Doosan Robotics’ merger with Bobcat fails on share price plunge

Bobcat was supposed to be spun off from Doosan Enerbility, and then taken over by Robotics

By Dec 10, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Doosan Group on Tuesday canceled Doosan Bobcat Co.'s merger with Doosan Robotics Inc. again after President Yoo Suk Yeol’s failed martial law attempt pummeled South Korean financial markets, particularly nuclear energy stocks, on increased uncertainty about the country's nuclear energy policy.

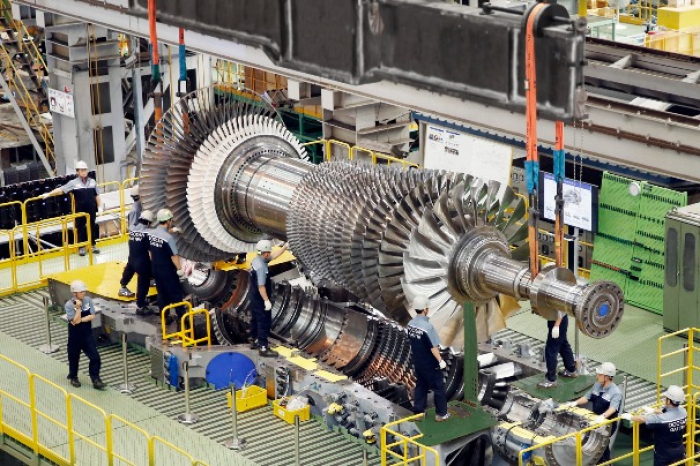

The botched merger thwarts Doosan Enerbility Co.'s plan to reduce debt and attract fresh capital to prepare for a boom in the nuclear power market buoyed by Yoon's ambition to grow the country's nuclear power industry.

Bobcat was supposed to be spun off from Enerbility, its largest shareholder with a 46% stake, and then be taken over by Robotics. Through the deal, Enerbility planned to transfer Bobcat's 700 billion won ($490 million) in debt to Robotics.

But a plunge in the share prices of Enerbility and Robotics below their buyback prices led to an increasing number of shareholders turning their backs on the deal and requesting share repurchases, said the two companies in regulatory filings.

“Due to unexpected changes in the external environment ... the stock prices of the companies involved in the spin-off and merger have fallen sharply in a short period, significantly widening the gap between the stock prices and the buyback prices,” Enerbility said in a filing.

“It seems almost certain the number of shareholders exercising buyback rights will exceed our projections,” it added.

Doosan Robotics’ share price plunged 9.06% to end at 52,200 won, far below its buyback price of 80,472 won per share. It marked its lowest finish since late November 2023.

Shares in Doosan Enerbility edged down 1.15% to close at 17,180 won, lower than its buyback at 20,890 won per share. It was heavily sold off after Yoon's martial law declaration was repealed by parliament a few hours later.

Doosan Corp. and its stakeholders own 30.67% of Enerbility. Including the National Pension Service's 6.85% stake, foreign and minority shareholders hold 64.56% of Enerbility's outstanding shares.

In comparison, Bobcat closed up 1.5% at 43,200 won, with the broader Kospi index up 2.43% at 2,417,84.

If buyback requests exceed 4.5% of Enerbility's outstanding shares, they would surpass 600 billion won ($420 million), the maximum amount the company earmarked for share repurchases.

"For Doosan, which resumed the merger process after scrapping it due to opposition from the Financial Supervisory Service in July, the martial law decree is like a thunderstorm," said a nuclear industry official.

The merger met with a strong backlash from shareholders, who argued that the merger between loss-making Robotics and cash cow Bobcat failed to properly reflect the latter’s enterprise value and would hurt minority shareholders’ interests.

After the deal's twists and turns, Doosan finally cleared a regulatory hurdle after revising the merger ratio in favor of minority shareholders.

A spin-off of Enerbility, which owns Bobcat, was planned to be merged into Robotics at a ratio of 1:0043, up from the previously proposed 1:0031 ratio.

Write to Hyung-Kyu Kim at khk@hankyung.com

Yeonhee Kim edited this article.

-

Corporate restructuringNPS steps back from Doosan Robotics' Bobcat merger

Corporate restructuringNPS steps back from Doosan Robotics' Bobcat mergerDec 09, 2024 (Gmt+09:00)

2 Min read -

Corporate restructuringDoosan to resume Bobcat, Robotics merger with new ratio

Corporate restructuringDoosan to resume Bobcat, Robotics merger with new ratioOct 21, 2024 (Gmt+09:00)

3 Min read -

Shareholder activismAlign Partners calls on Doosan Bobcat to boost shareholder value

Shareholder activismAlign Partners calls on Doosan Bobcat to boost shareholder valueOct 18, 2024 (Gmt+09:00)

2 Min read -

-

Mergers & AcquisitionsDoosan Bobcat scraps merger with Doosan Robotics

Mergers & AcquisitionsDoosan Bobcat scraps merger with Doosan RoboticsAug 29, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsDoosan Robotics, Bobcat ordered to clarify merger deal

Mergers & AcquisitionsDoosan Robotics, Bobcat ordered to clarify merger dealJul 26, 2024 (Gmt+09:00)

3 Min read -

Corporate restructuringDoosan Robotics, Bobcat merger prompts call for law revision

Corporate restructuringDoosan Robotics, Bobcat merger prompts call for law revisionJul 22, 2024 (Gmt+09:00)

3 Min read -

Corporate restructuringDoosan Robotics to merge with Doosan Bobcat by early 2025

Corporate restructuringDoosan Robotics to merge with Doosan Bobcat by early 2025Jul 21, 2024 (Gmt+09:00)

3 Min read -

Corporate restructuringDoosan Robotics to delist, wholly own cash-cow Doosan Bobcat

Corporate restructuringDoosan Robotics to delist, wholly own cash-cow Doosan BobcatJul 11, 2024 (Gmt+09:00)

3 Min read -

Corporate bondsDoosan emerges as darling in Korea’s BBB bond market

Corporate bondsDoosan emerges as darling in Korea’s BBB bond marketJun 25, 2024 (Gmt+09:00)

2 Min read