S.Korea's dawn delivery pioneer Kurly sells luxury goods to uplift profit

South Korea’s grocery dawn delivery pioneer bets on item diversification for better profit as it girds up to re-attempt an IPO

By Dec 20, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Kurly Inc., South Korea's dawn delivery service market pioneer, has invited a third-party online retailer to sell luxury goods on its platform to boost profit after years of posting losses to gird up for its much-delayed initial public offering.

This is the first time for the Korean e-commerce startup to sell luxury fashion items through its platform, which started as an online gourmet food and fresh produce shopping site.

The addition of luxury fashion items to its platform is deemed as Kurly’s effort to halt its losses and bump up profit and valuation before its much-awaited IPO.

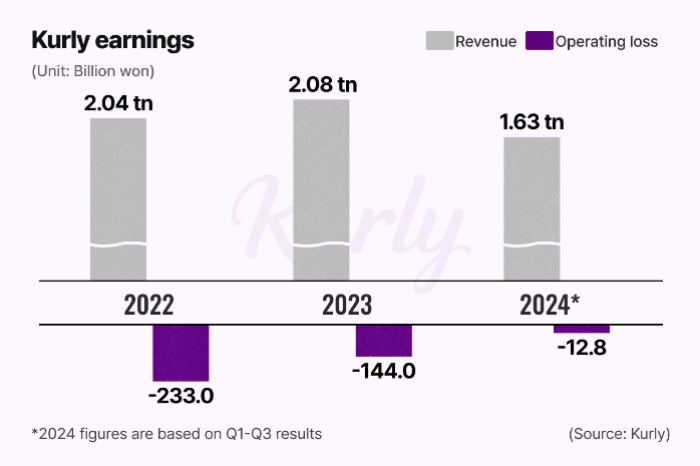

Kurly logged 12.8 billion won in consolidated operating loss in the first nine months of this year, and its enterprise valuation has shrunken sharply from its peak of 4 trillion won in December 2021 when it raised funding from Anchor Equity Partners (Anchor PE).

In May 2023, its value nearly halved to 2.5 trillion won when it raised 120 billion won in pre-IPO funding from Anchor PE and Aspex Management Ltd.

Anchor PE is the largest shareholder in Kurly with a 13.5% stake as of November 2024. Its other backers include DST Global, Sequoia Capital China and Aspex Management, as well as some Korea-based strategic investors such as CJ Logistics and SK Networks.

In 2022, Kurly got the preliminary nod from the Korea Exchange for its IPO but put off its listing in January of last year after its valuation nosedived amid the languid stock market.

It has been looking to re-attempt the listing since early this year.

UPLIFTING VALUATION VIA PRODUCT DIVERSIFICATION

To improve its profit, Kurly has been seeking to diversify the products it sells through its platform Kurly, formerly Market Kurly.

The company began selling cosmetics products through its platform in 2017 and added cosmetics manufacturing and sales to its business purpose by changing its corporate articles in 2022.

Its cosmetics sales have generated steady revenue since then.

Encouraged by the brisk beauty product sales, the company changed the platform name from Market Kurly to Kurly in late 2022 to expand its business scope.

Since then, it has added more fashion and living goods to sell on its platform and started investing more actively in fashion and living items.

According to Kurly, its fashion item sales from January to November this year nearly quadrupled from the same period last year.

The company attributed the addition of brands favored by women in their 30s and 40s, who are Kurly’s key customers, to a jump in its fashion item sales.

“We have seen positive responses from our customers to products from brands that are hard to find on other marketplaces,” said an official from Kurly.

“As women are highly interested in luxury fashion in general, we will cherry-pick international (high-end) brands and products to introduce them through our platform.”

Kurly also plans to sell other popular non-grocery or beauty products to beef up profit.

Founded in 2014, the unicorn startup garnered market attention with its early morning delivery service under the Market Kurly brand, which delivers products by 7 a.m. the next day if customers order before 11 p.m. the night before.

The online grocery platform has been mired in cumulative losses due to its heavy investments to build cold-chain logistics centers for fresh produce. Further, sales growth led to an increase in variable costs related to transportation and packaging.

(Correction: An earlier version of this story incorrectly named one of Kurly's shareholders as Aspect Capital. The shareholder’s name is Aspex Management.)

Write to Hyun-jin Ra at raraland@hankyung.com

Sookyung Seo edited this article.

-

-

-

Corporate strategyMarket Kurly drops Market from platform name to expand business scope

Corporate strategyMarket Kurly drops Market from platform name to expand business scopeNov 02, 2022 (Gmt+09:00)

1 Min read -

-