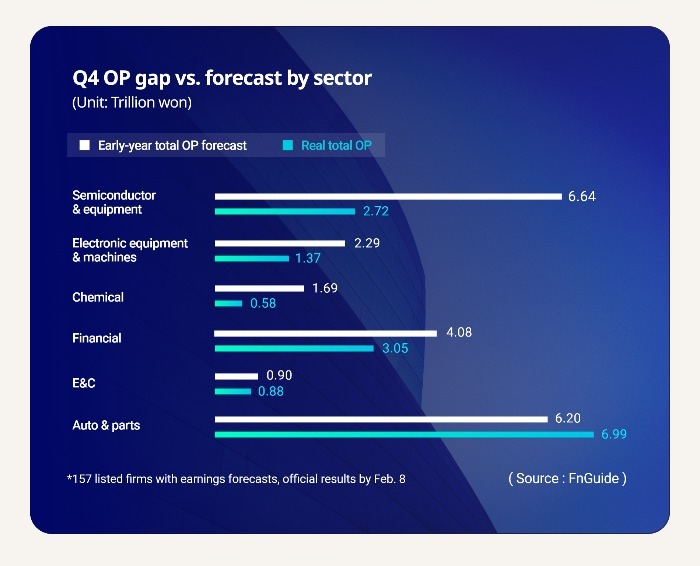

According to Seoul-based financial information service company FnGuide on Thursday, 157 companies listed on the Kospi and Kosdaq markets reported a combined operating profit of 20.18 trillion won ($15.9 billion) for the last three months of 2022 as of Feb. 8. This is 37.5% smaller than an earlier forecast of 32.30 trillion won.

The total operating profit of 156 firms without bellwether Samsung Electronics Co. reached 15.87 trillion won, down 36.7%.

Nearly half of them, or 85 firms, reported an earnings shock for the fourth-quarter operating profit. The number of companies that missed the forecast by 10% and more stood at 71, and of which 23 reported more than 50% less profit than forecast, and 14 swung to losses despite profit projections.

Earnings that come below estimates by 10% and more are considered an earnings shock.

CHEMICAL, CHIP, STEEL HIT HARDEST

By sector, chemical, semiconductor and steel companies in the economy-sensitive cyclical industries suffered the most. The combined operating income of 12 companies in the chemical industry came at 580.5 billion won, sharply below the early projection of 1.69 trillion won.

They took a hard hit from the lengthy city and town lockdowns in China last year due to BeijingŌĆÖs strict zero Covid policy and repeated strikes by trucker unions in Korea, said Choi Go-woon, an analyst at Korea Investment & Securities Co.

The total operating profit for 13 companies in the semiconductor sector including Samsung Electronics reached 2.72 trillion won, off 59% from the forecast.

POSCO Holdings Inc. and Hyundai Steel Co. were expected to post profits in the fourth quarter but each reported an operating loss of 425.4 billion won and 275.9 billion won.

On the contrary, auto, auto parts and engineering & construction companies fared better than expected, with nine companies in the automotive sector reporting 6.99 trillion won in operating profit, above the projection.

Q1 REMAINS GLOOMY

The countryŌĆÖs stock market has so far bucked the earnings trend since early this year, with the Kospi and Kosdaq climbing 11.5% and 16.8%, respectively, from the first trading day of this year.

The strong move lifted the KospiŌĆÖs 12-month forward price-to-earnings (PER) ratio to 12.5 times, similar to the level seen in 2021 when the Kospi was traded in the 3,200-3,300 range. The Kospi traded in the low 2,400 level on Friday.

Market analysts present a gloomy outlook for corporate earnings this year.

According to FnGuide, this yearŌĆÖs operating profit for 246 listed Korean firms is estimated at 17.18 trillion won, down from the previous projection of 19.4 trillion won.

Korean companiesŌĆÖ earnings are expected to remain weak until the first quarter of this year, said Kim Min-kyu, an analyst at KB Securities Co., adding that they are expected to recover in the middle of the second quarter, around April or May.

Write to Tae-ung Bae at btu104@hankyung.com

Sookyung Seo edited this article.

-

-

Korean stock marketKorean stocks with healthy earnings to shine in H2 2023

Korean stock marketKorean stocks with healthy earnings to shine in H2 2023Dec 15, 2022 (Gmt+09:00)

4 Min read -

EarningsSouth Korea's listed companies suffer 26% drop in operating profit in Q3

EarningsSouth Korea's listed companies suffer 26% drop in operating profit in Q3Nov 17, 2022 (Gmt+09:00)

1 Min read