Corporate strategy

Doosan Bobcat unveils massive corporate value-up plans

The bolstered shareholder return policy comes after its attempt to merge with Doosan Robotics fell through

By Dec 17, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Doosan Bobcat Inc., a global construction machinery maker owned by South Korea’s Doosan Group, has unveiled massive corporate value-up measures, including a higher shareholder return ratio, a more frequent dividend payout and a share buyback and cancellation.

The move is part of a value-enhancement plan introduced to appease shareholders after its attempt to merge with Doosan Robotics Inc. failed following its spin-off from Doosan Enerbility Co.

Doosan Bobcat on Monday announced plans to raise its total shareholder return (TSR) ratio and dividends to industry-leading levels and buy back treasury shares worth 200 billion won ($139 million) for cancellation.

The company has set a TSR ratio target of 40% for this year, exceeding the domestic industry and manufacturing sector average. Last year, Doosan Bobcat’s shareholder return ratio stood at 17%.

TSR is a measure of financial performance, indicating the total amount an investor reaps from an investment – specifically, equities or shares of stock.

It is calculated by combining the amount spent on dividends and share buybacks and cancellations, divided by net income. TSR is a critical metric for stock investors.

BOLSTERED SHAREHOLDER RETURN POLICY

Starting this year, the company plans to pay a minimum dividend of 1,600 won per share. In 2022 and last year, the company paid 1,350 won and 1,600 won in dividends, respectively.

“Last year’s dividend was the highest since the company went public. We aim to maintain or exceed this level consistently,” said a company official.

The company said it will increase the frequency of its dividend payout from twice a year to a quarterly dividend payment system.

Starting in the first quarter of 2025, the company will pay 400 won per share at the end of each quarter through the third quarter. The year-end dividend for the fourth quarter will be a minimum of 400 won per share, it said.

Depending on the shareholder return ratio and market conditions, it said additional dividends or share buybacks are possible.

As part of a special shareholder return initiative, Doosan Bobcat will implement a share buyback and cancellation worth 200 billion won this month.

To back up its bolstered shareholder return policy, Bobcat said it aims to increase its sales revenue by an average of 12% annually through 2030.

If successful, its sales would rise to 16 trillion won in 2030 from an estimated 8.24 trillion won this year, it said.

“We aim to enhance corporate value through higher shareholder returns and business growth. We also plan to achieve revenue growth through M&As and technological innovation,” said a company executive.

ALIGN PARTNERS’ REQUEST

In October, Align Partners Capital Management Inc., a Korean activist fund, called on Doosan Bobcat to implement measures to boost its shareholder value, saying that Doosan Bobcat’s corporate value is significantly lower than its fundamentals.

A minority shareholder of Doosan Bobcat with a 1% stake in the machinery maker, Align Partners sent a letter to Doosan Bobcat’s management requesting to increase shareholder returns, including higher dividends, and sell non-core assets.

In July, Doosan Corp. the conglomerate’s holding company, pushed for corporate restructuring that involved Doosan Enerbility, a power plant engineering affiliate, handing over its entire 46.06% stake in Doosan Bobcat, a group cash cow, to loss-making Doosan Robotics.

The group, however, scrapped the plan in August amid opposition from investors and Korea’s financial watchdog agency, the Financial Supervisory Service.

The conglomerate pushed the merger again but failed to bear fruit after President Yoo Suk Yeol’s failed martial law attempt pummeled the country’s financial markets.

Doosan Bobcat manufactures construction equipment such as compact excavators, tractors, forklifts and skid-steer loaders and sells them under the Bobcat brand around the globe.

Doosan Group acquired Bobcat from US-based industrial equipment company Ingersoll Rand for $4.9 billion in 2007 — the conglomerate’s largest overseas acquisition at the time.

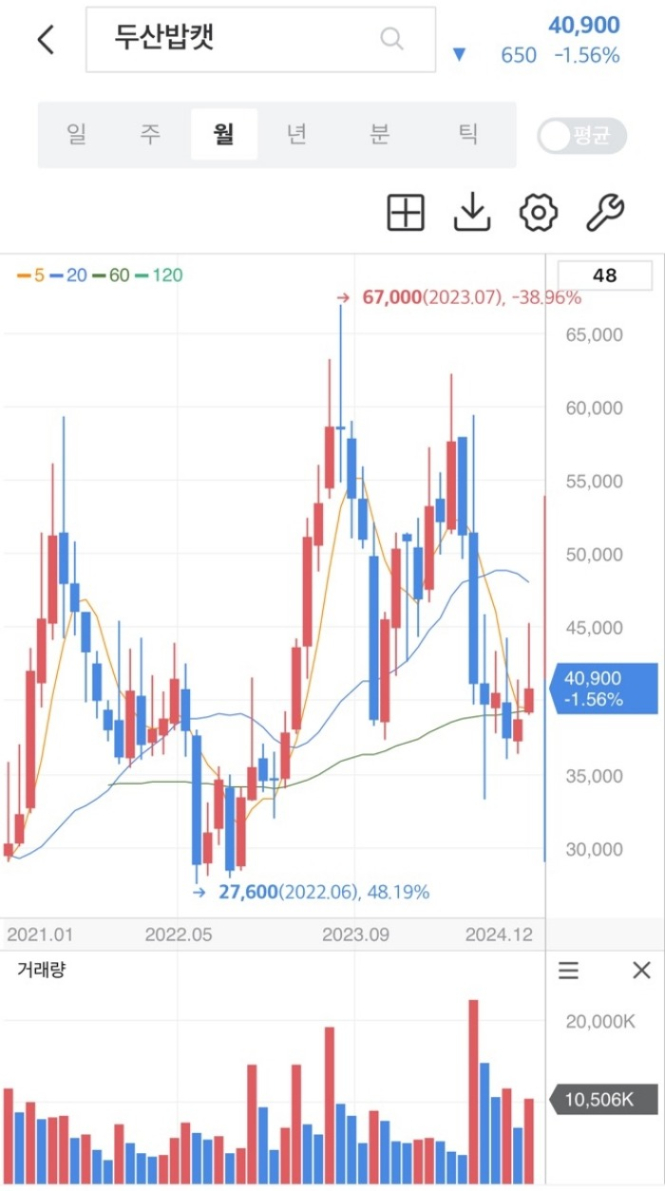

In early Tuesday trade in Seoul, shares of Doosan Bobcat were up 0.7% at 41,850 won, outperforming the broader Kospi index’s 0.7% fall.

The stock closed 3.2% lower on Monday.

Write to Woo-Sub Kim at duter@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Corporate restructuringDoosan Robotics’ merger with Bobcat fails on share price plunge

Corporate restructuringDoosan Robotics’ merger with Bobcat fails on share price plungeDec 10, 2024 (Gmt+09:00)

2 Min read -

Shareholder activismAlign Partners calls on Doosan Bobcat to boost shareholder value

Shareholder activismAlign Partners calls on Doosan Bobcat to boost shareholder valueOct 18, 2024 (Gmt+09:00)

2 Min read -

Corporate restructuringDoosan Robotics to delist, wholly own cash-cow Doosan Bobcat

Corporate restructuringDoosan Robotics to delist, wholly own cash-cow Doosan BobcatJul 11, 2024 (Gmt+09:00)

3 Min read -

MachineryHyundai Infracore, Doosan Bobcat agree to product cross-selling in US

MachineryHyundai Infracore, Doosan Bobcat agree to product cross-selling in USMay 23, 2024 (Gmt+09:00)

2 Min read -

MachineryDoosan forklifts to be sold under Bobcat brand in US, eventually to Europe

MachineryDoosan forklifts to be sold under Bobcat brand in US, eventually to EuropeJul 05, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN