LG bets $34 bn on battery, automotive electronics biz for its future

South Korea’s No. 4 conglomerate unveils plan to invest $84 billion by 2026, focusing on future growth sectors

By May 26, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

LG Group, South Korea’s fourth-largest conglomerate, is set to pour $34 billion into the battery, automotive electronics and other future growth sectors as it aims to take the global lead in those industries.

The group on Thursday unveiled a plan to spend 43 trillion won ($33.9 billion) on battery, battery materials, automotive electronics, next-generation displays, artificial intelligence and data, as well as eco-friendly clean technologies by 2026 out of its total domestic investment of 106 trillion won. That would mark the chaebol’s largest-ever domestic investment.

“It has decided to make the bold investment to further strengthen its global competitiveness and prepare for a sustainable future in a preemptive manner despite growing uncertainties in management conditions,” the group said in a statement.

The conglomerate, affiliates of which include LG Electronics Inc., LG Energy Solution Ltd. and LG Chem Ltd. is poised to invest 21 trillion won on research and development in the future growth sectors of total R&D spending of 48 trillion won.

BATTERY AND MATERIALS

LG Group has pinpointed battery and battery materials as the most important sectors, pouring more than 10 trillion won into these in the next five years.

LG Energy, the world’s second-largest electric vehicle battery maker, will increase investment in its local factory to produce cylindrical batteries and others. The country’s top battery manufacturer also focuses on next-generation products such as solid-state batteries and lithium-sulfur batteries to lead the global industry.

LG Chem aims to become the world’s leading battery materials player with an investment of 1.7 trillion won in various ingredients such as cathode materials, separators and carbon nanotubes. LG Chem, which is a building a cathode plant in South Korea, is considering mergers and acquisitions or joint ventures with companies that have strong technologies and marketability.

AI, DATA AND BIO

The group is set to invest 3.6 trillion won in the AI and data sectors to develop AI and big data technologies for all of its affiliates.

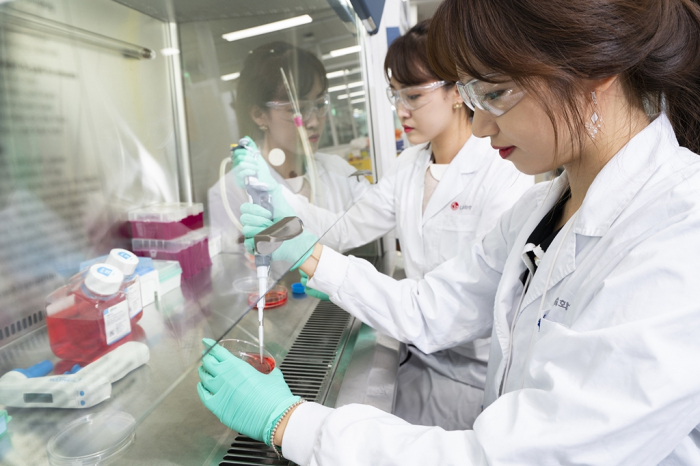

It is also scheduled to spend 1.5 trillion won on the development of new drugs with LG Chem leading the group’s bio business.

LG Chem is currently developing innovative new medicines including cell therapies with the goal of expanding new drug pipelines ready for clinical trials. To achieve the target, the company is mulling various strategies such as M&As or JVs.

The group plans to spend 1.8 trillion won in eco-friendly clean technology sectors such as renewable energy industrial materials by 2026.

For the existing core businesses such as smart home appliances, TV, petrochemicals, information technology and telecommunication, the group aims to develop them into global leaders.

LG Corp. Chairman Koo Kwang-mo is scheduled to meet with executives of each affiliate from May 30 to check strategic directions related to their long-term investment plans, a group official said.

The group decided to hire about 10,000 employees a year by 2026, employing more than 3,000 experts a year in AI, software, big data, eco-friendly materials and batteries over the next three years.

LG Group’s spending plans come as other conglomerates such as Samsung Group and Hyundai Motor Group announced massive investment plans after the country’s new President Yoon Suk-yeol took office earlier this month.

Write to Ji-Eun Jeong at jeong@hankyung.com

Jongwoo Cheon edited this article.

-

Corporate investmentBio, mobility to top Lotte's $30 bn spending list by 2026

Corporate investmentBio, mobility to top Lotte's $30 bn spending list by 2026May 25, 2022 (Gmt+09:00)

1 Min read -

Corporate investmentHanwha to boost defense, aerospace biz with $2.1 bn spending

Corporate investmentHanwha to boost defense, aerospace biz with $2.1 bn spendingMay 25, 2022 (Gmt+09:00)

2 Min read -

Corporate investmentHyundai to spend $30 bn on improving quality of combustion engine cars

Corporate investmentHyundai to spend $30 bn on improving quality of combustion engine carsMay 25, 2022 (Gmt+09:00)

3 Min read -

Corporate investmentSamsung to invest $355 billion in chip, biotech, 6G over five years

Corporate investmentSamsung to invest $355 billion in chip, biotech, 6G over five yearsMay 24, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to make mobile AP chip dedicated to Galaxy smartphones

Korean chipmakersSamsung to make mobile AP chip dedicated to Galaxy smartphonesMay 16, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsSamsung buys $2.3 bn Bioepis stake from Biogen to end partnership

Mergers & AcquisitionsSamsung buys $2.3 bn Bioepis stake from Biogen to end partnershipJan 28, 2022 (Gmt+09:00)

3 Min read -

COVID-19Samsung Biologics-made Moderna vaccine available to Koreans this week

COVID-19Samsung Biologics-made Moderna vaccine available to Koreans this weekOct 27, 2021 (Gmt+09:00)

3 Min read