LG Chem to sell film factories amid shift to new growth drivers

The S.Korean chemical giant is seeking to dispose of nonprofitable businesses facing fierce competition from Chinese rivals

By Aug 23, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

LG Chem Ltd., South Korea’s chemical major, is seeking to sell its film factories at home amid accelerating business reorganization centered around its new growth drivers to mitigate a prolonged slump in the global petrochemical market.

According to sources in the chemical industry on Wednesday, LG Chem has decided to look for a new owner of its display film factories in Ochang and Cheongju in North Chungcheong Province.

With the disposal, the company is expected to exit from the information technology (IT) materials business, which was once a lucrative business with fixed customers like TV set makers.

The latest move comes less than two months after LG Chem put its core naphtha cracking center (NCC) in Yeosu up for sale as part of its business reshuffle to focus more on new growth drivers and high-value-added petrochemical products by ditching nonprofitable businesses.

In mid-June, its petrochemical division head Roh Kuk-rae said that the company would restructure “marginal businesses in a pre-emptive move.”

LG Chem’s mainstay petrochemical business reported losses for three quarters in a row in the second quarter ended in June this year. In the January-June period, it logged 63.5 billion won ($47.4 million) in loss versus more than 4 trillion won in profit in 2021.

The petrochemical division’s average utilization rate skid to 76.0% in the first half of this year from 81.4% in 2022 and 91.9% in 2021.

On the contrary, the advanced materials division, which produces battery materials like cathodes and separators, raked in nearly 1 trillion won in operating profit in 2022, a big gain from 14.4 billion won in 2019.

Battery materials are one of the company’s three new growth engines.

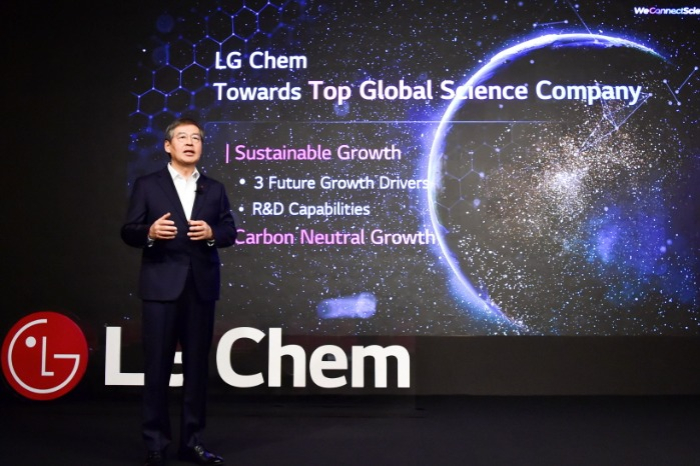

LG Chem has set a goal to earn 40 trillion won in sales from its three new growth pillars - battery materials, eco-friendly materials and life science for innovative drug development - by 2030 under the direction of Chief Executive Officer Shin Hak-Cheol.

TO FOCUS ON LUCRATIVE ADVANCED FILMS

The film factories in the company’s Ochang and Cheongju campuses produce display films and polarizer.

The company’s decision to let go its film factories comes after the dwindling TV demand has dampened demand for display films.

Even after TV demand recovers, the Korean chemical giant is expected to face fiercer competition from Chinese petrochemical peers that have rushed to mass produce display materials, boding ill for the overall profitability of its display materials business.

After abandoning general display films, LG Chem is expected to focus on special premium films used in batteries.

The company already shuttered styrene monomer (SM) lines in its Daesan complex in May as part of its efforts to replace versatile petrochemical products with advanced green materials.

It plans to build 10 factories for eco-friendly materials, including biodegradable random copolymer polybutylene adipate terephthalate (PBAT) and high-value-added polyolefin Elastomer (POE)-based solar film facilities slated to commence mass production in phases from 2024.

GREEN MATERIALS AS NEW GROWTH DRIVER

LG Chem has set a goal to generate 8 trillion won in revenue from eco-friendly materials by 2030. It earned 1.9 trillion won from the business in 2022.

The company bets big on the plastics recycling market, which is forecast to grow to 100 trillion won in sales by 2028, as well as biodegradable and other biomaterials sectors, which are projected to grow at an annual average of 20% over the same period.

Along with the green material business, the parent company of the world’s second-largest electric vehicle battery maker LG Energy Solution Ltd. is also striving to scale up its battery material business with a goal to bolster its sales by six times to about 30 trillion won by 2030 from 4.7 trillion won in 2022.

Its current main cathode customer is LG Energy Solution but it plans to up its portion of cathode sales to other global customers to 40%.

It also expects to reap 2 trillion won in sales from its medicine business by 2030 versus almost zero in 2022.

LG Chem expects the combined sales of the three new core businesses to account for 57% of its entire sales projection of 70 trillion won in 2030.

They made up 21% of LG Chem’s sales in 2022.

Write to Hyung-Kyu Kim at khk@hankyung.com

Sookyung Seo edited this article.

-

Corporate restructuringLG Chem seeks to sell 2nd NCC facility in Korea in face of China’s ascent

Corporate restructuringLG Chem seeks to sell 2nd NCC facility in Korea in face of China’s ascentJul 02, 2023 (Gmt+09:00)

5 Min read -

BatteriesLG Chem breaks ground on 4th cathode material plant in S.Korea

BatteriesLG Chem breaks ground on 4th cathode material plant in S.KoreaMay 31, 2023 (Gmt+09:00)

1 Min read -

BatteriesLG Chem aims higher for battery materials with diverse portfolio

BatteriesLG Chem aims higher for battery materials with diverse portfolioMay 16, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Chem, China’s Huayou Cobalt to build $923 million precursor plant

BatteriesLG Chem, China’s Huayou Cobalt to build $923 million precursor plantApr 14, 2023 (Gmt+09:00)

4 Min read -

Chemical IndustryLG Chem teams up with US company to expand bioplastic global business

Chemical IndustryLG Chem teams up with US company to expand bioplastic global businessApr 13, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaLG Chem to launch new diabetes combination drug Zemidapa

Bio & PharmaLG Chem to launch new diabetes combination drug ZemidapaApr 04, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaLG Chem builds S.Korea's first plant for clinical trials

Bio & PharmaLG Chem builds S.Korea's first plant for clinical trialsFeb 14, 2023 (Gmt+09:00)

2 Min read