Corporate restructuring

Kolon Industries to downsize industrial film business amid weak demand

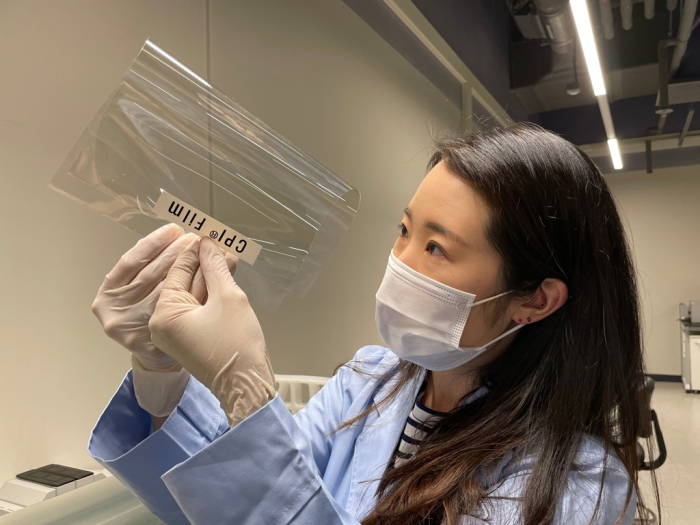

Korean chemical firms are reducing or shutting down their industrial film operations amid an ascent of Chinese rivals

By Dec 15, 2023 (Gmt+09:00)

1

Min read

Most Read

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

NPS to hike risky asset purchases under simplified allocation system

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

S.Korea's LS Materials set to boost earnings ahead of IPO process

UAE to invest up to $1 bn in S.Korean ventures

Kolon Industries Inc., a South Korean chemical and textile manufacturer, is downsizing its industrial film business amid weak demand and growing competition with Chinese rivals.

The company has decided to shut its film plant in Gimcheon, North Gyeongsang Province, and move some facilities and employees to its film factory in Gumi in the same province.

Established in 1985, the Gimcheon plant produces optical and industrial polyethylene terephthalate (PET) plastic film, general packaging film and nylon film for wrapping. The factory currently has 300 employees.

ŌĆ£Kolon wants to reduce its production volume through the shutdown of the Gimcheon plant,ŌĆØ said an industry official.

The company said in August that its two film plants had operating rates of about 70% and the company plans to lower the operating rates further. But it said it will not pull out of the film business entirely.

As of the end of September, the operating rates of the film plants in Gimcheon and Gumi each stood at around 65%, below the companyŌĆÖs other chemical plantsŌĆÖ operating rates of 81%.

KOREAN FIRMS EXIT FILM BUSINESS

Other Korean petrochemical companies are either reducing or shutting their industrial film businesses on weak demand from electronics makers, including TV makers.

The move also comes amid the rapid ascent of Chinese players.

Many Chinese petrochemical peers have jumped into the Information Technology film market, intensifying competition and deteriorating profitability.

SKC Ltd. sold off its film business last year.

In September, LG Chem Ltd., the parent of electric battery maker LG Energy Solution Ltd., sold its industrial film plants in Korea to two Chinese companies for about a combined $800 million.

The company sold its polarizer business to Suzhou-based Shanjin Optoelectronics for $200 million and its polarizer materials business to Hefei Xinmei Materials Technology Co. for 4.5 billion yuan ($616 million).

LG said it would instead focus on special premium film used in batteries.

Another Korean petrochemical firm, Hyosung Chemical Co., recently shut its film plant in Daejeon and moved equipment to its Gumi plant for downsizing.

Write to Jae-Fu Kim at hu@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Corporate restructuringLG Chem to sell film factories amid shift to new growth drivers

Corporate restructuringLG Chem to sell film factories amid shift to new growth driversAug 23, 2023 (Gmt+09:00)

3 Min read -

Chemical IndustrySKC's film business units change their names, start anew

Chemical IndustrySKC's film business units change their names, start anewJan 03, 2023 (Gmt+09:00)

1 Min read -

Hydrogen economyKolon Industries to mass produce key material for fuel cells

Hydrogen economyKolon Industries to mass produce key material for fuel cellsNov 19, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN